9th January 2025

In Reeves We Truss – Part 2

In the aftermath of the Budget, Treasury Minister Darren Jones concluded ‘we’ve all got Liz Truss PTSD’. He was trying to swat away concerns about the post Budget move up in yields but he was right in more ways than one.

- Absent the Truss episode, the Reeves budget would have delivered the biggest two day increase in 10y gilt yields of any budget since 2006, as this chart from Deutsche showed:

- The market was therefore already sceptical about Reeves’ plan to ramp up and frontload borrowing in order to increase public sector investment. As one investor told us, “Why should I finance pay rises for ASLEF?”

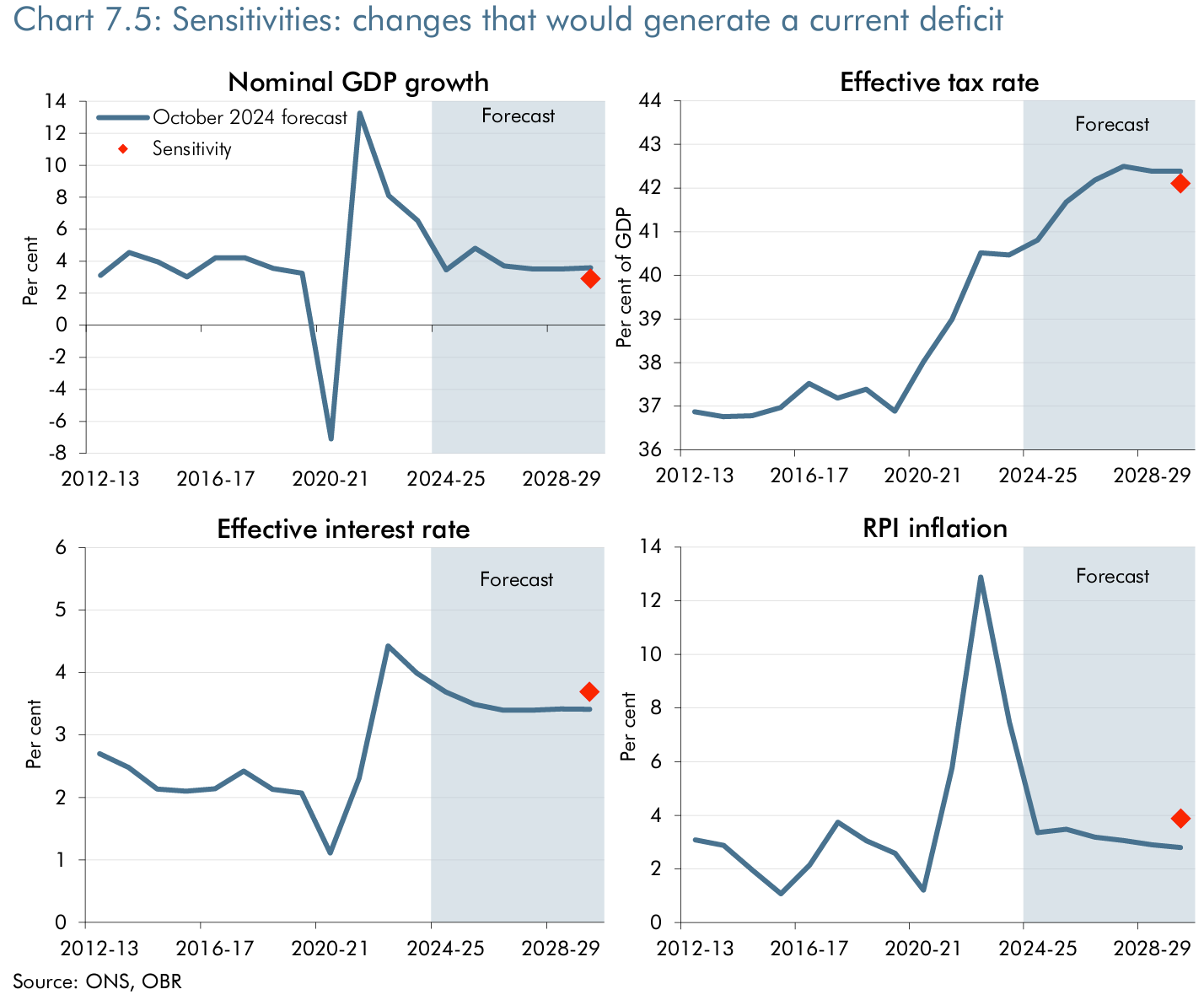

- And the OBR warned that it was all built on a shaky edifice. Their sensitivity charts show that Reeves’ ability to meet her rules was prey to even tiny changes in growth, taxes, inflation and interest rates:

- Just over two months later, almost all the variables have deteriorated: A recalcitrant Bank of England, sticky inflation, stagnant growth and diminished consumer and business sentiment cannot be ignored.

- At the same time, the market is reassessing its appetite for all debt. There’s a lot of it out there already and more to come, thanks to DJT 2.0.

- Who can pay their way?

- The US has a new government with a mandate for reflation and a reduction in government spending

- The EU is in political stasis but the ECB is cutting rates to fill the vacuum

- The UK is the worst of both worlds. No rate cuts, no imminent signs of growth. There is a government with a big majority but it has no mandate.

- Worse, it’s a government that chose a plan the market already considered to lack credibility.

- Who can pay their way?

- And so the market is shunning UK debt for being too risky in a world of higher debt and higher interest rates.

- Absent a dramatic reversal in interest rates, the UK is in a self-fulfilling doom loop where so much money is spent on financing the large extra amounts of borrowing that Reeves can never meet her fiscal targets – leading to even higher interest rates as investors pull out, leading to even higher interest payments by the government, and so on.

- To break the loop, Reeves could:

- Rip up the budget.

- Politically impossible (for her, at least).

- Raise taxes.

- But that exacerbates the stagnant growth, so it’s economically impossible.

- Borrow more.

- But that means pouring fuel on the fire, so it’s financially impossible.

- Reduce the growth of public spending.

- The market has inferred this is therefore the only option. But given the spending review has been pushed back to June; that cabinet ministers wrote to the PM two weeks before the Budget complaining about cuts in their departments; and that the government has scrapped Latin in secondary schools to save a measly £4million, this will not happen without a massive, possibly existential, fight.

- Rip up the budget.

- Eventually the market will realise that this is therefore also not an option.

- There was no mandate for austerity, or even for low growth in public spending.

- To ease the pressure, the government could get on the front foot. Its responses of the last 24 hours do not bode well.

- The Treasury issued a statement (subsequently downgraded by Darren Jones to ‘The Treasury responded to requests from journalists about headroom, as we might do in the normal way’) which said ‘only the OBR’s forecast can accurately predict how much headroom the government has’.

- Aside from the OBR’s less than stellar record as a forecaster, this is an astonishing failure to understand how markets work. The statement added ‘anything else is pure speculation’.

- But that’s exactly what markets do. They judge every second of every day about the price of risk.

- They are not going to wait until the OBR releases its updated forecast on 26th March 2025 to determine whether the government has a credible plan.

- This is Truss PTSD writ large.

- The OBR is not the alpha and omega of the price of Gilts, it’s merely one of several institutional guardrails.

- Obsessing about the OBR appears to have blinded the Treasury. HMT must be proactive, not reactive. They need to communicate directly with the market, not wait for an independent body to issue a number that the Chancellor plugs into her spreadsheet.

- Truss didn’t lose her job because of the OBR.

- The government is wildly behind the curve.

- Reeves hasn’t even made a public statement. She didn’t attend Parliament for today’s Urgent Question, as she’s on a trip (!) to China (!!) with the Bank of England Governor (!!!) and the Chief Executive of the FCA (!!!!), on an illiquid market holiday (!!!!!) the day after the biggest 5 year Gilt auction for a decade (!!!!!!).

- She left it to Darren Jones to respond. He blamed the Conservatives and ‘global geopolitical events‘ whilst reiterating ‘There should be no doubt about the government’s commitment to economic stability and sound public finances, this is why meeting the fiscal rules is non-negotiable’.

- But there is a doubt. A rational doubt. There is growing volatility. Rational volatility. Because simply reiterating that you will stick to rules you cannot, in fact, stick to, is the definition of madness.

- The Treasury issued a statement (subsequently downgraded by Darren Jones to ‘The Treasury responded to requests from journalists about headroom, as we might do in the normal way’) which said ‘only the OBR’s forecast can accurately predict how much headroom the government has’.

- This isn’t an election campaign. This is government. Once you lose the confidence of the markets, it’s gone.

- It’s not enough just to not be Liz Truss. A rational repricing of UK government debt means the market has concluded Reeves has made the wrong diagnosis and delivered the wrong solution.

- From our piece “The Countdown Budget – Part 2” on 30th October: ‘The spreadsheet swot is taking a gamble. She has gone all in on her ideology that an actively investing government will deliver growth, even as she imposes a tax on jobs. Higher borrowing leaves the government even more exposed to shocks and in particular the threat of higher interest rates. With a deficit-busting tariff-loving President just around the corner in the US, she had better hope growth hoves into view pronto to convince the markets that she can pay off the debt she is about to rapidly incur.’

The gamble has gone wrong. The floor manager is tapping Reeves on the shoulder and burly bouncers are rolling up their sleeves. If Reeves won’t change, Starmer will have to change the Chancellor.