Zeitenwende-wende

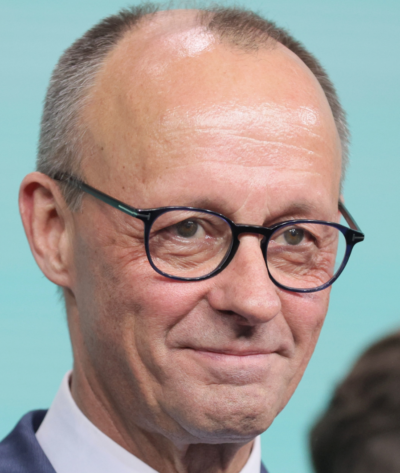

CDU leader and prospective German Chancellor Merz saw your Zeitenwende Olaf Scholz and he raised you. Three years ago, after Russia invaded Ukraine, Scholz announced a special defence spending programme of EUR 100bn in what he described as the “Zeitenwende”, or literally the “times turn”. Now Merz has doubled down on “the end of an era”. He announced limitless national borrowing to finance defence spending. And he doesn’t want to stop there. It’s not simply that defence spending above 1% of GDP will be exempt from the debt brake: the debt brake itself must be reformed. On top of this, he threw in looser debt rules and EUR 100bn for Germany’s federal states. His likely coalition partners, the SPD, also got him to agree to EUR 500bn of infrastructure spending.

Just in case you weren’t clear on how much of a bazooka this is, Merz deliberately borrowed Mario Draghi’s words: ‘In view of the threats to our freedom and peace on our continent, whatever it takes must now also apply to our defence’.

This goes beyond the end of an era for the German shibboleth of restrained defence spending: it is the complete shredding of Germany’s approach to fiscal discipline altogether. This is a country that wrote into its post-war constitution tighter and tighter budgetary requirements. From “Revenue and expenditure must be balanced” in Article 110 of the 1949 draft, they progressed in the aftermath of the financial crisis to “Revenues and expenditures shall in principle be balanced without revenue from credits. This principle shall be satisfied when revenue obtained by the borrowing of funds does not exceed 0.35 per cent in relation to the nominal gross domestic product” in Article 115 of the current Grundgesetz.

Merz isn’t only going to change the direction of the constitution, he’s going to do it by using the lame duck parliament. He doesn’t have much time. It can only be reconvened before the newly elected MPs take their seats, giving him a deadline of 25th March. After that, he can’t be sure of commanding the two-thirds majority required for constitutional reform, thanks to the 216 seats won in the recent election between the two extreme parties, the AfD and Die Linke.

This would be bold for any newly elected leader, let alone one who managed to deliver the second worst electoral result in his party’s history, and doing so alongside the SPD who had their worst post-war result. The CDU/CSU and SPD have precious little mandate for anything, let alone tearing up the Schwarze Null at the heart of Germanic fiscal prudence.

This must be what people refer to when they say Trump has created uncertainty. Not from his own decisions, which he has pursued clearly and consistently for decades, but the response of others. Merz, the erstwhile Atlanticist, has spotted that NATO is effectively dead and that requires a complete re-think of his position. He had spent recent years arguing for a return to the imposition of the debt brake after it was temporarily suspended due to Covid. In a TV debate in the election campaign he warned “How far do we actually want to go with our debt? I am of the opinion that we also have an obligation to our children, who will have to pay it back at some point”. Just over three weeks later, we hear the FT report today that ‘Berlin wants to make significant defence expenditure possible in the medium- and long-term through an adaptation of the [Eurozone fiscal] rules’. Far from temporary deviations, Merz is looking for something more permanent. A real wende.

Berlin’s exhortations will fall on welcoming ears in Brussels. Von Der Leyen (formerly a German defence minister) has pitched a five point “Rearm Europe Plan” which proposes a “new instrument” to provide EUR 150bn of loans to member states to finance joint defence systems.

This rush towards fiscal largesse is even more astonishing for the broader Eurozone given the fiscal rules that underpinned the creation of the Euro in the first place. The Stability and Growth Pact was always going to need some adjustment, almost thirty years after it was introduced. New rules to soften the 3% deficit / 60% debt-to-GDP levels that accompanied the introduction of monetary union had already been fleshed out in the past twelve months, not least because they had become so out of date in a world of much higher debt. Step forward another unexpected player in the world of fiscal creativity, the Bundesbank. Yesterday they published “Sound public finances, stronger investment: a proposal to reform the debt brake“: ‘these proposals have sound public finances as their objective. They are centred on the 60 % reference value for the debt ratio enshrined in the EU Treaties. They differ from the existing debt brake rules in that they envisage greater scope for borrowing, though much of this is reserved for additional fixed asset formation”.

Let’s just stop for a moment and recap:

- The non-government of Germany, composed of two parties that failed to gain a mandate, is going to ram constitutional change through the parliament that existed prior to the election;

- The constitutional change will allow for unlimited defence spending in a country that has constitutionally requisitioned balanced budgets for its entire post-war existence;

- The central bank most renowned for a cultural pursuit of sound money proposes its own reform of constitutional debt rules which ‘envisage greater scope for borrowing’;

- The executive body managing the union of which the newly profligate country is a core member then embraces the fiscal shift across its member states.

Zeitenwende-wende doesn’t even begin to cover the extent of the change.

Three years ago after war broke out in Ukraine, we wrote about the challenges from the response of the West:

- Monetary and Fiscal Response.

- This will be tougher to execute than in the pandemic.

- More spending will go towards Defence, which famously has a low multiplier in terms of its impact on growth.

- Debt and deficits are already creaking, although war provides a decent excuse to avoid bringing them back down.

- If central banks were already worried about a possible wage-price spiral with oil at $100, how will they feel if it gets to $200? They need to ensure they remain vigilant on the inflationary threat.

- Whatever It Takes was already dead. Now it’s a world of least worst options where either Russia withdraws its gas or Europe stops buying it, leaving everyone economically worse off.

- This will be tougher to execute than in the pandemic.

Drill, baby, drill might take the third point off the table, whilst rapprochement with Russia reduces the pain of the final point. But the first two conclusions have just been turbocharged by the Zeitenwende-wende. Merz decided to go all-in when he doubled down. Higher yields on European debt and higher volatility will be the outcome.