28th March 2025

Redundant Reeves

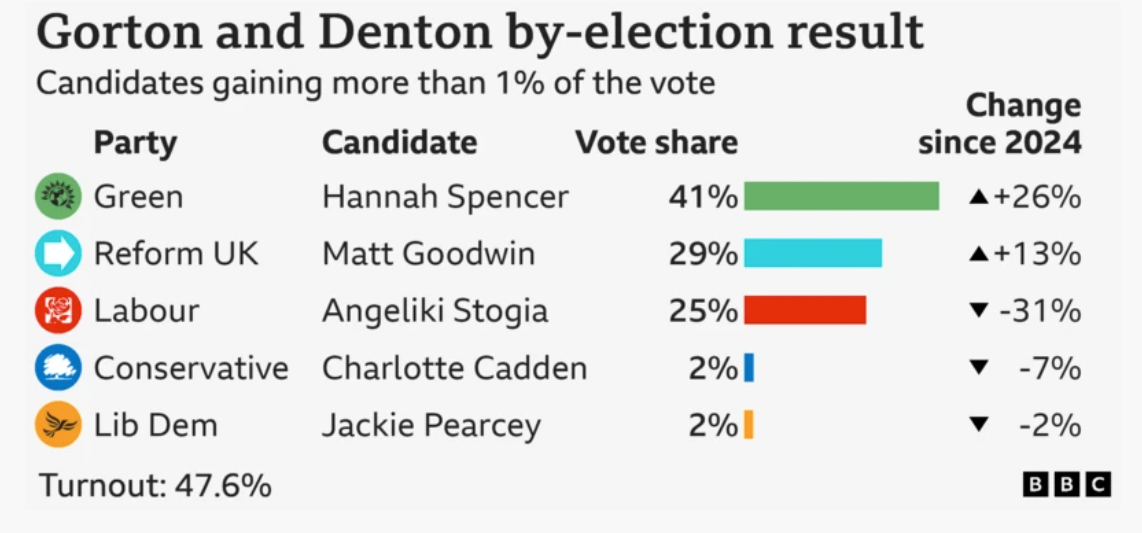

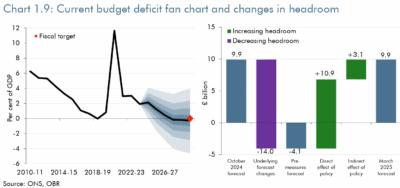

- Rachel ensured the numbers added up, slicing and dicing welfare cuts and reclassifying defence spending to get back exactly to the fiscal headroom number of October:

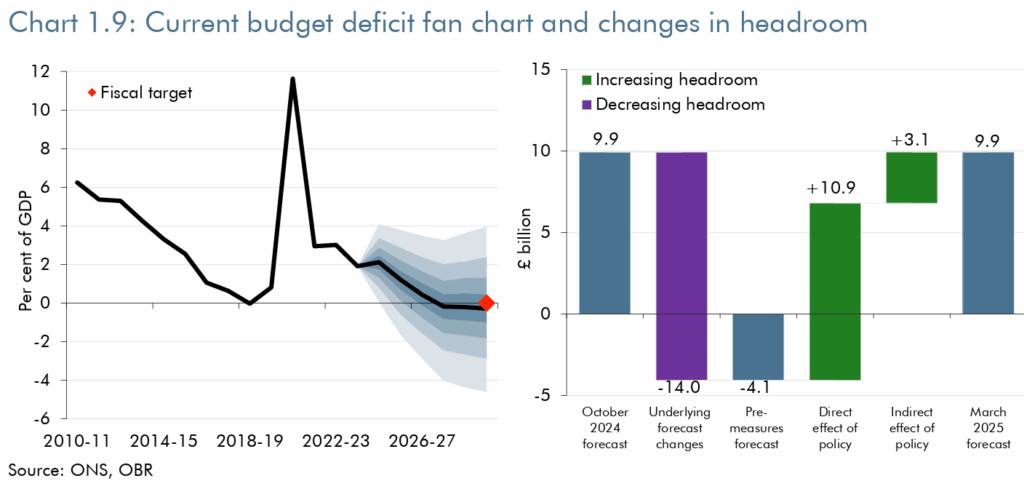

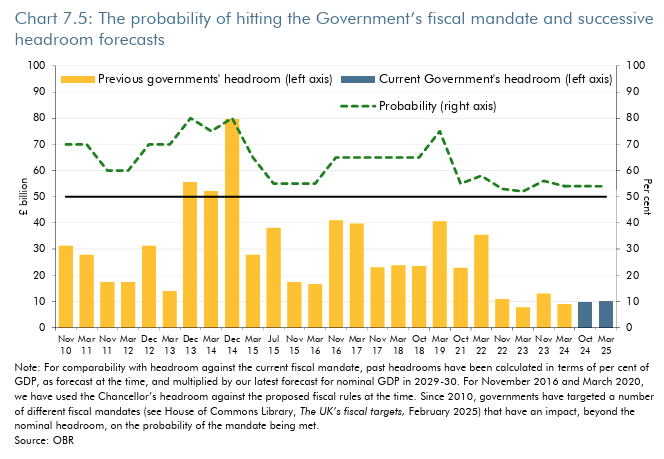

- Presentationally perfect but utterly pointless. If Gilt yields move up by 0.6 pct pts, the headroom disappears – see bottom left chart:

- If nominal GDP growth were 0.1 ppts lower in each year of the forecast, it would also disappear (see the top left chart).

- Gilt yields already moved up 0.4 pct pts since the last OBR forecast.

- They’ve had a range of a full 1 percentage point since then.

- They’ve even moved ~0.2 pct pts since the OBR prepared its latest forecast.

- The message is clear: any permanent increase in UK yields from this point forward and the fiscal rules will not be met.

- The probability has been tight before. The key difference now is that the world and financial markets are more volatile, thanks to the end of QE and return of higher interest rates:

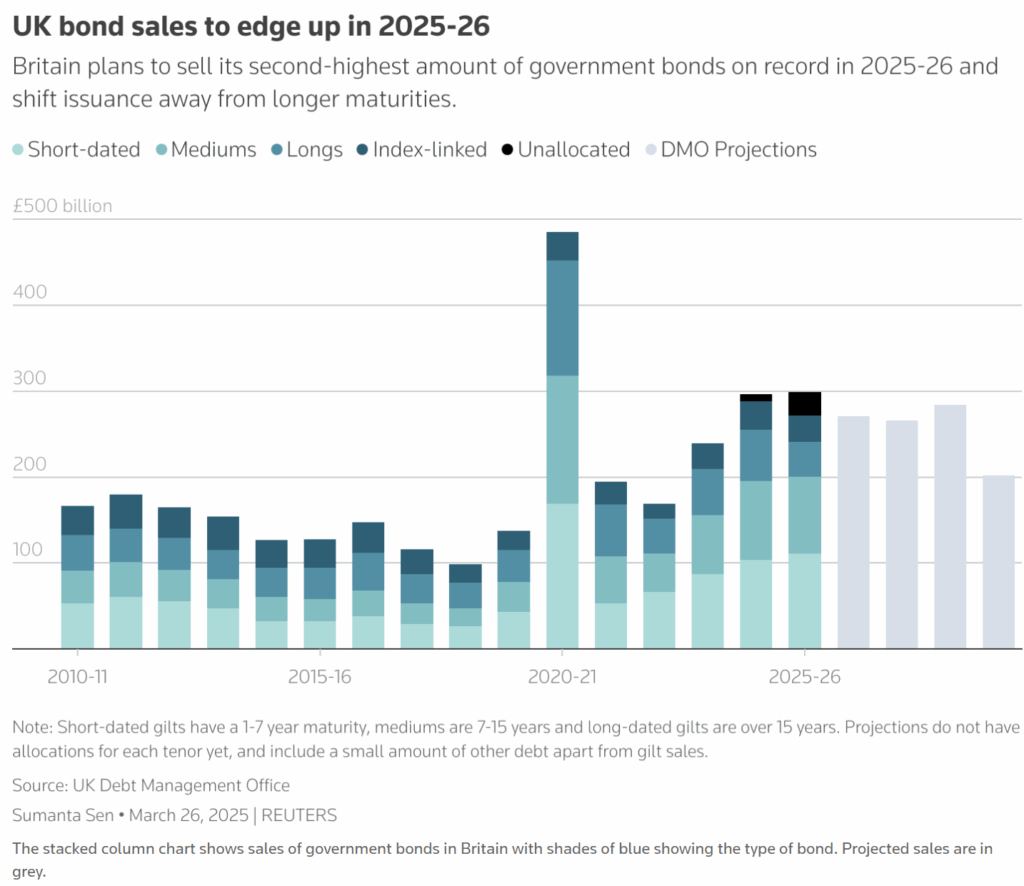

- Alongside which there is the massive pile of debt accumulated during the pandemic. Gilts had a reprieve yesterday when the DMO announced issuance for the year at the lower end of expectations. But it will still be the second highest amount on record:

- And the £299bn issuance figure is itself likely to be revised higher once the full prior year PSNBR is known on 23rd April.

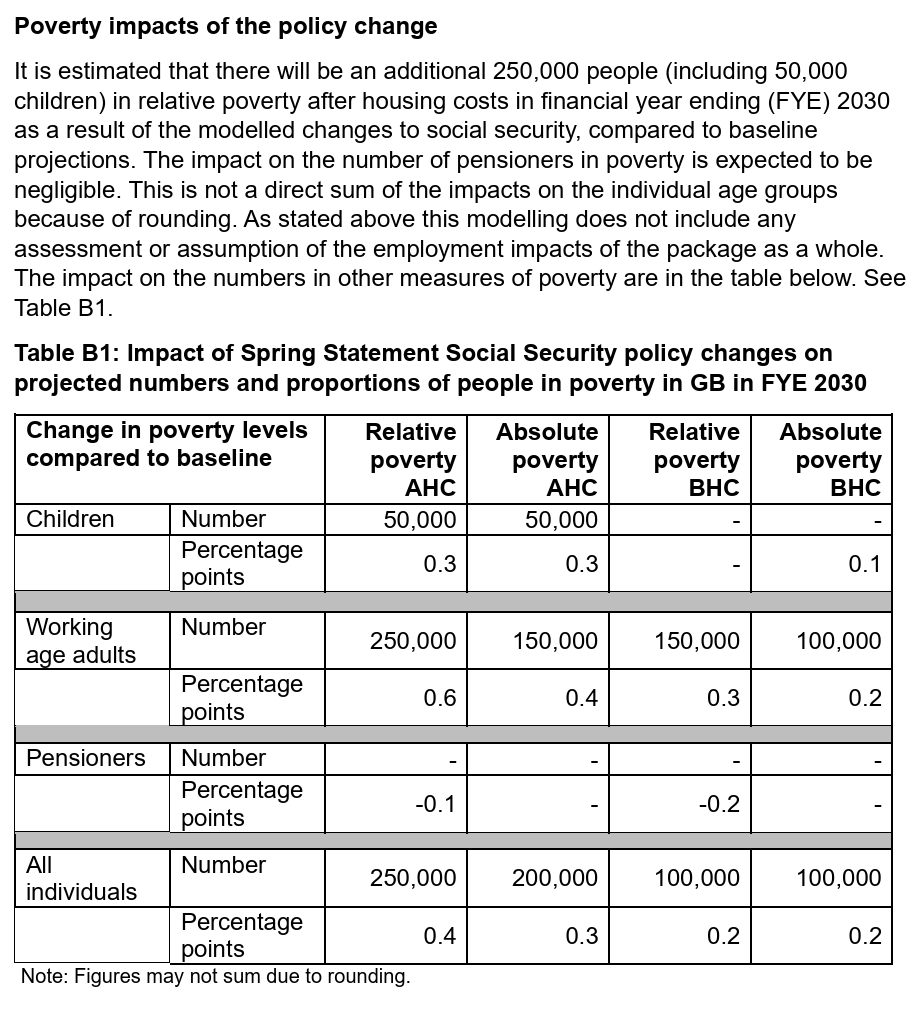

- To get to this precarious position, Reeves rushed through changes to welfare that the Treasury’s own impact assessment predicts will put 250,000 people into relative poverty by 2030:

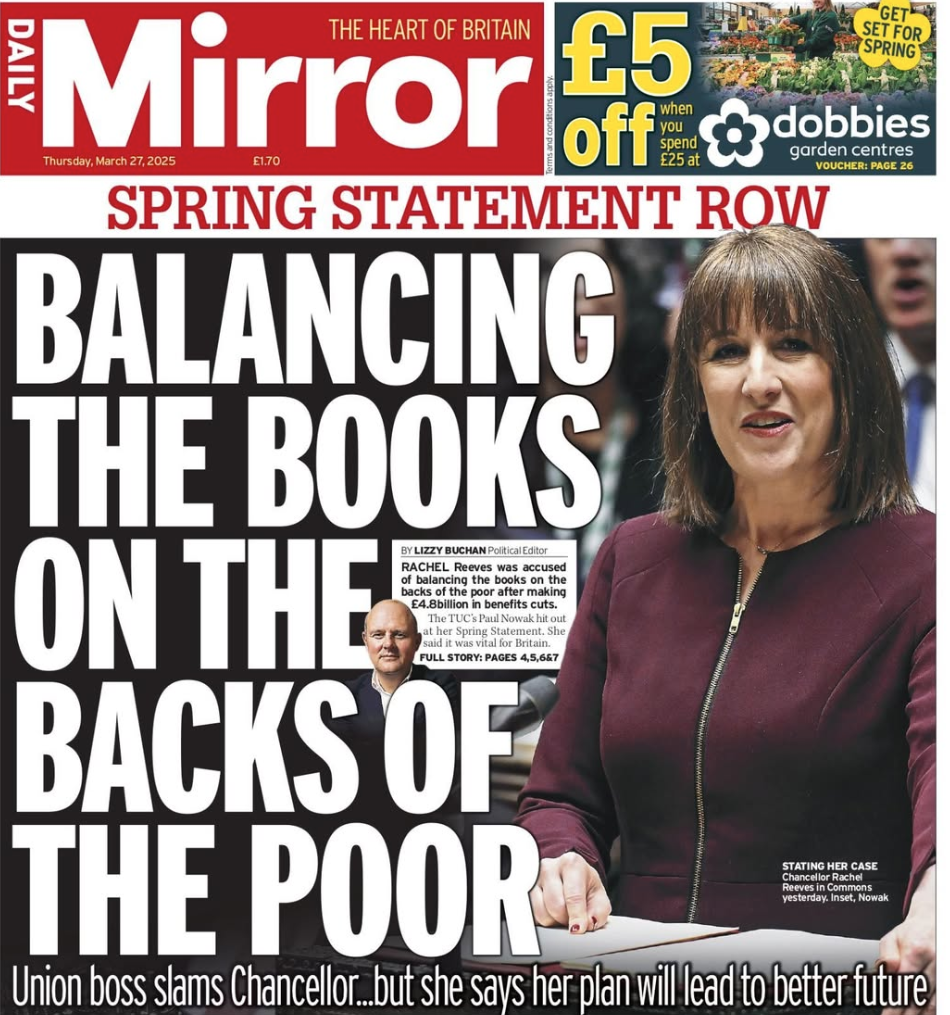

- The Daily Mirror ran a front page with a simple summary:

- Such an accusation will be hard to refute and reflects the political capital Reeves was willing to burn through in order to make sure the OBR’s spreadsheet added up.

- And it is the OBR in the driving seat. The Chancellor is scrabbling around trying making wild political decisions to please them.

- She used the word OBR seventeen times in her Spring Statement – more even than the 15 mentions for Working People (thank you to our intern Amelia who was forced to watch the statement twice).

- This comes from Reeves conducting a reductio ad absurdum whereby to avoid being jettisoned by markets like Truss, she has narrowed her entire operation down to one maxim: “Please the OBR”.

- This isn’t even a necessary nor sufficient condition to please markets. Respecting the institutions of budget making is useful for trying to avoid a loss of credibility if you’re new to the role. But the real test is quite simple: do your decisions take the economy in the right direction?

- Reeves has failed this test spectacularly.

- Big public sector pay rises and public sector spending that crowds out private investment; taxing jobs by raising employer NICs; capital investment on low-growth-multiplier defence spending…

- And while she is trying and failing to please markets she is now severely running the risk of losing her MPs, her party activists and her voters.

- Once Labour fall to 20% in the polls, her work will be complete.

- And she is also failing to please the OBR.

- Despite all the grumbling after Labour’s election victory, she had to wait until October for her budget because there is a 12-16 week forecast preparation period (which means the next update begins in August, just five months time).

- This time round, the welfare changes were given to the OBR at such a last minute stage of proceedings, it earned her an implicit rebuke in the Foreword to the OBR’s update:

- The extent of the last minute panic from the Chancellor’s team can be seen in the phrase “relatively small changes were made to the policy parameters of two welfare measures following the costings certification deadline“.

- She handed in her homework late and in a mess.

- This is no way to conduct a government, let alone one with a huge debt pile. It is creating the conditions for a full blown fiscal crisis:

- Independent forecaster sets parameters for government to meet rules; government grabs any policy lever to make the sums add up; even though the sums are predicated on an unpredictable forecast; and the policies are anathema to the voters who gave the government its majority; undermining the credibility of the government and the forecaster.

- When, not if, markets decide the game is up – either because global events take yields higher or because there is no domestic growth – they will set in train a feedback loop which takes down Reeves, and if Starmer isn’t careful, the government.

- Reeves is about to find out that trying not to be Truss delivers her the same fate.

She has already been made redundant by her slavish obedience to the unfortunate OBR; her voters are about to make her redundant for failing to deliver on the mandate they gave her. The markets don’t need to wait for an October budget to deliver their verdict.