13th June 2025

UK Spending Review review

- The most surprising element of the Spending Review is that it was such a focus in the first place.

- Usually covering anything up to four years, spending reviews have mainly been purely a Westminster obsession, given the overall tax and spending numbers are set in the more regular set-piece annual Budget.

- They provide an opportunity to instil fiscal discipline between government departments and steal a few headlines for an eye-catching political priority, but they’re not of much wider interest.

- Usually covering anything up to four years, spending reviews have mainly been purely a Westminster obsession, given the overall tax and spending numbers are set in the more regular set-piece annual Budget.

- The OBR didn’t need to be consulted this time round because they are only obligated to produce analysis for “fiscally significant events” which the Charter for Budget Responsibility stipulated is more than 1% of GDP and is not required within an already agreed spending envelope.

- Hence all the Spending Review numbers are only calculated by the Treasury.

- The fact that this one has been pored over in such detail gets to the heart of the problem that has dogged the Labour government since it came into government: What is its plan for delivering productive growth? And is it credible?

- Reeves’s words say:

- ‘My driving purpose since I became Chancellor is to make working people, in all parts of our country, better off’

- But Reeves’ actions have been:

- Cutting pensioner winter fuel payments to pay for public sector pay rises, then restoring them just as the outlook for global growth darkens, whilst raising taxes on jobs and farmers.

- Reeves’s words say:

- With rhetoric not matching reality, voters are unconvinced.

- A focus group of Labour 2024 voters by More In Common in the aftermath captured the mood, with comments like “She just says what she thinks we want to hear. And we do want to hear it. But will we see it? I definitely won’t hold my breath”.

- Markets are only convinced that she won’t break her fiscal rules because they have assumed that any failure to do so will simply be met with reduced spending and/or tax rises.

- But they should pay heed to the content and tone of her speech. Red meat was flying off the shelves to red wall constituencies, “buses in Rochdale… train stations in Merseyside and Middlesbrough… metro extensions in Birmingham“.

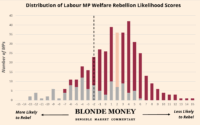

- As our Starmer Ratings have shown, Labour MPs are in a restive mood.

- Reeves needs to pass the welfare reforms or this will show the markets that she doesn’t have a majority capable of delivering the required fiscal adjustments.

- And so this was not an economic speech. It was political, designed to buy off Labour MPs to ensure they back the upcoming welfare vote, at a minimum.

- Reeves was at pains to burnish her party credentials, receiving a loud cheer from her side of the chamber when she said ‘I joined the Labour Party over 30 years ago – because I knew the Tories didn’t care about schools like mine‘.

- The government is still not sure the welfare reforms will pass, with sources briefing the Guardian of tweaks to make them more palatable.

- But the fact this has to happen for a government with a majority of 165 should give pause to markets assuming the necessary adjustments will just happen.

- The majority without a mandate has dogged his government from the beginning. What did the public vote for? Pay rises for train drivers or getting a GP appointment? Both? Something else?

- Hence her speech was peppered with reference to her “choices” which she claimed were “the choice of the British People”.

- And the obsession over the numbers in the Spending Review demonstrates just how fragile the fiscal position is.

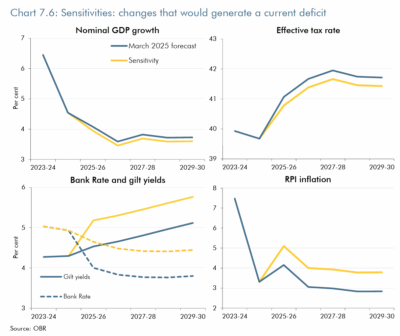

- As the OBR demonstrated in March, if GDP were 0.1 pct pts lower in each forecast year or if Gilt yields on newly issued debt were 0.6 pct pts higher, the fiscal headroom has gone:

- The government is in zugzwang.

- Hostage to a few basis points from a poor Gilt auction, higher inflation or lower growth, the government cannot reconcile market demands for fiscal prudence with ideological demands for largesse.

- All the decisions taken so far by the government are making its own position worse, with the inevitable march of tax hikes from an Autumn budget now set to weigh on the economy, making it harder to meet its own fiscal rules.

- The irreconcilable tension between its two constituencies – markets and voters – will eventually erupt into a fiscal crisis.