23rd May 2025

Frit

- UK PM Starmer told Parliament on Wednesday “as the economy improves, we want to make sure that people feel those improvements each day as their lives go forward. That is why we want to ensure that more pensioners are eligible for winter fuel payments as we go forward. As you would expect, Mr Speaker, we will make only the decisions that we can afford, and that is why we will look at that as part of a fiscal event.“

- This, then, is a u-turn that is only the hint of a u-turn.

- It doesn’t offer details of what would change eligibility and provides no date for its enactment.

- It is assumed the next fiscal event would be a Budget in October, not least because the Chancellor set out in the Charter for Budget Responsibility a “commitment to a single fiscal event every year”.

- But the eligibility for the winter fuel payment is calculated in mid September and the OBR needs at least 10 weeks to prepare a fiscal forecast.

- And the Chancellor needs the OBR to have as much evidence as possible for its forecasts so that she knows what is available in her budgetary spreadsheet.

- Without it, she cannot compute the trade offs between political capital and fiscal constraint

- This is where the last minute arguments over restrictions on disability benefits came from during Spring Statement preparations

- This is all cart before horse.

- Waiting twice a year for the OBR to tell you what money you can spend is not what the electorate voted for

- They want the government to make competent decisions, not technocratic tweaks

- This is not the work of a surefooted government with a solid majority and mandate for action.

- The government is, as Maggie T would have put it, frit.

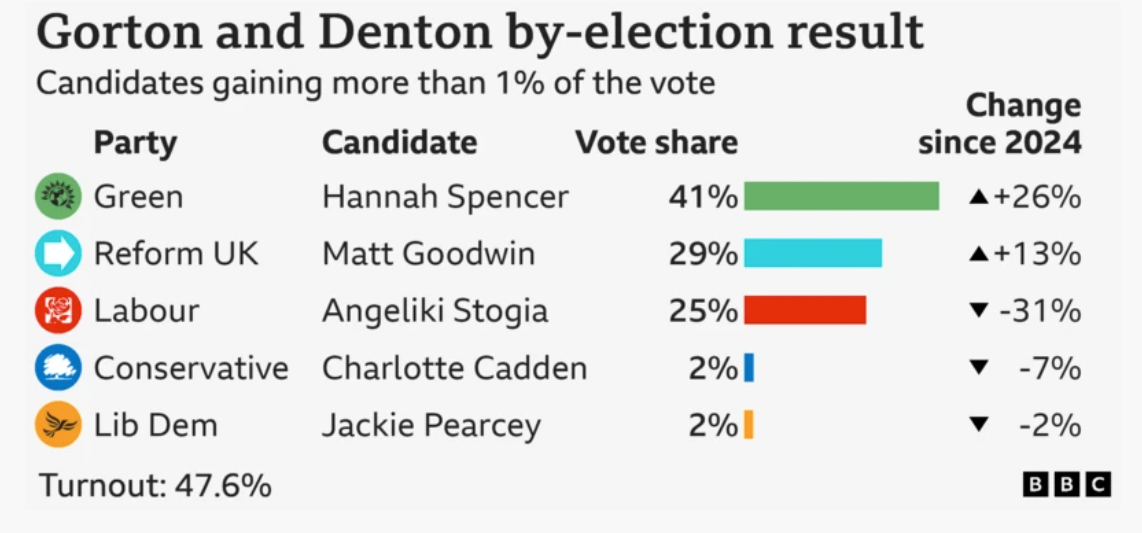

- Frightened by the loss of their sixteenth safest seat, with Reform winning the Runcorn by-election

- Frightened by the loss of local councillors, in the same proportion as those lost by the Conservatives

- Frightened by plummeting in the polls, having lost as much support as the Conservatives did during the Truss premiership

- MPs are scared and the Prime Minister is scared they won’t support him.

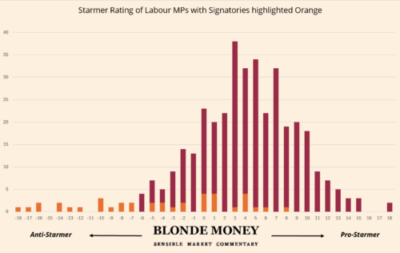

- Our Starmer Ratings suggest this is rational, with even MPs who are more pre-disposed to the PM becoming frit of such changes:

- The government is, as Maggie T would have put it, frit.

- But the government is also frightened of the bond market.

- Satisfying the OBR was only a necessary but not sufficient condition for satisfying the markets.

- With bonds under pressure globally as deficits and inflation rise, it doesn’t matter what the OBR says in five months’ time.

- The market will judge each second of every day whether the government has a credible plan, just as it does for all other governments.

- With fiscal headroom fast disappearing, the government can ill afford to ease off on fiscal discipline

- And yet the Prime Minister decided to surprise with a u-turn

- But fear of the market meant it couldn’t be a real u-turn

- So now it’s the worst of all worlds: trying to regain political capital but in such a small way that it risks losing the fiscal discipline that the capital was sacrificed for in the first place.

- Starmer is coming unstuck.

- Hence leaks that Rayner had sent a very detailed memo to Reeves ahead of the Spring Statement, calling for tax rises and changes to benefit entitlements.

- And reports that Starmer is in a dispute with his chief of staff Morgan McSweeney over the two-child benefit cap.

- Former PM Gordon Brown has stepped in, calling for the two-child benefit cap to be scrapped, paid for by taxes on the gambling industry or reducing the interest paid to commercial banks for their deposits held by the BOE.

- Pressure is building.

- There is a Scottish Parliament by-election on 5th June, in the seat that is represented in Westminster by McSweeney’s wife.

- There is a Spending Review to publish next month, which will bring into stark reality what a reduction in the growth of public spending will mean in practice.

- There is a vote due next month on the changes to welfare benefits.

- Any wobble in Gilt markets will remind Labour MPs of their predicament.

- They don’t like the decisions made so far but if – indeed, when – the debt/deficit dynamics worsen, they’ll like those decisions much less.

- If the government is already frit, less than a year into winning a huge majority and after two fiscal events, imagine the damage after another Gilt market wobble, let alone a full blown fiscal crisis.