The Year That Will Be 2026

Here are our 5 Ps to help Prevent Poor Performance this year:

- Peak Trump

The setting couldn’t have been better for the first reality television US President. There were already celebrations a-plenty planned with it being 250 years since the US gained independence. At the same time, the Men’s Football World Cup will be taking place in North America – a literal battle between nations, hosted by the US in conjunction with Mexico and Canada, the USMCA made flesh. There could be no better backdrop for Donald Trump to demonstrate what Scott Bessent described to The Economist in October 2024 as “reshaping the international economic order“.

The World Cup will therefore provide more than just the usual set pieces. If the gods of football deign to rhyme with history, there is a path in which the USA face off against England in Philadelphia at the Lincoln Financial Field on Independence Day, only a few miles from Liberty Bell itself, with the sun setting as the match ends – just in time for all the fireworks.

Whoever ultimately lifts the (modern day) Jules Rimet trophy, we already know Trump will be by their side, having gatecrashed Chelsea’s celebrations at the inaugural Club World Cup last summer:

The whole championship kicks off three days before Trump’s 80th birthday – which itself will be marked by (what else?) an Ultimate Fighting Championship competition on the White House lawn. This event is so significant that it has already forced the G7 to push their summer summit back by a day. The G20 summit later in the year will be taking place in Miami – at where else but a Trump resort. The website currently consists of this sole image:

All of this frenzied media hype is going to lead to Peak Hubris from Trump himself and, in response, Peak Challenge from his opponents on all sides.

But how far is each side prepared to go? Trump probes the Fed Chair; the DoJ launches an investigation; Powell ratchets up in response that the subpoenas are “threatening a criminal indictment”; the world’s central banks join in with a #MeToo joint statement backing Powell before any charges have been brought; which earns the RBNZ Governor a rebuke from New Zealand’s Foreign Minister for doing so. Hubris plus Challenge leads to a heady cocktail.

Trump always wants you to think he’s bringing a bazooka to a knife fight; but don’t bring a gun if you’re not prepared to use it or the whole thing can spiral out of control. He is not playing a deep constitutional game to rewrite the role of the President, nor gobbling up nations in some ideological foreign policy plan. He’s just flexing any and every muscle to make sure he wins every battle. Congress is stirring from its supine slumber with five Republicans voting through a war powers resolution – only for two of them to fold at the next stage, kiboshing attempts by the legislature to restrict the power of the executive. Trump still holds the whip hand. He will always consider the nuclear option where his opponents would not. Don’t be surprised to hear him talk of increasing the number of Supreme Court justices if even his own conservative packed court doesn’t play ball (echoing FDR’s failed attempt). There is still life in the US Constitution yet.

As the constitution offers the executive the role of Commander-in-Chief, foreign policy is a natural place for Trump to flex his aggrandising muscles. To this end, no jurisdiction is off the table for the Dealmaker-in-Chief. It’s not a question of whether the US will gain control of Greenland’s strategic position and resources; only of how. Trump would remember Operation Chrome Dome – a US Air Force mission in the 1960s which saw a B52 bomber armed with nuclear weapons in constant airborne alert in order to face off against the Soviet Cold War threat. These flights routinely flew over Greenland.

When it comes to the Middle East, the balance of power is shifting with Iran’s Ayatollah in his ninth decade and the millennial MBS turning towards modernity (recently loosening rules on alcohol and house purchases for wealthy expats). Israel has to hold a parliamentary election by 27th October 2026, potentially one of the most consequential events of the year for global international relations.

In our 2025 outlook we noted that President Trump is “the CEO of a company who can write his own laws”. We have never seen anything quite like it but you can be sure we will be seeing an awful lot more of it.

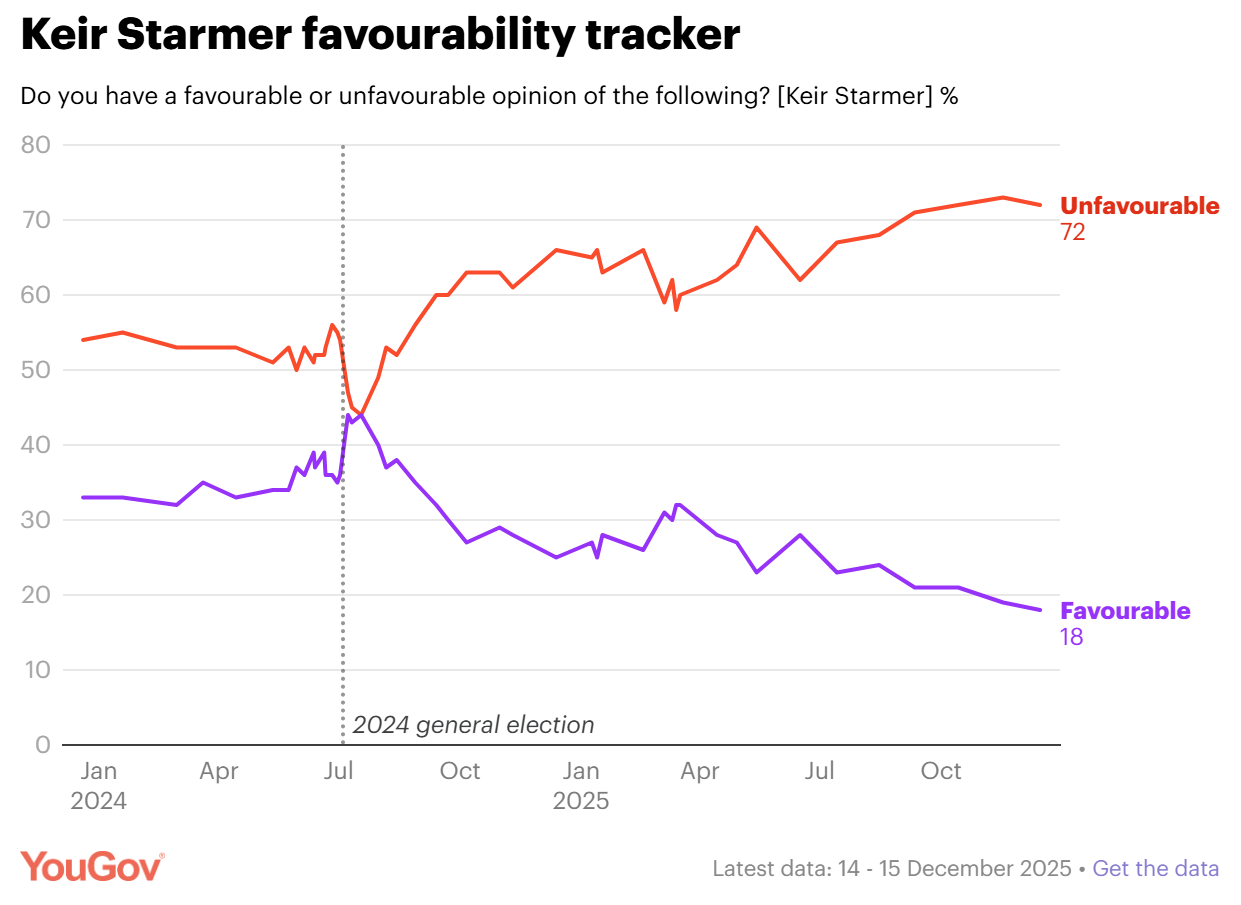

- Post Starmer

We will be seeing a lot less of Keir Starmer. The shadow battle for his replacement is already well underway. Everyone is simply waiting for something, or someone, else to kick off the transition.

With thwarted speculation that Starmer might have been in line for a position on the US administration’s proposed “peace board” in Gaza, some are clearly keen to think about his next move. His preferred foreign policy stage might stay the execution but British politics is won within the confines of the sceptred isle.

His replacement will at least be afforded a honeymoon boost. The party will have to fall into line behind the new leader, reducing the backbiting and in-fighting, for a while at least. The new leader will also have the window of opportunity to articulate a clear policy platform. As of 3rd March 2026, they will have a Spring Forecast update from the OBR which would enable them to make changes to fiscal policy, assuming the leadership change is complete by June at the latest. Clarity over direction will provide reassurance to financial markets, reducing the UK risk premium.

It won’t last long term as the Labour Party remains irrevocably split over how to match its fundamental ideals with the fiscal constraints of 100% debt-to-GDP. This will ultimately lead to government collapse as Labour MPs defect or sit as independents, ushering an election sooner than 2029. That contest will ultimately be Reform v The Greens as the electorate continues to tire of legacy parties and seeks to roll the dice with more extreme forces.

- Pre Le Pen

The French electorate are already revolting. Plus ça change. But it would be complacent to assume it’s all la même chose. The government could fall at any time. With Le Pen’s Rassemblement National consistently ahead in the polls, the right wing has plenty to gain from fresh elections. Momentum from those elections could have the added bonus of catapulting their candidate into the Presidency with the election due in April 2027.

Except who will the candidate be? Le Pen has just started her appeal against conviction for misuse of EU funds and the result isn’t expected for a number of months. Even when it is delivered, we may not have clarity, as the appellate court may only partially overturn the result, or could change the ban but not the conviction. In the midst of all of this, Macron may decide to bring matters to a head and resign, triggering a presidential election while Le Pen remains barred from office. As he can’t run again himself, this would hasten the hiatus if he were to plan to return for a non-consecutive third term.

In any case, the insurgent forces that propelled Macron into power in the first place will now work against him as they look for a new home. Should Le Pen be ineligible to run, her protégé Jordan Bardella is ready to take her place. Polling at the end of last year showed him beating any candidate in the Presidential second round. He may only be 30 but he has, as is customary, written a book that is topping bestseller lists. “What The French Want” features Bardella’s chats with 20 ordinary people. A far cry from Macron’s gilded palace. The Jupiterian crown is now wilting atop Emmanuel’s head. The electoral guillotine awaits. France’s enormous debt pile will pay the price.

- Poor Merz

Chancellor Merz’s decision to ratchet up German debt levels within days of barely winning the last election may have been welcomed by investors but it has left a lasting mark on his party. Regularly beaten in opinion polls by the AfD, the CDU/CSU appears to have entered into a death spiral by chumming up with the SPD for a coalition that pleases no-one.

The Chancellor almost lost a key vote on pension reforms at the end of last year thanks to a revolt by the youth wing of his own party. Having unneccessarily demanded the vote pass by absolute majority, it managed to do so by just three votes. Seven of his own MPs voted against, two abstained and one didn’t vote. One of those who voted against is Helmut Kohl’s grandson. Aged 29, he is just one of the younger party members who argued that his generation will be the one bearing the burden.

There are five state elections taking place which will crystallise voter discontent with the ruling coalition. The two elections where the AfD is currently polling towards 40% take place in Saxony-Anhalt on 6th September and Mecklenburg-Vorpommern on 20th September. If the AfD can beat the firewall of the opposition parties and govern, it would gain representation in the Bundesrat. It could also complicate matters for NATO troops in any AfD controlled region given criticism of the alliance by some AfD politicians.

Poor old Merz won the electoral battle in 2025 but 2026 will be when he starts to lose the war.

- Pro-Reflation Takaichi

Japan’s Prime Minister is taking the fight to the electorate, calling a snap election in the hope of winning a mandate and, importantly, restoring a majority. As of last year, Japan’s all-conquering LDP has for the first time in its history failed to hold a majority in both houses. Takaichi is gambling her high personal approval rating will translate into electoral success for her party.

If so, she can pursue a reheated Abenomics 2.0 except this time the world might be rather more focused on the foreign policy dimension than whether loose fiscal and tight monetary policy might shore up the currency. Japan and the US have been conducting aerial drills in opposition to those by the Chinese and Russians whilst an unnamed official suggested in a personal comment to reporters that Japan should possess nuclear weapons.

- And finally…“Don’t Get Caught Short”

The market only learnt one lesson from last year’s political risk: “Don’t Get Caught Short”. This kicked in over the volatility around the Liberation Day tariffs. The extent of the dislocation can be seen in the SPY ETF. This is one of the largest and most highly traded ETFs in the world, given it tracks the highly liquid S&P500. As such, it usually trades in fractions of a basis point versus the underlying. When Trump announced the tariff pause on 9th April, it printed at a premium of about 90 basis points. This was the largest premium since the financial crisis and reflects the sheer desperation and scale of traders trying to cover short positions.

This has created a curious market response to the manifestation of political risk – ignore it because it’s too expensive to remain short if irrational politicians eventually do something rational. This happened time and again last year, with Rachel Reeves’ tears saving Gilts and the reappointment of yet another French prime minister failing to shred OATs.

Rationality in the eyes of the market doesn’t always concur with a politician’s rational response, given each has a different constituency. Hence we are in a position where, at some point, the build up of political risk is just too much for the market to ignore.

This changes the potential distribution of outcomes. There will be more expectation of upside returns, with more time spent in the upper half of the distribution. But the fat tail on the far left downside will get even fatter:

Expect higher volatility of volatility for the year ahead.