The Two Weeks That Will Be (22nd June 2025)

1. War

Once again Trump might surprise with the timing of his interventions but not with their magnitude. In 2017 he authorised the first use of the MOAB bomb (in Afghanistan); in 2025 he has repeated the trick with the bunker-busting MOP in Iran. As he headlined in that newspaper advert he took out in 1987, “There’s nothing wrong with America’s Foreign Defence Policy that a little backbone can’t cure”.

The first couple of paragraphs of that advert from forty years ago make it quite clear what we can expect at Tuesday’s NATO Summit: “For decades, Japan and other nations have been taking advantage of the United States. The saga continues unabated as we defend the Persian Gulf, an area of only marginal significance to the United States for its oil supplies, but one upon which Japan and others are almost totally dependent“. Given he’s been banging the same drum for four decades, it’s no surprise the summit has been shortened from two days to a two-hour meeting. Trump wants other nations to take responsibility for their defence and Nato secretary-general Mark Rutte has been doing a thorough job of signing everyone up to a 3.5% of GDP defence spending target (and 1.5% for military related infrastructure) by 2030. Spain is the remaining hold out but Prime Minister Sanchez has his own travails at home, with the swirling corruption scandals now taking out one of his closest advisors. We think it more than likely Spain will end up in a snap election this year. (You can add that to the list of unstable European governments).

Conversely, the US intervention in Iran is likely to generate more, rather than less, stability in the longer term. There’s nothing like seven B2 stealth bombers breezing through your airspace to remind you of your position in the world. And this is what Trump 2.0 is all about: Be In My Gang and Be A Winner. As Bessent put it in his op-ed for the Economist in October “the cost to remaining outside the perimeter would be high”.

In the short-term, there is a heightened risk of an accident or miscalculation, whether stray missile, cyberattack or lone wolf terror attack. This fragility comes just as gamma drops on the S&P500 due to the regular third Friday of the month options expiries, leaving the financial markets prey to increased volatility.

2. Central Bankers

Through the fog of war, central bankers are trying to remain calm, acutely aware they could be accused of being “too late” through inaction. Powell has been awarded the moniker regularly by Trump, who can with one announcement render Jerome an irrelevant lame duck by naming his successor. As Bessent pointed out, again in October last year, “You could do the earliest Fed nomination and create a shadow Fed chair. And based on the concept of forward guidance, no one is really going to care what Jerome Powell has to say anymore.”

This means Trump can juice up some monetary easing simply by announcing the successor – which might even be Bessent himself. Janet Yellen has already set the precedent by moving in the opposite direction. Bessent in control of the Fed would certainly cement the Trump reflationary agenda. Someone is trading on the outcome of a dovish chair, with Bloomberg flagging up a trade going through on the March 2026/June 2026 flattener (Powell’s term ends May 2026):

Fed Waller gets his latest opportunity to audition for the role in his speech on Monday, whilst Powell can try to secure his legacy in the increasingly irrelevant semi-annual testimony to Congress on Tuesday and Wednesday.

Then the central bankers all get together for the ECB Conference in Sintra from Monday 30 June. The showcase panel comes on Tuesday 1 July with Powell, Lagarde, Bailey and Ueda joined this year by South Korea’s central bank governor.

3. The UK

Bank of England MPC members are falling over themselves to speak before the likely next date for a rate cut in their next meeting in August. Four of them speak Tuesday, with Ramsden the most significant given his switch to join uber-doves Dhingra and Taylor by voting for a cut in the last meeting.

This will all come to be a sideshow if the government can’t keep its fiscal house in order. The vote on welfare reforms is expected to take place on Tuesday 1st July and Government Whip Vicky Foxcroft has already resigned rather than have to vote for the bill. Losing a whip, the person who is supposed to be prosecuting the government’s position, signals the danger ahead. Our quantitative analysis suggests the government will indeed lose the vote.

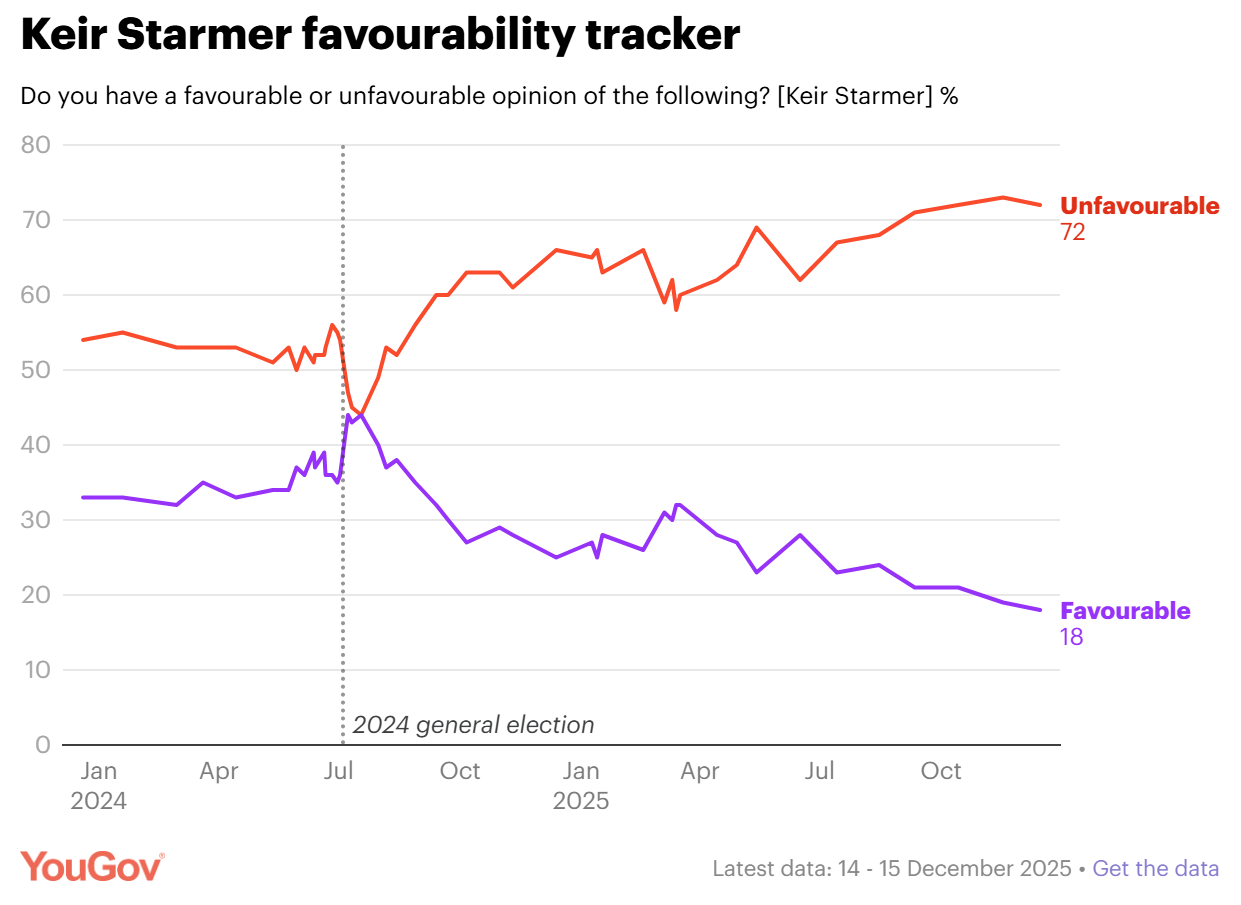

The fact this is even a possibility for a party with such a large majority shows the severely compromised position in which the government finds itself. Turns out promising not to raise any of the major taxes and then raising a whole number of other ones to sacrifice Labour’s moral shibboleths at the altar of the OBR isn’t all that popular with the party’s voters. The latest opinion polls have solidified the lead of Reform, with Labour and Conservative losing around half of their 2024 voters, according to Ipsos Mori.

And this is before the upcoming challenge to the Gilt market when it becomes clear that the government cannot meet its self imposed fiscal rules without fracturing beyond repair. The welfare reforms have been presented in a Green Paper but the vote itself is expected to be deemed a Money Bill by the Speaker, meaning that it can become law after one month, with or without the approval of the House of Lords. Why the need to act so expeditiously? The OBR needs about 3 months to prepare all of its forecasts ahead of the Budget and the Chancellor needs to give them proof that she is taking steps to stay within their predictions. A bit like how the winter fuel payment had to be removed before eligibility was calculated in September last year ahead of the Budget, the OBR timing is the tail wagging the economic planning dog.

Although the latest public sector net borrowing figures came in very slightly below OBR forecasts, it was still the second highest amount ever recorded for the month of May. As the Deputy Director for the public finances at the ONS pointed out, “While receipts were up, thanks partly to higher income tax revenue and national insurance contributions, spending was up more, affected by increased running costs and inflation-linked uplifts to many benefits”. This gets to the crux of the problem – tax more but spend even more and Mr Micawber is unhappy indeed.

So when the government loses the welfare vote, leaving another £5bn to be found on top of ~£1bn for the winter fuel u-turn, the market would be foolish to assume simply that some other tax hikes or spending cuts can be found in the autumn budget. The government is fast losing control of the situation.

4. The US

Rachel and Keir can at least feel relieved that the frenetic activity in the White House has merely raised questions over the sustainability of the US, rather than UK, deficits. This will be thrown into sharp relief once again if – or rather when – Trump manages to get the Big Beautiful Bill through Congress before the 4th of July holiday.

Steven Miran, Chairman of the Council of Economic Advisers, appears on the latest episode of Bloomberg’s Odd Lots podcast to explain Trump’s plan, reflecting on the success of ‘The same policy mix from the president’s first term, of trade renegotiation, tax reform, deregulation, energy, abundance, same exact mix in the first term that led to 3.5% unemployment, negligible inflation and historic gains in income, in real median and household incomes”.

He argues that extending the tax cuts is imperative, ‘because higher tax rates are really bad for the economy and they’re really bad for economic growth and they’re really bad for competitiveness’. He goes on to argue that higher tariffs will increase revenues and haven’t been factored into the CBO scoring process. In short, the administration’s argument is that the Big Beautiful Bill alongside tariffs and restricted immigration will turbo charge growth and that will take care of the deficit. And do you want the US Treasuries backed by B2 stealth bombers or not?

This question is more relevant for investor interest in US assets than the bellwether ISM report on Tuesday 1 July and the (earlier than usual) Payrolls on Thursday 3 July. Rumours of the demise of the US Dollar have been greatly exaggerated. Economics is now explicitly tied up in politics. ‘Twas ever thus, but the NICE decade (Non-Inflationary, Consistently Expansionary) papered over a myriad of international relations cracks. The return of inflation and fractured electorates has necessarily ushered in a new era.