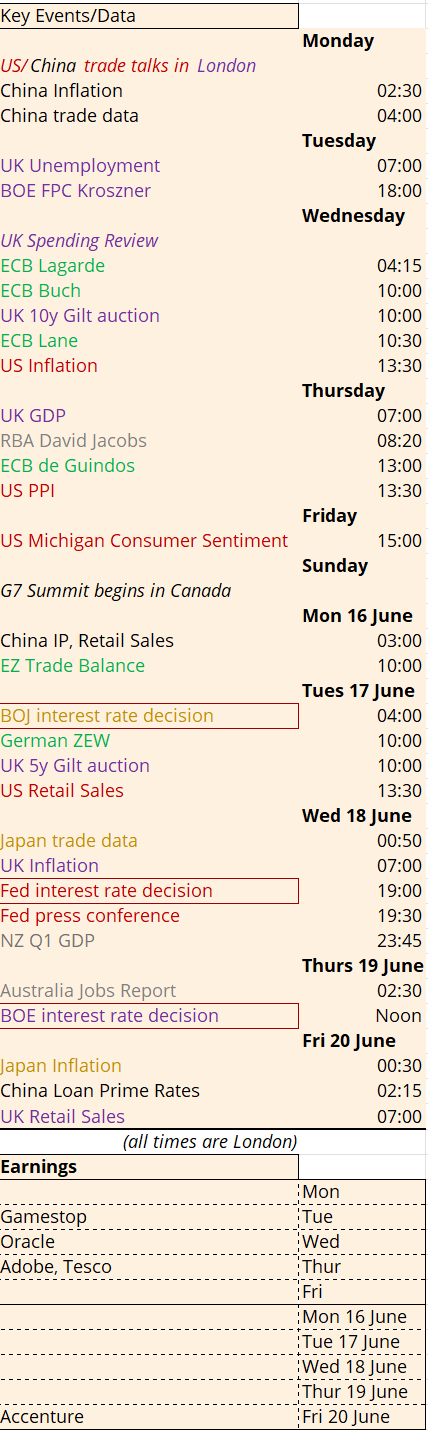

The Two Weeks That Will Be (8th June 2025)

The Bank of Japan, the Federal Reserve and the Bank of England will all be unchanged on Tuesday 17 June, Wednesday 18 June and Thursday 19 June respectively. The first two want to wait and see what happens to tariffs whilst the BOE remain split over how soon to deliver the next interest rate cut.

The BOE can’t even rely on data as their guide, thanks to ongoing issues over the reliability of the output from the Office for National Statistics. The new labour force survey was supposed to be in place by now but might not see the light of day until 2027; the trade data had to be delayed in March due to an error; and then we found out the headline inflation rate for April was overstated. It will therefore be difficult to draw conclusions from the May inflation number which is released on Wednesday 18 June.

Not that the data really matters right now, with political decisions the driver of the economy. Trade and tariffs will be right back in focus over the next two weeks, as we enter a key period for the Trump Administration’s agenda. Before Congress breaks up for summer after Independence Day on 4th July, the president will be hoping the Big Beautiful Bill has become law, that the pause in reciprocal tariffs has yielded big beautiful trading partnerships and the NATO Summit has the whole western world, rather than just America, tooled up and ready for war. Expect a ramping up of threats, intimidation, handshakes and back slapping, all at once.

This approach has led many to complain that the US is unpredictable and no longer a home for investors. The FT reported “Big Investors Shift Away From US Markets”, quoting a vice chair at Blackstone ‘We’ve been quite, quite optimistic [on Europe]. Governments are relatively stable here. Shifting money to Europe is certainly not a bad bet’. This is the Europe where the Dutch government just collapsed, the far-right Chega party have replaced the Socialist party to become Portugal’s opposition after a snap election, France has had its second consecutive unelected prime minister, and Germany’s new Chancellor failed to be elected in the first parliamentary ballot for the first time in post-war history. Electorates are split. Parties are fracturing. Coalitions are fraying.

Conversely, the US electoral system has delivered a leader who won his election and the popular vote, whose party has won both houses of the legislature, and who selected ideologically friendly justices for the courts in his prior electoral term. Investors might not like the revolutionary mandate upon which Trump was elected but they can’t be surprised by the vigour with which he pursues it. [For more on how Trump, like presidents before him, is pushing constitutional boundaries, listen to our podcast with American Politics Professor, Dr. Nigel Bowles].

If stable means predictable, then the US is far clearer to predict than Europe, who find themselves forced into their own Zeitenwende.

It begins with the US/China trade talks taking place in London on Monday. It will end with US tax cuts, a higher US deficit, higher NATO country government bond issuance, higher tariffs than we have seen for decades and a plethora of ongoing US court cases. The final point, plus the back-and-forth on Trump’s dealmaking, will leave the stock market volatile but biased to the upside. We are in the final hurrah of FOMO, where TACO is just another acronym to encourage retail investors to BTFD.

Bonds is where the canary in the coal mine lives. As Jamie Dimon recently put it at the Reagan National Economic Forum, the bond market is “likely to crack… I just don’t know if it’s going to be a crisis in six months or six years, and I’m hoping that we change both the trajectory of the debt and the ability of market makers to make markets“. He went on to say that it was the people in the room who set interest rates, not the Federal Reserve. In other words, if investors decide they don’t want government bonds at current prices, not only will the effective interest rate charged on the debt rise but market makers will struggle to intermediate the selling, risking market dysfunction, or even, as he points out, the market closing completely.

A good time then for the ECB annual conference on Nonbank Financial Institutions and Financial Stability which is taking place on Tuesdayand Wednesday at which Bank of England FPC member Randall Kroszner will be making the keynote speech on Tuesday. Then on Wednesday ECB Chief Economist Philip Lane speaks at the World Bank’s annual “World Borrowers Forum” and on Thursday the RBA’s David Jacobs speaks on “Australia’s bond market in a volatile world” at the Australian Government Fixed Income Forum in Tokyo. At least this time round, the British Monarch won’t be able to ask central bankers why they didn’t see it coming.

And the central bankers are not merely an audience to the drama – they can be key actors. ECB President Lagarde will be making a presentation to the People’s Bank of China on Wednesday (the ECB website divulges no details of its contents). With the EU caught between the two sides of the US/China economic war, Lagarde appears keen to step up and take on European economic leadership. Not for her the plenipotentiary sinecure of running the World Economic Forum in Davos. She is, as her large gold necklace stated at the last ECB meeting, “in charge”.

Elected leaders have no need of such regalia. Their power comes from the mandate awarded to them by the voters. Rachel Reeves is about to find out that the Labour Party’s massive parliamentary majority wasn’t a mandate for her simply to get the Treasury to optimise the OBR’s spreadsheet. The long-awaited Spending Review will be delivered on Wednesday, the timing itself inviting intense scrutiny of each and every penny allocated. This would usually be a purely political exercise, where voters see what the government prioritises. The choice to increase spending for protected departments required offsetting reduced spending elsewhere, as this chart from the Institute for Government shows:

But these political priorities have an impact for Gilt investors too. They will look for answers to two questions:

- What is the plan?

- Specifying the breakdown in spending will show how the government seeks to deliver productive growth – with investment in economic infrastructure like railways and energy networks, or on public services like new hospitals?

- Can the plan be implemented?

- The market was already sceptical that the fiscal rules could be met, what with meagre fiscal headroom that was vulnerable to even the sniff of higher long term interest rates.

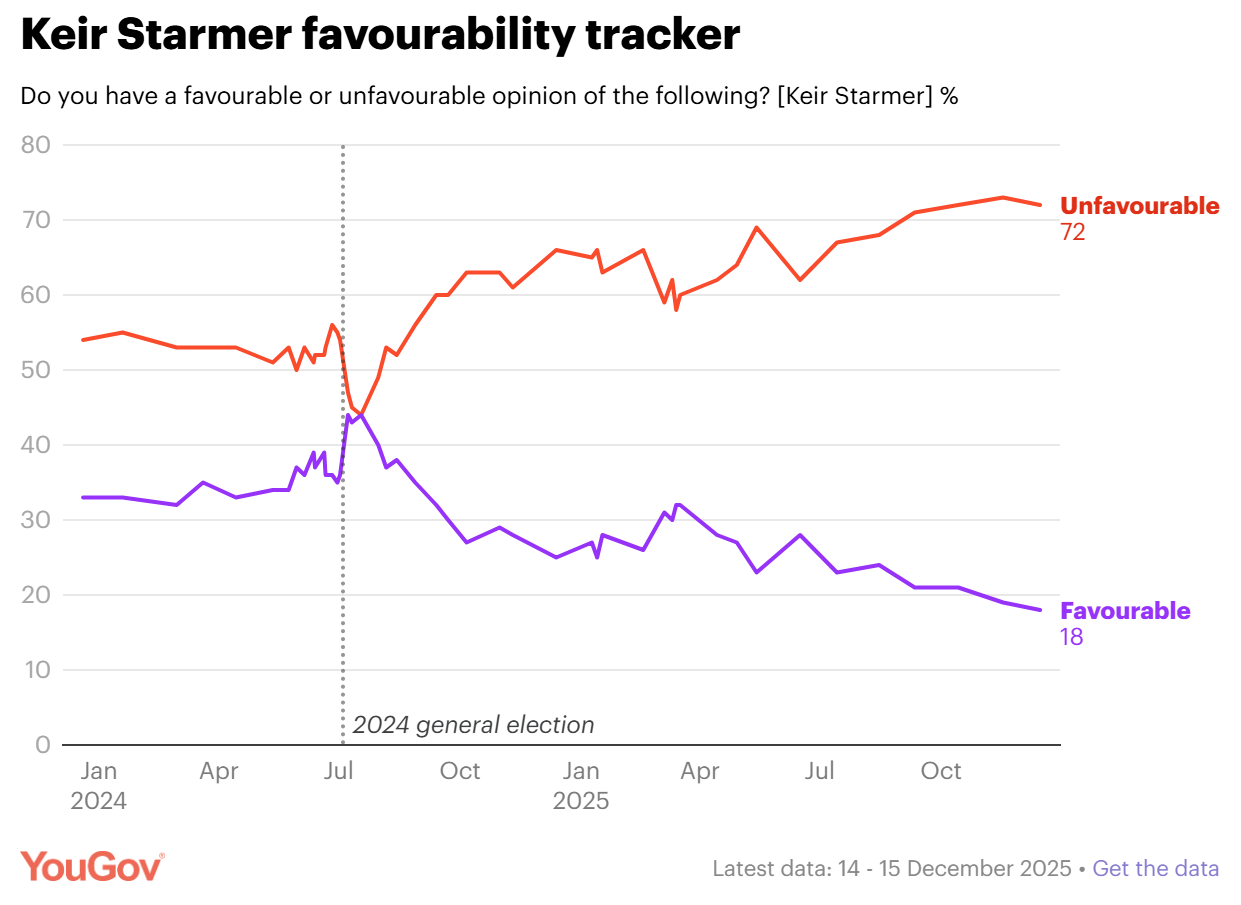

- But now there is a new constraint: Labour MPs, perturbed by plummeting poll ratings and a sense that many recent decisions were not what they came into government to deliver.

- Our Starmer Ratings show that the government will struggle to push through its planned cuts to welfare

- Hence the u-turn on winter fuel payments and widened entitlement to free school meals (currently received by 25% of all schoolchildren)

- If the government can’t deliver on its spending plans then the market would rationally reprice Gilts lower to reflect the risk

- Which would increase market interest rates, eroding fiscal headroom further…

- …requiring more belt-tightening from the government

- ….causing more unrest in the party

- And so on.

Reeves had better make decisions that convince her MPs, voters and the markets of her plan. Although as Mike Tyson once said, everyone has a plan until they get punched in the face.

The G7 summit takes place in Canada from Sunday 15 June to Tuesday 17 June. Then comes the NATO Summit in The Hague from Tuesday 24 June to Wednesday 25 June. The best laid plans often go awry. But the leader with the biggest financial market, the clearest electoral mandate, the salesmanship of a reality TV star and the most powerful military in the world will feel confident he’s the one to be landing the punches.