The Two Weeks That Will Be (7th September 2025)

1. France

For a country about to lose its fourth prime minister in nineteen months, French assets are remarkably becalmed. On Monday, PM François Bayrou will face – and lose – a no confidence vote that he called in himself ahead of thorny budget negotiations with a divided parliament. Two days later, on Wednesday, the nation faces disruption from the so-called ‘Block Everything’ protests, organised by largely young and radical left agitators. France’s top unions have called strikes for 18th September. As one minister’s political adviser told Politico, ‘A political crisis on Sept. 8, a social crisis on Sept. 10. That’s a regime crisis, isn’t it?‘.

The parliamentary arithmetic simply won’t ever agree on the tough decisions required to combat France’s 114% debt-to-GDP ratio and the largest budget deficit in the EU. There will need to be fresh elections. If not, any choice of prime minister by Macron only serves at the pleasure of the far right and the far left, hardly the straitjacket the President wants to manage for the final eighteen months of his presidential term. He needs to get back on the front foot.

Macron can always return as President after a hiatus. The Constitution only limits the president to two consecutive terms. It is time for him to roll the dice: submit to another set of legislative elections, hoping for better arithmetic, and if not, resign and bring forward the presidential election. Ensuing financial market chaos would only be grist to his mill, providing him with the argument that flirting with extremists only makes things worse. Fitch will deliver an updated credit rating on France on Friday.

2. The ECB

France’s 10 year yield is about to surpass that of Italy for the first time in the Euro’s creation, having already gone beyond Spain, Portugal and Greece. President Lagarde famously said in March 2020, only four months into her tenure at the ECB, that “we are not here to close spreads“. Last week she told French Radio Classique, “I am looking very attentively at the French bond spreads situation“. How the music changes now that Eurozone core has become periphery. (Chart below courtesy of @fwred):

Except that there is little the ECB could or even should do about a rational re-pricing of France’s sclerotic debt-deficit dynamics. From the alphabet soup of bond-buying programmes they announced since 2012 (PSPP, PEPP, OMT, TPI), only the the pure monetary stimulus QE versions (the first two) have ever been used in anger. The other two were designed as backstops to ensure government bond markets didn’t descend into complete dysfunction but have (so far) never been activated. Eurozone bond markets have blurred into one, with the gap between the highest and lowest yield falling to its lowest since before Lehman Brothers fell.

This complacency is set to be challenged given the huge amounts of debt incurred since the pandemic alongside Germany’s Zeitenwende-wende into higher debt issuance. The draft German budget proposal sees borrowing almost triple in 2026 from where it was in 2024. The inexorable logic of monetary union means that the markets are due for yet another fundamental reassessment of the Eurozone’s debt position. The answer will be some sort of debt-pooling, paving the way towards the fiscal union that completes the logic of EMU. But for electorates to accept this, fiscal pressures will first have to increase. The monetary authority might backstop total meltdown but it cannot intervene to prevent it, for fear of undermining its own independence.

There is always a bit of a fudge however. A recent ECB blog post concluded “Economic uncertainty weakens monetary policy transmission” and suggested more forceful action is required from the central bank when things are more uncertain:

The “Transmission Protection Instrument” was the most recent addition to the ECB’s toolkit, created in July 2022 to “ensure that the monetary policy stance is transmitted smoothly across all euro area countries“. Lagarde can’t close the spreads but she wants to do more than look at them. She can start with an interest rate cut at the ECB meeting on Thursday.

3. The Fed

There will be cover from an uber-dovish Fed on Wednesday 17th September where we think they’ll go for broke with a 50bp cut in the wake of the poor recent jobs report. Powell might indeed have been ‘too late’ so best he owns the narrative himself by switching to dove. The annual benchmark revision should provide a useful excuse. Due on Tuesday it is expected to show that the economy lost up to almost 1million more jobs between April 2024 and March 2025 than the BLS had originally estimated.

This is in line with the prior year but these are some of the biggest revisions ever seen. Partly this is due to the huge shift in the labour market in the wake of the pandemic but at least part of it is due to the problems the statistical authority have had in collating and disseminating the data. As we noted in our article for MoneyWeek the BLS had been in for a torrid time even before Trump jumped in to fire the Labor Commissioner: ‘over the last eighteen months it has “inadvertently” released inflation data early, posted the annual employment revisions late and informed some financial institutions (referred to by a BLS employee as “super users”) about details in the data that others might have missed’. Meanwhile declining survey response rates raise the question of whether the data is even fit for purpose:

“Technical difficulties” even plagued the release of this month’s payrolls data. Inflation data due on Thursday won’t stop the Fed from getting on the dovish front foot.

4. The UK

The UK jobs report is due on Tuesday 16th September but is still a statistical work in progress. Starmer might envy that Trump actually had a national statistician to fire – the current post in the UK is held only on an interim basis after the incumbent stepped down.

Still, Starmer might be done with the hiring and firing for now. The Reshuffle is all about delivery. Those who were deemed to have failed to deliver the welfare reforms were booted out – Liz Kendall gone and Chief Whip removed from Sir Alan Campbell. Starmer evidently wants to give welfare reforms another go with his installation of safe pair of hands Pat McFadden at a beefed up Work and Pensions brief. Starmer is evidently unaware that financial markets are forward, rather than backward, looking. The damage has already been done – the markets will need a lot more than £5bn of savings to believe the government has a credible plan.

And the reshuffle will force markets to address the increasing split within the Labour Party. Moving ministers always creates enemies. One sacked minister reportedly said “I will f*** Starmer up”. The minister who had been working alongside Angela Rayner on the totemic Employment Rights Bill took to social media warning “it would be really, really foolish for the Government to row back on key manifesto commitments” on employment rights. Safe to say whoever is elected Deputy Leader of the Labour Party will not be a friend of Starmer – every single one of his enemies, whether MPs, trade unionists or party members, now has the opportunity to unite against him.

And the battle for the soul of the party will not wait until the Budget on 26th November – as soon as numbers start to leak, the fighting will break into the open. In such a febrile atmosphere, we can ignore GDP data on Friday and inflation on Wednesday 17th September as they will be politicised. The Bank of England should get interest rate cuts in before the political risk intensifies further. Their meeting on Thursday 18th September is the penultimate one ahead of Budget day. At this meeting they can and will significantly reduce their annual QT plans which should at least provide a short term bit of breathing room for the government.

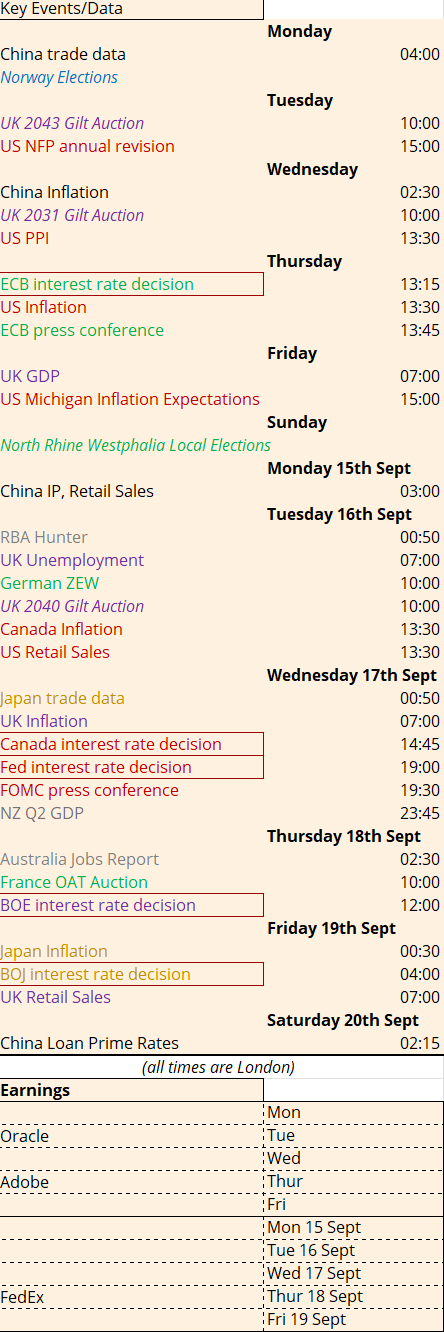

The DMO has been getting its issuance in while it can. The £14bn syndicated 10 year issuance on 2nd September was the “largest ever gilt issuance event in the DMO’s history“. The index-linked auction on 4th September was completed at the highest real rate since 2001. The DMO is aware of the potential for volatility. The timing of the Budget led to a typical rearrangement of Gilt auctions around the date – except that the long bond auction was removed. It was replaced by a general commitment to another auction that would be decided nearer the time. The DMO knows it needs flexibility. There are further Gilt auctions coming up on Tuesday, Wednesday and Tuesday 16th September.

5. Japan

But it’s not all within the power of the UK government to determine Gilt prices. Government bonds are caught up globally in a toxic mixture of huge issuance, sticky inflation and political risk. JGBs have been leading the charge with sell-offs in the long end of government bonds. The resignation of Prime Minister Ishiba now that the Japan/US trade deal has been signed off will usher in a period of uncertainty.

It will not be clear for some time who the next leader of Japan will be. The vote itself operates as a run off, unless one candidate gets an outright majority in the first round, with a balance of votes between MPs and party members. This tends to harm frontrunners, with a compromise candidate emerging. The process could be truncated – there is the possibility that a party convention can be bypassed, with a candidate voted on by a joint meeting of both houses of parliament. Even then, the winner is not necessarily appointed prime minister as opposition parties can unite behind a rival candidate.

Suffice to say, political risk is rising. The Bank of Japan will want to avoid any criticism from candidates (some of whom have been quite vocal in their discomfort over BOJ hikes) and so will do very little at their meeting on Friday 19th September.