The Two Weeks That Will Be (11th January 2026)

1. Geopolitics

Venezuela, Colombia, Greenland, Iran… take your pick (Trump certainly will). Dust off those international relations textbooks, basis points on inflation are no longer the driving force for the global economy. Instead it is all about weaponisation of resources and how economic systems operate as national security umbrellas. After all, last year’s Liberation Day tariffs were launched under the headline “PURSUING RECIPROCITY TO REBUILD THE ECONOMY AND RESTORE NATIONAL AND ECONOMIC SECURITY”. Defence policy is intertwined with economic policy – and for the man who prides himself on expertise in the Art of the Deal, intimidation must be ramped up against those with whom you negotiate. Always handy to turn up to a poker game with the USS Gerald R. Ford in your back pocket.

With all foreign policy goals pursued through a business lens, Trump has decided to turn up in person at Davos this year, for the first time in six years. The alpine confab kicks off on Monday 19th January. With the founder Klaus Schwab having finally stepped down, the jamboree is under the interim leadership of co-chairs BlackRock boss Larry Fink and Roche vice-chair André Hoffmann and the vibe is already different. The website does not (yet?) show a publicly available programme of events but it does offer the opportunity to “become a Pro or Premium Member to join the exclusive virtual program” for just 30/90 Euros per month. Meanwhile the Davos base for US government officials this time around is attracting corporate sponsorship at $1mm a time. Business is very much in the ascendence.

For all the sherpas and lackeys in attendance, the biggest players in the room (alongside Donald of course) will be those from China. The latest Chinese trade data is released on Wednesday and it is on track to hit the highest surplus on record at $1.2 trillion. Tariffs are not going away any time soon, whatever the Supreme Court decides. The President will try something else – anything to ensure the deal is always in play and negotiations are always ongoing, until he emerges triumphant.

2. The Fed

Trump is a man in a hurry, churning out executive orders, commander-in-chief military decisions and exhortations to mortgage markets and credit card companies now that he is six months from his eightieth birthday and one year into his final term in office. His latest salvo has been to pursue criminal charges against the Fed Chair, earning a public rebuke as Powell flexes the institutional muscle of the Federal Reserve against the constitutional might of the Presidency.

With the mid-term elections ahead, his decisions are united around one theme: affordability. In December he admitted “I can’t say ‘affordability hoax’ because I agree the prices were too high“, having previously refused to engage with the concept as a smear by the Democrats. Now it’s all about making everything more affordable, whether it’s mortgages, interest rates or oil prices. Where UK PM Starmer had to mime pulling a lever in front of parliament’s liaison committee as he desperately complained of his inability to find one that worked, President Trump is pulling absolutely any lever he can find and making up the rest. If removing the president of Venezuela releases 50 million barrels of oil then why not? Decapitating the axis-of-evil fund flows whilst he’s at it is surely a bonus. Ditto any potential regime change in Iran.

US data remains unreliable given we are still exiting the shutdown period but that will not stop the politicisation of the inflation data due Tuesday. But it is firmly in the rear view mirror in a world where the Fed Chair is about to become an uber-dove, reinforced by the ever-more-vociferous Treasury Secretary Scott Bessent who recently said “We are still substantially above the neutral rate, and I think that we should not be in restrictionary mode. I think most models would show 2.50 to 3.25%” for US interest rates. The Beige Book is released Wednesday and will provide some information on the extent to which a reflationary US economy is exacerbating the so-called K-shaped recovery where the asset-rich get richer whilst the poor remain languishing as jobs disappear.

Another cheerleader for the doves, Stephen Miran, speaks Wednesday on “Regulations, the Supply Side and Monetary Policy”. Before Christmas he noted “I think you have to give Chairman Powell credit for having wrangled three cuts out of these guys in succession“. Miran will keep advocating for more, even as his term technically expires at the end of January, although he has said he will stay on until his successor is confirmed by the Senate.

3. The BOJ

The Bank of Japan is headed in the opposite direction. Governor Ueda made a classic Christmas Day speech where he outlined some life-affirming charts showing Japan’s move towards becoming “An Economy In Which Both Wages and Prices Rise Moderately”. The lost decades look to be over:

We will get the latest inflation data on Thursday 22nd January, the day before the BOJ meeting on Friday 23rd January. Although considered to be too soon for another rate rise, Ueda is growing increasingly confident that Japanese rates can rise again and should signal this in the updated quarterly outlook. A weaker Yen is grist to the mill. A potential snap election in February for new PM Takaichi could see the government gain a mandate for reflationary Abenomics 2.0 – except this time the BOJ will be hiking into economic strength rather than easing due to weakness.

4. The BOE

The Bank of England is still very divided over its direction. Although, as the government keeps reminding us, there have been six interest rate cuts under the Labour government, these were mostly delivered by a split committee. We hear from the doves this week, with Governor Bailey on Tuesday followed by Ramsden and uber-dove Taylor on Wednesday. One of those who preferred to leave rates unchanged in December, Megan Greene, speaks Friday 23rd January.

The shadow of the Budget returns with November’s GDP data released on Thursday. Given the shambles over delivering the budget, low expectations will already be baked into the cake. Rachel Reeves seems to be hoping she can keep her head down. She’s already announced the date of the Spring Statement for 3rd March – now downgraded to a mere Spring Forecast as the OBR have been relinquished from their role of judging whether she’s meeting her fiscal rules and will only be providing an updated forecast. From which we can likely interpolate whether the rules have been met, but it doesn’t matter, because she won’t have to do anything about it. Because markets only care about OBR judgements. Or so the logic goes.

But forecasts are not reality, as we know from the periodic release of public finances data where outturns rarely match predictions. The PSNBR will be out on Thursday 22nd January. Before then the Finance Bill continues its march through parliament. Where this should have been a stroll through the park for a government with a huge majority it has already become bogged down in a mild rebellion by a handful of backbenchers along with outraged lobbying by the pub industry – the former having seen farmer inheritance tax thresholds eased and the latter providing business rates relief. If this goes on – and it will – the final budget will look very little like the one that Reeves stood up to deliver at the despatch box two months ago.

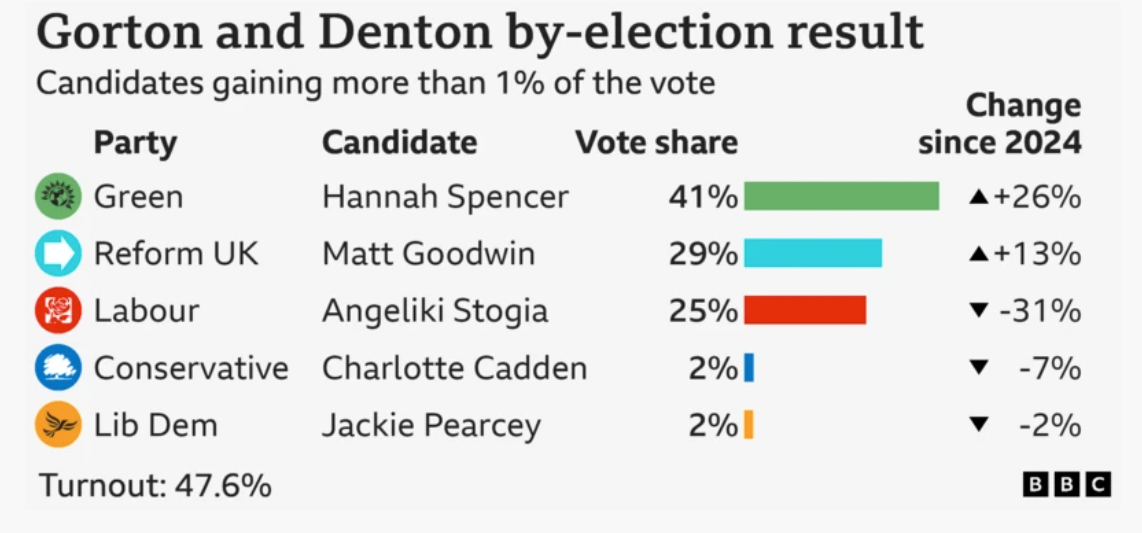

Financial markets might have moved on from political risk in Number 11 Downing Street but that just focuses the spotlight on Number 10. Whilst geopolitics drags headlines towards global issues, the PM can retreat to his preferred international stage. But domestic discontent persists. He can’t hide forever. The latest opinion polls put Labour in third place, having fallen over the traditionally quiet Christmas period. If that’s what voters think when they’re enjoying sherry and turkey with all the trimmings, how will they feel when they’re assaulted by negative political news in the depths of dry, grey January? Starmer remains in a vulnerable position, enemies of all sides just waiting for the excuse to pounce.

5. Earnings

Whilst Donald Trump does everything in his power to juice the economy, we will hear how companies are currently performing as earnings season returns. Kicking off with JP Morgan on Tuesday, there will be geopolitics made manifest with the report from TSMC (Taiwan Semiconductor Manufacturing Company) on Thursday and then an update on the consumer from Procter & Gamble on Thursday 22nd January.