The Two Weeks That Will Be

1. The US

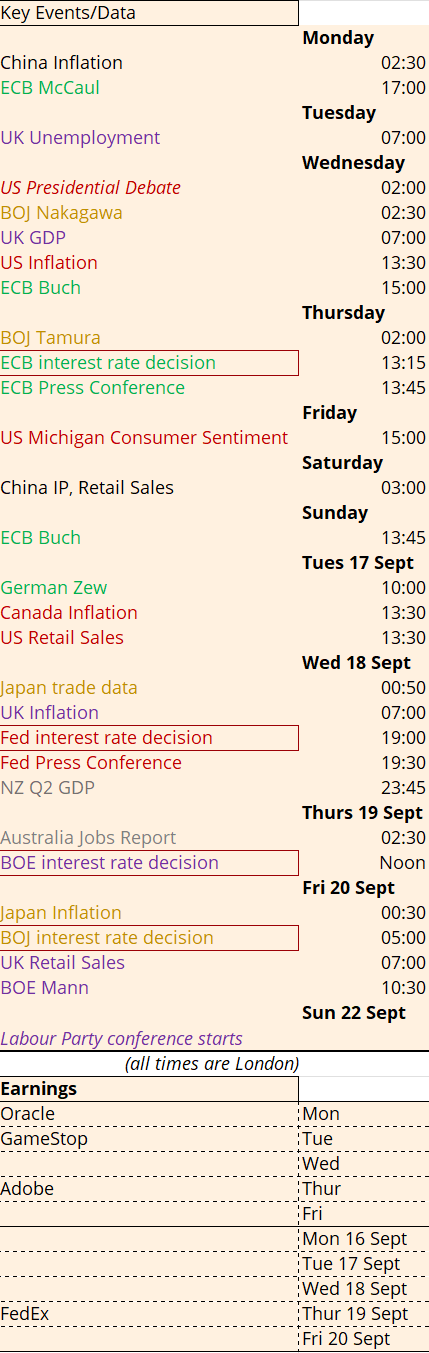

The Fed will cut interest rates by 50bp on Wednesday 18th September. Or at least they will if Powell has anything to do with it (and the Fed is most certainly not a democracy). The arguments are lining up for him: the labour market is softening, the balance of risks to growth is shifting to the downside, his future could do with a boost at this stage in the political cycle and his legacy hangs by a thread if the final act goes pear shaped. Once you’ve decided “the time has come”, you might as well go all in. If the criticism for rate hikes was that they were too late and too large, then you don’t want to be too slow and too small on the way back down. If you’re damned if you do and damned if you don’t, then at least if you do something, you’re being consistent.

Hence the lack of words from Powell like ‘measured’ and ‘gradual’ that surprised ex-Fed Vice Chair Donald Kohn who concluded ‘It was a complete pivot from ‘whatever it takes’ on inflation to ‘whatever it takes’ on the labor market‘. And the jobs market data has certainly supported the view of the doves. Unemployment keeps ticking up, the latest payrolls showed full-time jobs are falling as part-time jobs are rising, the Sahm Rule recession indicator is flashing red and the biggest payrolls revision since 2009 suggests the current data might be even worse than reality.

But, say the hawks, the unemployment rate is still fairly low by historical standards and the “last mile” on inflation has yet to be completed with headline CPI sticky above the Fed’s target. Why not wait and see?

Because this is not a normal economic cycle. It’s not really a ‘cycle’ at all. There was a huge recession, nay depression, in 2020 that was postponed (not removed) by a huge monetary and fiscal intervention. At the same time, there was a paradigm shift in the global economy due to changes in the way we live and work. Almost five years later and only now are more settled patterns emerging, from global supply chains to hybrid working. Huge debt burdens and higher interest rates will be with us all for some time to come.

Immigration is far from settled. New Zealand has seen record emigration from its young people trying to escape a high cost of living – but the government is clamping down on visas for immigrants; just as Australia struggles with high wage inflation to fill jobs which are attracting the New Zealanders. NZ inflation is too high due to a lack of labour supply; Australia inflation is too high due to a lack of labour demand. Both central banks have had to lean more hawkish than they would like. Not because of an economic cycle but because the economy remains in a state of flux.

Powell has spotted an opportunity in the flux. The US unemployment rate is now above the level that the median estimate in the last Summary of Economic Projections said it would be by Q4 (4.0%). The labour market is worsening more rapidly than the median FOMC member had anticipated. Powell cannot afford to for the Fed to be too slow again. This September there will be a new SEP. The market has priced almost 100bps of cuts by the end of the year. In June, the dot plot showed only one 25bp cut. With only one dot plot for December to come in the SEP, how will the median dot possibly drop far enough to reflect market pricing?

It won’t, unless there is a big cut to start with or there has been a fundamental reassessment of the reaction function of FOMC members. Waller has said ‘I am open-minded about the size and pace of cuts… If the data suggests the need for larger cuts, then I will support that as well. I was a big advocate of front-loading rate hikes when inflation accelerated in 2022, and I will be an advocate of front-loading rate cuts if that is appropriate’.

There is an academic argument ready for him. The Jackson Hole schedule was relatively light this year but the symposium kicked off with one relatively meaty paper by Gauti Eggertsson. At first sight it merely looked like a useful vindication exercise of Fed action to date – that they managed to keep a lid on inflation expectations with aggressive rate hikes without sacrificing employment, thanks to a high vacancy rate. But it is also a useful document for Powell to exhort action now.

The paper argues that the slope of the Phillips Curve shifts once the Beveridge threshold is crossed. Away from economics parlance that means the trade off between inflation and employment can suddenly become more costly once the ratio of vacancies to unemployment falls. The Fed need not have feared people losing jobs when they hiked rates, because there were so many vacancies – but if vacancies have now fallen then there is a greater risk of job losses if they don’t cut rates. The paper is so useful for Powell now because there is a literal pivot point where the balance of risks shifts. Hence his headlong hurtle into how “the time has come”.

The inflation number on Wednesday, Michigan Consumer Sentiment on Friday and retail sales on Tuesday 17th September can all provide useful excuses for those looking to change course.

But the real ace up Powell’s sleeve is the volatility experienced by markets in August, the reverberation of that as people reduce risk on their return after the summer holidays, and the impact on financial conditions if the Fed disappoints. A sell off in risky assets would tighten financial conditions just as the Fed has finally decided to ease policy. By Powell explicitly encouraging the market to price in cuts, he boxes in the wait-and-see Fed hawks. If they don’t act now, they’ll just make their job even harder for themselves later.

Away from the economics, it’s Momala vs The Donald in the early hours of Wednesday morning UK time. We expect an inconclusive outcome for the race. It’s more important for both participants that neither scores an own goal. This means Kamala could come across as unlikeable to the neutral voter when she goals full prosecutor in order to stir up some viral clips for her core vote to distribute on social media. But it’s unlikely that Trump can do anything that would enable him to declare victory over swing voters in Pennsylvania either. He is already a known quantity.

2. The UK

Voters might have thought the new Labour government was a known quantity too. Their promise of boring competence will be tested on Tuesday with the vote on the removal of the universal Winter Fuel Payment for pensioners. The current briefing is that 30-50 MPs might abstain with a handful outright voting against the policy. It will still pass due to the ginormous majority but this will be the first chance to see how much of the Labour Party is the official opposition.

Tony Blair also suffered an early rebellion. On the 11th December 1997, 47 of his own MPs voted against a cut to benefits for single parents and 100 abstained. One minister and two PPS had to resign and a ministerial aide was sacked. Those against the policy included Diane Abbott and a new MP who went by the name of John McDonnell. Plus ça change, except that McDonnell is no longer sitting under the Labour whip after he had it withdrawn for his vote against maintaining the two child benefit cap.

And this is the key difference between now and 1997. The Starmer brigade have done a very good job of ensuring candidate selection provided loyal subjects. Any rebellion at all is a sign that some of the newbies might not feel quite so on board with the practicalities of government as compared to the relative ease of campaigning in opposition.

It is only going to get harder for the squeamish from here. Both Reeves and Starmer relish unpopularity as a badge of success. Taking hard decisions depicts competent credibility, particularly with financial markets. The Sunday Times quoted two allies of Rachel Reeves who said ‘We were elected on a mandate to bring economic stability back’ and ‘It is a signal to the markets — that the chancellor is prepared to make politically difficult, unpopular choices to remain fiscally disciplined’. Starmer, a la Blair, will also welcome the chance to stamp his authority onto his party early. Labour Party conference starts Sunday 22nd September.

In the heat of growing discontent, keep an eye on new parties: Nigel Farage is going big under the money of the new Chairman of Reform UK, the bright young entrepreneur Zia Yusuf, and Dominic Cummings has promised to start making noise on his blog in the week of 9th September about his new Start Up Party.

The Bank of England have already gone early in the parliament with their interest rate cut, enabling them to take a breather and leave rates unchanged on Thursday 19th September. The UK inflation number the day before the BOE meeting on Wednesday 18th September is likely to provide arguments in both directions given the ongoing sticky nature of services inflation even as the headline number falls back under control. The uber-hawk Catherine Mann gives a speech the day after the meeting, Friday 20th September, which suggests she would like the opportunity to explain herself now that she has to sit alongside a growing group of doves. Governor Bailey himself has shown his discomfort at the close decision with his speech at Jackson Hole showing that he is dancing on the head of a pin.

3. The EU

The ECB will cut at its meeting on Thursday but it’s not this meeting that matters, it’s what is signalled for October and beyond. Lagarde didn’t even bother to go to Jackson Hole, perhaps more engaged by the political shenanigans in her home country. France has finally managed to settle on a Prime Minister in Barnier but now we know who is really in charge. As the left staged protests, Marine Le Pen pointed out ‘Macron took the National Rally’s criteria into account in choosing his prime minister. [Barnier] seems to have reached the same conclusion as we have on immigration’.

It will be a fiery and unstable French government from here on in.

4. The BOJ and Volatility

The Bank of Japan will raise interest rates again on Friday 20th September. BOJ member Takata has warned ‘If market developments emerge as a risk to the economy, we need to take that into account’ but also ‘We must scrutinise without any pre-set idea the chance of Japan seeing another wave of price hikes toward the latter half of the current fiscal year’. The BOJ are worried about getting the blame for setting off a tsunami across financial markets but they also have their own job to do. And they’ll want to get on with it.

On 27th September there will be a new Japanese Prime Minister when the LDP leadership election takes place. Koizumi’s son is in pole position and he has said he would call a snap election if he does indeed become the new PM. He also accepted that interest rates are going to keep moving higher, saying ‘I’ll aim to beef up the underlying strength of the Japanese economy so that growth can be attained even in an era where inflation and higher interest rates co-exist’.

As we have seen from the rumbling September aftershocks of the August spike in volatility, there will be more worry ahead of the BOJ meeting event than after the actual event itself.