It Will All Come To Aught

Five years ago, we argued that when it came to policymakers’ response to the impending pandemic, “it all comes to nought”: that interest rates would be slashed to zero but the impact would be far from enough to offset the financial crisis enveloping the world on top of a health crisis. While right on the former, we were wrong on the latter. The huge fiscal stimulus and unprecedented central bank asset purchases kept markets not only open, but up. We underestimated policymaker’s capacity and willingness to write such a blank cheque that the entire left tail of the potential distribution of outcomes was lopped off altogether.

The price tag for that decision is now becoming clear. Inflation driving up the price of basic necessities. Inequality expanding as the asset wealthy move further away from the cash poor. Risk distorted with asset prices floating on air whilst volatility was eradicated. None of this is normal. Electorates are seething. Almost two decades of intervention have created a system that simply doesn’t work for them, unless they happen to be in the lucky 0.1%.

And now their standard bearer, one Donald J Trump, the lightning rod for ‘deplorable swivel-eyed loons’, has won an historic non-consecutive second term along with the popular vote and control of all three branches of government. They want nothing less than a full revolution. The system must collapse in order to be rebuilt. Any resulting financial instability isn’t just collateral damage in the progression to a new world order, it’s a painful necessity. Wealth must be redistributed to the masses.

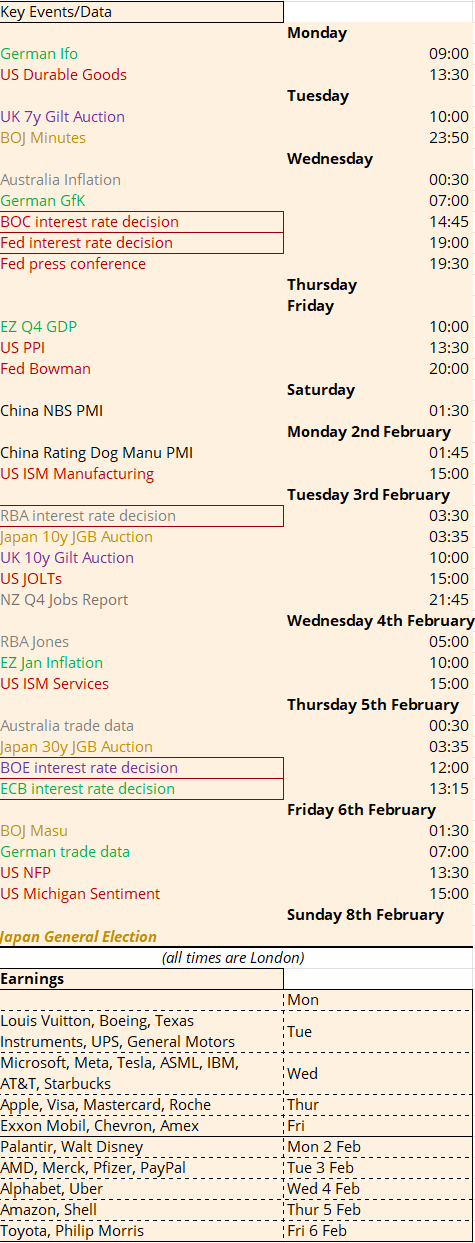

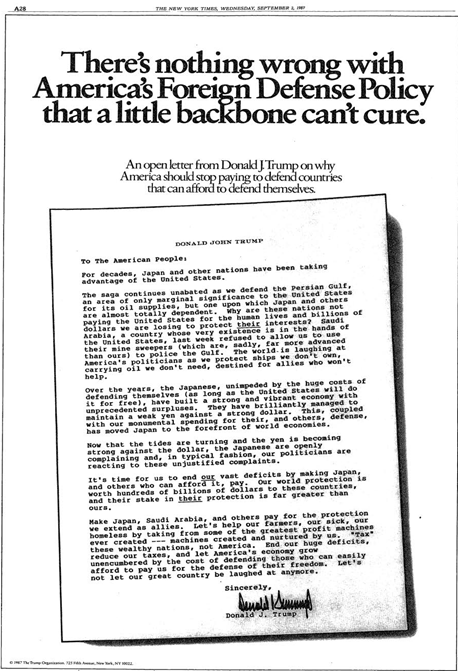

Every lurch lower in asset prices is a chance for the little guy to get in on the Trump train. He’s promised it’s headed for a new destination, where America is Great Again. The journey has been clearly signposted by its driver for over forty years: Tax Cuts, Tariffs, Tight Immigration, and Tough Foreign Policy. He literally took out an advert in 1987 to explain his roadmap:

Trump wasn’t alone amongst US Presidents in his final exhortation to “let America’s economy grow unencumbered by the cost of defending those who can easily afford to pay us for the defense of their freedom”:

- 18 years ago, George W Bush attended a NATO summit in Bucharest where he “will encourage European partners to increase their defense investments to support both NATO and European Union operations. The U.S. believes if Europeans invest in their own defense, they will also be stronger and more capable when we deploy together”.

- 11 years ago, Barack Obama said “we can’t have a situation in which the United States is consistently spending over three percent of our GDP on defense – much of that focused on Europe, (and) potentially more, if we end up having ongoing crises within Europe – and Europe is spending, let’s say, one percent. The gap becomes too large…. We need to make sure that everybody is doing their fair share”.

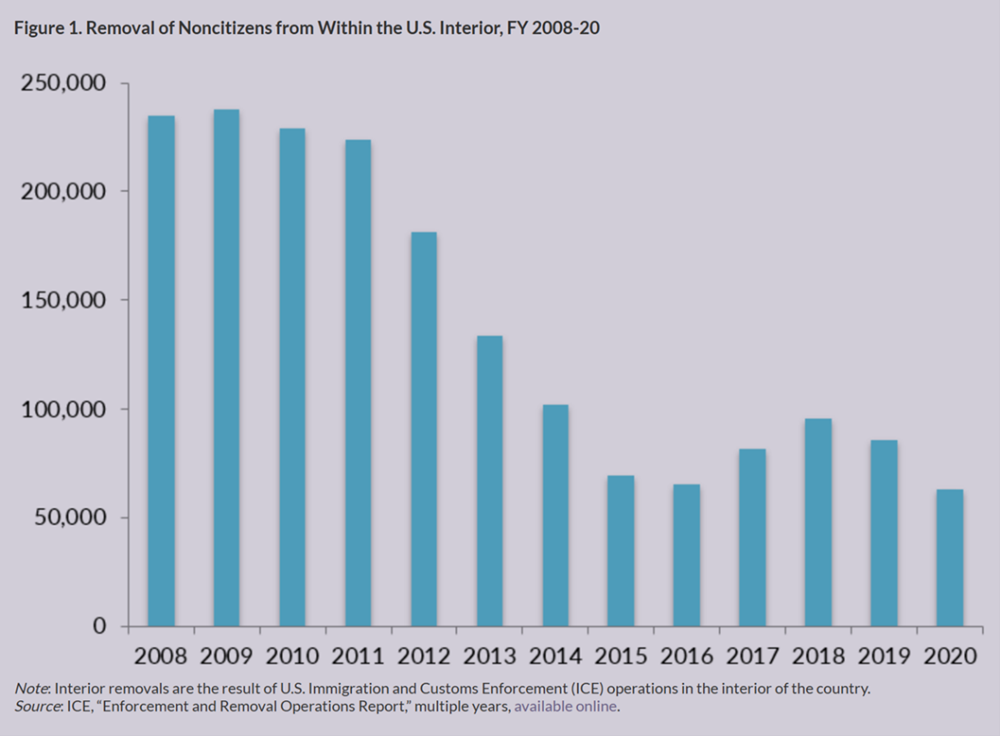

Trump, then, is entirely consistent with his predecessors on defence, and entirely consistent with himself. His second term policies are echoes of those he pursued in his first term. He ripped up NAFTA and replaced it with USMCA. He imposed tariffs on China that ultimately led to a fresh trade deal. He cut taxes. He deported immigrants, although far fewer than Obama did in his first term:

Aside from a singular theatrical ability to dominate social media with deliberate controversy, Trump is not an uncertain actor in terms of the policies he has announced. It is those responding to him that are introducing uncertainty:

- A British Government facing severe fiscal constraints committed to increased defence spending at the expense of other departments, just weeks before a crucial update from the independent fiscal watchdog;

- A Canadian Government is now headed by a man who has never won electoral office and isn’t even a member of parliament;

- A German Government that has yet to be sworn in has thrown out a constitutional commitment to balanced budgets and military rectitude, all to be passed by the prior parliament and without it being the policy of any party in the recent election campaign;

- A French Government facing challenging debt-deficit dynamics has passed a budget which barely delivers any fiscal consolidation and only managed to do so after the fourth prime minister in a single year, who wasn’t a member of the National Assembly, utilised the constitutional bypass of Article 49.3 which doesn’t require a parliamentary vote.

If you’re looking for constitutional outrage, the US isn’t the first place to turn.

Financial markets were initially euphoric at the election of a leader with a reflationary mandate. Recent jitters are supposed to come from sentiment turning sour towards an allegedly unpalatable leader who will apparently send the economy into a recession thanks to his irrational policies.

The truth is that the market is operating on skewed logic. Tariffs = inflation = higher interest rates = sell risky assets? Tax cuts = higher deficits = higher debt = higher interest rates = sell risky assets? Reduced immigration = lower labour supply = inflation = higher interest rates = sell risky assets? And so on… with the common denominator being an absolute visceral fear of higher interest rates.

This is where the trip to nought has become a trip to aught. Far from being able to rely on lower interest rates to remove the risk of something bad happening, anything and everything is now on the table. Trump’s revolution, firing swathes of government workers and slapping tariffs on anyone he deems an enemy, could mean inflation soars then plummets. Growth could collapse then rebound. For Trump and his supporters, it’s all short term pain for long term gain. The train is headed to MAGA Land. It might be a long and tiring journey but at least the righteous train is on the track.

For markets, this is mayhem. The response to the pandemic only embedded the post financial crisis mantra that markets would be bailed out, that the Fed would slash interest rates to zero and buy ETFs. Whatever It Takes, remember?

But we are now in a higher inflation world. The tremors that took out a British Prime Minister as the Fed jacked up interest rates were just the start. The market won’t simply get QE at the drop of a hat with inflation around 2-4% rather than 0-2%.

And why should it?

It will be rational for markets to reprice the new risks created by the Trump Train. The train could career off the tracks. It could be headed for destination recession. Other countries could switch the signalbox by taking a sudden political U-turn. Volatility is back and here to stay. Central banks can’t squish it down forever.

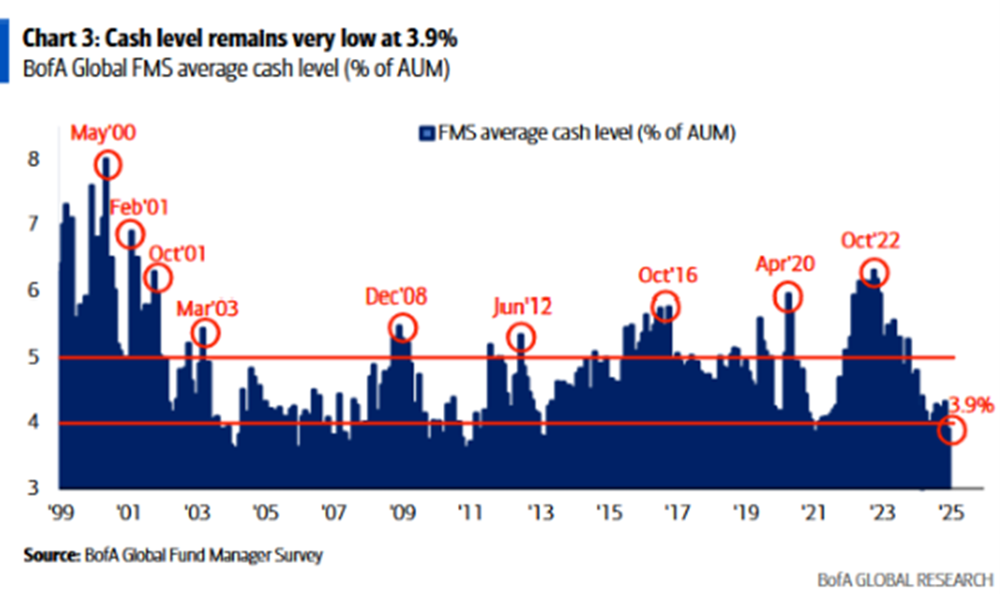

Investors need to get on board the new world order. It’s no longer buy-the-dip on a FOMO that you’ll miss the easy rally. Over the last two years the Sharpe Ratio for the S&P500 has been 2, astonishingly higher than the average of 0.4 that had been the historical norm. This feat will not be repeated given volatility is going to be significantly higher. The latest BAML Fund Manager survey shows how deeply invested people had become, with cash levels at almost record lows:

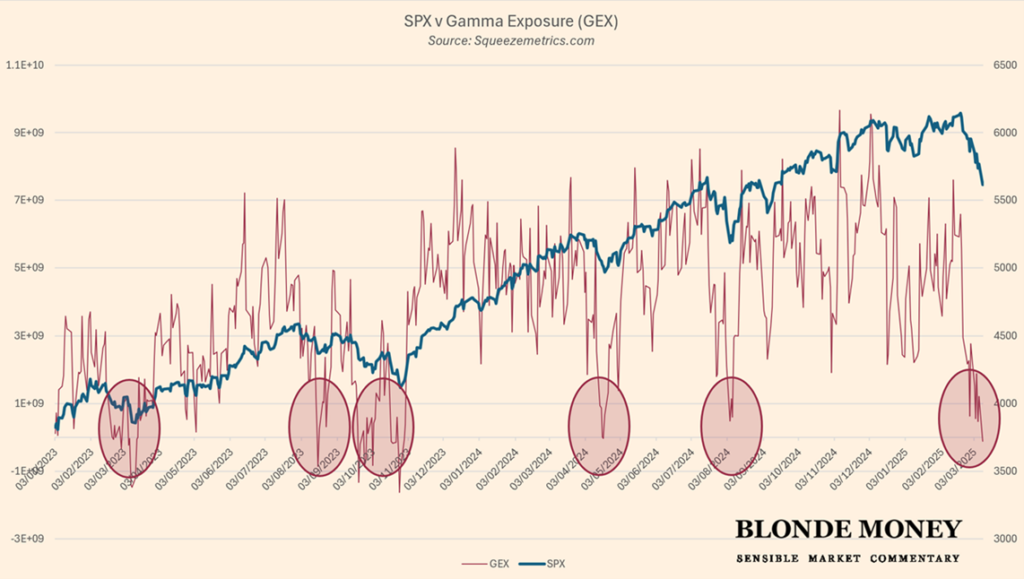

Implied volatility has reflected this complacency. As volatility specialist SqueezeMetrics put it in his most recent weekly note:

The 1-month S&P straddle, right now, implies a 1-month average move of… just 4.5%. To put that in context, SPX just fell 4% in the last two weeks, and has been moving, close-to-close, 1.29% per day on average over the past week. An average move of 1.29% corresponds to an ATM volatility of >25%. But the actual SPX ATM volatility is a measly 19–20% right now.

“Aught” means ‘anything whatever’. If that sounds confusing, it is. The new regime means the potential distribution of outcomes now has its left tail fully restored – and both the positive and negative tails are fatter. Something really bad could happen, but so could something really good. In fact, we are becoming more likely to see both.

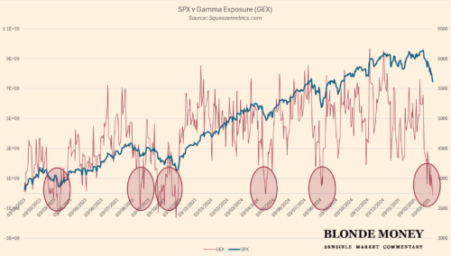

In such a world, even the most macro fundamental of us need to keep an eye on gamma. When this turns negative, the option market makers on the S&P500 stop buying on dips and selling rallies, reducing volatility, and flip to the reverse activity, selling as the price falls and buying as it increases, exacerbating volatility. This usually presages a decline in the index:

With gamma exposure now turning negative again, the market is vulnerable to shocks. Uncertainty over the new Trumpian regime is enough of an excuse to challenge the post pandemic narrative that all dips should be bought. This is a sensible moment to reassess the assumptions that have underpinned your investments for the last few years.

This is a time to adjust positions to take account of increased volatility; to pick stocks that work in a more conflicted world; and to avoid debt of nations that are shackled by high deficits and low growth. If you want to retreat to crypto or gold, feel free. Everyone will need some kind of safe haven. It will all come to aught.