3rd December 2025

Misleading

This is what we now know:

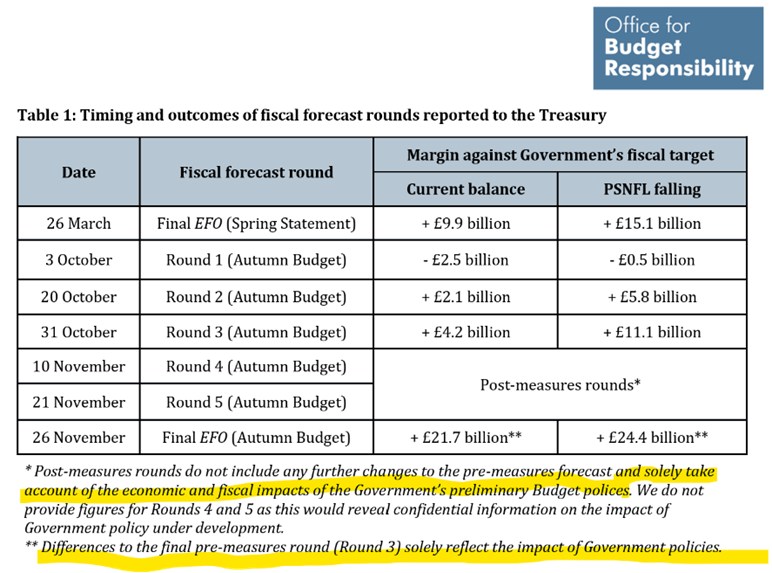

- On 31st October, the OBR submitted their final pre-measures forecast round, showing +4bn headroom.

- This incorporated both a downgrade to productivity but also an upgrade from higher than expected wage growth.

- On 4th November, the Chancellor gave her “scene setting” speech where she said:

- the OBR will “set out the conclusions of their review of the supply side of the UK economy. I will not pre-empt those conclusions…but it is already clear that the productivity performance is weaker than previously thought”.

- On 11th November, aides to the Prime Minister briefed that he would fight any leadership challenge.

- On 12th November, Bloomberg reported the Chancellor “has been unable to make final decisions on what policies to announce in part because of ongoing arguments in cabinet about what to do”.

- On 13th November, the FT reported the Chancellor had “ripped up” proposals to raise income tax.

- On 14th November, when the Gilt market opened, the 10 year had its biggest sell off since the tearful post-welfare rebellion in July.

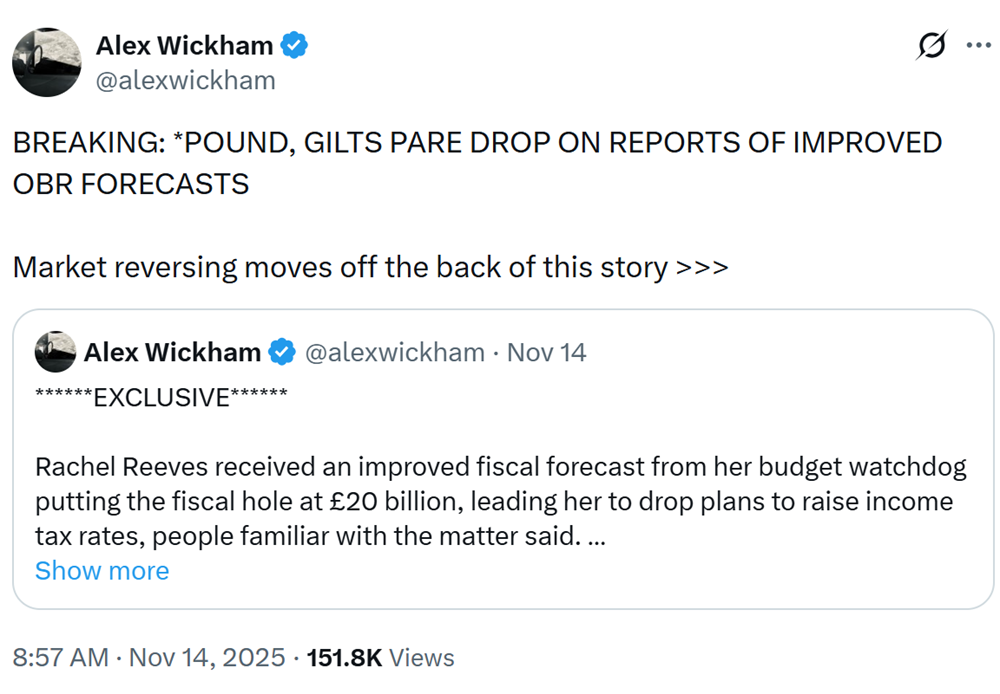

- On 14th November at 9am, Bloomberg ran a story with the headline “Reeves’ Tax U-Turn Came After Better Forecasts from UK Watchdog”, which explained

- “The OBR delivered its latest judgment this week, the fourth in a round of five preliminary forecasts it privately prepares for the Treasury ahead of budgets. People familiar with the matter said those showed that strong wage growth offset some of the downgrade in productivity that had been expected to constrain the chancellor.”

- This story saw Gilts rally back:

- On 2nd December, at the Treasury Select Committee hearing with the OBR, David Miles was asked by Harriett Baldwin:

- Between the time we were told of the Chancellor of the bad news and the moment on 14th Nov when the Treasury had to clarify to the gilt market because it reacted so badly that there was good news, the impression that was created was a false one. Wasn’t it?

- He replied: It’s certainly true that there wasn’t any immediately good bit of news in that particular window. I don’t think it was misleading for the Chancellor to say that the fiscal position was very challenging at the beginning of that week. Whether a message was then put out to say that it was less challenging by the end of the week, I don’t know, and I don’t know where that message would have come from. It certainly didn’t reflect anything that was news from the OBR being fed into the government.

- TSC Chair Meg Hillier then asked: Are you saying that the Treasury briefing that good news received from the OBR had driven the decision to reverse a proposed income tax rise was incorrect…?

- Miles: I honestly couldn’t tell you what drove that decision.

- Miles also said “I think our concern was that there seemed to be a misconception that there had somehow been… some good news… I’m not sure where that came from. It didn’t exist“.

What can we conclude from this? Politics, not economics, is driving policy. And with the prime minister and Chancellor intertwined into a weak, reactive position as they attempt to shore themselves up, they will continue to make decisions that roil the market rather than placate it.

- Pleasing the markets had been Reeves’ priority in order to ensure her survival. This has been eclipsed by the new priority of protecting Starmer.

- This means buying off backbenchers and stemming any market retaliation for the leftward lurch by any means necessary.

- Putting stories into the FT and Bloomberg demonstrates they were aware of the need to guide markets.

- But the backtrack to Bloomberg was at best a disingenuous misdirection.

- At worst it was a lie. As David Miles told the TSC about the briefed good news, “it didn’t exist”.

- The OBR did submit a forecast round on 10th November but that was focused only on the government’s policy measures, not any changes to its model of the economy. They emphasised this in their letter to the TSC – a letter that they had drafted up the week or so before the Budget, evidently due to the concern of how they were being misrepresented:

- The Chancellor is no longer able to make the call on economic decisions. It’s Starmer’s choices who have been driving policy.

- Torsten Bell energetically, and with some reportedly visceral language, thrust his “2 up 2 down” income tax idea into proceedings.

- Minouche Shafik suggested rejoining the EU customs union to boost growth, an idea now gaining ground with paymaster general – and EU negotiator – Nick Thomas-Symonds promoted to permanent Cabinet attendee.

- As we noted in August when we reflected on the pasty tax creeping into the omnishambles Budget of 2012:

- Osborne’s “team were so focused on the big ticket [items]…that they took their eye off the other balls”. If Number 10 now tries to intervene versus Number 11, more eyes will miss more balls. There will be a private battle played out in public as Starmer and Reeves determine between and against each other which policy sells best. Kites will be flown and shot down and resurrected. Sources have told the Guardian that this will be a deliberate policy; that it will be such a tough budget the government will need to roll the pitch.

- It all adds up to the sense of a chaotic and dysfunctional government with its back against the wall.

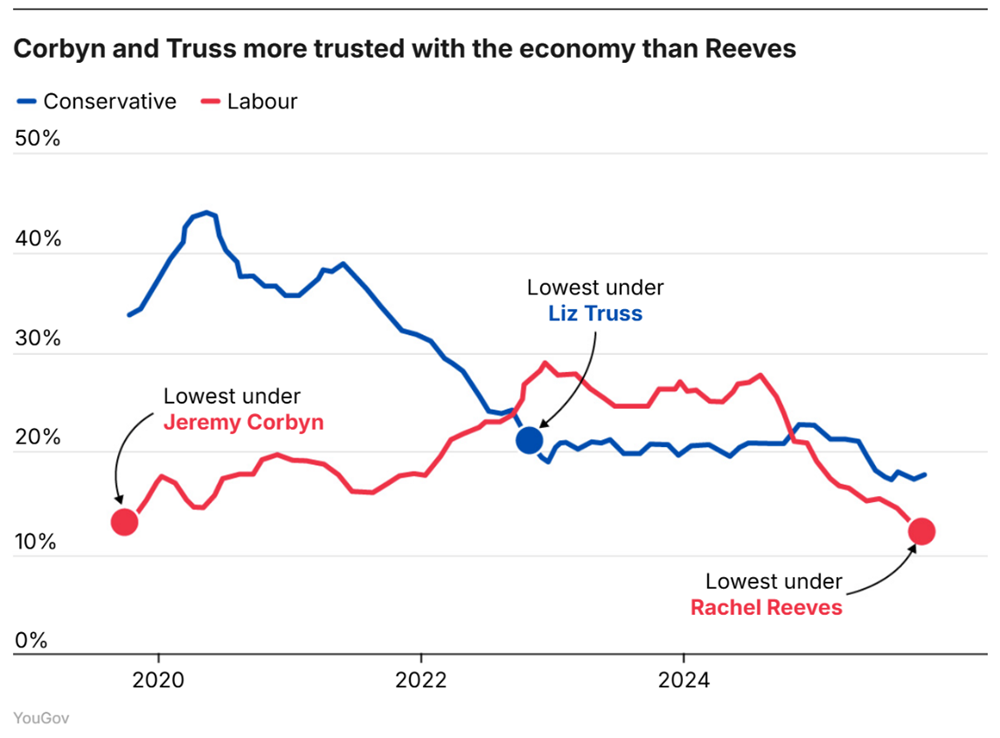

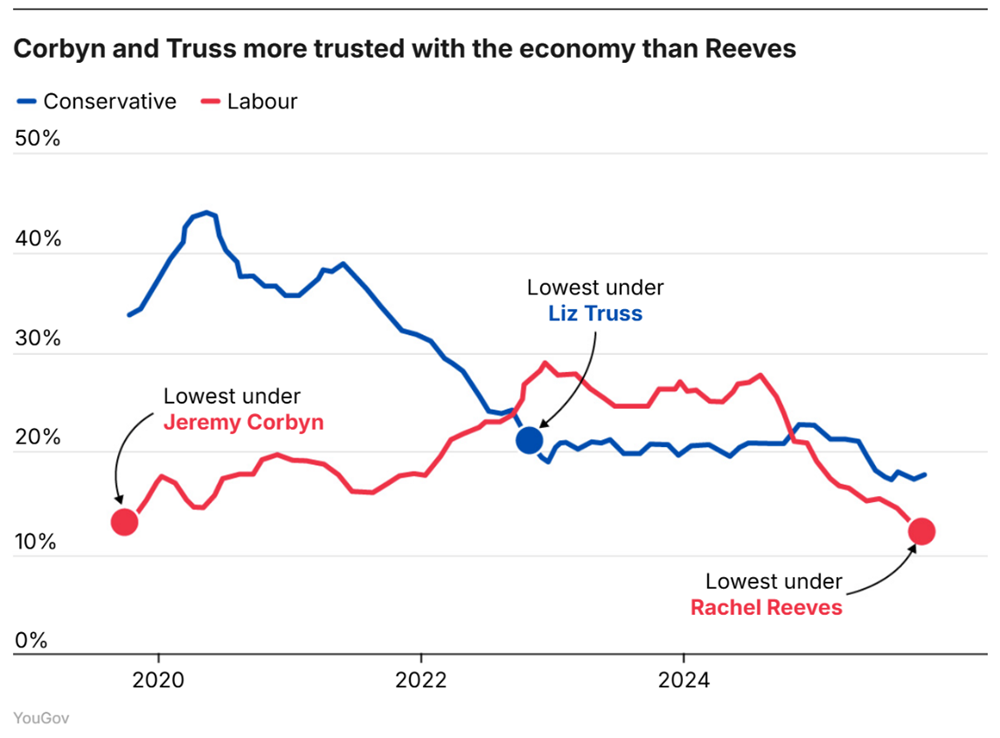

- Labour is now less trusted on the economy than the Conservatives were under Liz Truss, according to a YouGov poll

- Markets are broadly becalmed for now but that will not always be the case.

The day of the Gilt sell off, the VIX was headed up through 20. This looks to be the line in the sand for when political risk has an increasing impact on market pricing. Below that level and it is ignored – but not eradicated.