The Two Weeks That Will Be

1. The US

BlondeMoney was set up precisely because the worlds of business and politics struggled hard to understand one another. Now with DJT v2.0 there is going to be no choice but to confront the Trumpian philosophy that politics is business. This will inevitably lead to confusion from those watching in Washington or Westminster but will make far more sense to Wall Street. Like any corporate takeover, the senior management brought in by CEO Trump is comprised of loyal lieutenants who will be expected to run their departments in keeping with the core philosophy of Making America Great Again – and fired as soon as they step out of line. Anyone who has ever worked in an investment bank understands how to play these politics: the carrot of big bucks if you deliver for the CEO alongside the very painful stick of wearing any mistake that can be pinned on you. If all goes well, whether by luck or design, the company can grow rapidly. If not, it’s a chaotic bunfight of egos. Trump is hoping he is more JP Morgan buying Bear Stearns than RBS buying ABN Amro.

As the defenestrated knight Fred Goodwin showed however, politics isn’t simply about what works – it’s about what sells. Trump’s plans to turbo charge the economy with extended tax cuts, de-regulation and tariffs will be for naught if he can’t sell it to the electorate. The scale of his victory and the Republican capture of all branches of government initially puts him in a strong position because it means he is at least starting with a mandate. Liz Truss mistakenly thought that 100,000 party members had awarded her the same latitude and paid the ultimate price. Sashaying around the cabinet table and telling Treasury ministers “you’ve got to live a little” is a big bet to take without the support of the electorate behind you.

It’s also tricky without the markets behind you. Trump has the advantage of working in the world’s reserve currency but that doesn’t render the US debt pile immune to the risks incurred by running higher deficits. The concomitant rise in interest rates can only be bearable with higher growth. For now, Trump has the benefit of the doubt but the greatest risk to his second term comes from the long end of the US yield curve. Should this become untethered, it’s emerging markets sovereign crisis time.

And that tends not to sell well at all.

Fortunately for Trump, he’s always been a better salesman than businessman. He thrives on conflict; turns the haters into fuel for his supporters; and welcomes drama as light entertainment ratings. Investors must take care not to be dragged into the reality TV narrative. Very little of the column inches and social media spats are relevant. With one exception: whatever Elon Musk tweets. He now has 205 million (!) followers on X where his byline is simply ‘The people voted for major government reform’. And he has been put in charge of delivering this reform at the Department of Government Efficiency (DOGE).

Eventually the Musk/Trump bromance will fall prey to the impossible nuclear fission of two gargantuan egos but for now, each understands there is space for the other. Musk, thanks to the accident of his birth, cannot ever constitutionally be US President. Now he doesn’t need to be. He can do the bit he wants to do without having to sully himself with something as prosaic as getting elected. He is happy for Donald to find pleasure from winning elections. The Don is still the Don, constitutionally speaking.

In any case this isn’t a long-running marriage. The press release from Trump said the work of Musk and DOGE ‘will conclude no later than July 4 2026‘ which, in case you hadn’t spotted it, is ‘the 250th Anniversary of the Declaration of Independence‘. The sales pitch is being rolled.

Musk doesn’t really do sales. He is also almost endearingly naive about how politics works. This is going to cause consternation. He tweeted he prefers Lutnick over Bessent for Treasury Secretary but wants to ‘hear more people weigh in on this for @realDonaldTrump to consider feedback‘ as if Finance Minister of the world’s largest economy could be hashed out in a thread on Twitter. Or perhaps in the new era, it can. What politicians consider to be politically unpalatable might just become possible. For example, Musk expressed interest at an X user’s suggestion of removing subsidies on the least productive university degrees:

This is the sort of policy decision that (some) business people think looks straightforward. More engineers and fewer drama students is the sort of decision made by those looking at GDP as the only metric. Except without Broadway or Arthur Miller the nation would, at least to some voters, certainly be poorer.

Government by business people might be violently effective but it is going to cause serious arguments. It will deliberately put strain on existing institutions. Anyone at an investment bank who has argued with their risk department over extending the credit line to a client knows that rules are malleable when it comes to getting business done. But the international rule of law can’t be bust so easily without long term consequences.

2. The UK

And up pops new Conservative Party leader Kemi Badenoch with an op-ed in The Times about reforming the state: ‘If we want our government to make decisions more quickly, and be more effective, we need to reduce some of the public law burden… This is not an attack on the rule of law… The rule of law does not mean having ever more laws to rule us, and nor does it mean that we cannot challenge and criticise the laws that govern us‘. She goes on, unsurprisingly, to claim Labour are on the wrong side of this argument: ‘Keir Starmer sees no need to reform the government machine because he is a fully signed up member of the bureaucratic class who thrive in it‘.

And yet Rachel Reeves proceeded to rip up a fair bit of regulation in her Mansion House speech. She said ‘regulatory changes after the Global Financial Crisis… have resulted in a system which sought to eliminate risk taking. That has gone too far‘ before announcing support for potential removal of the Senior Managers and Certification Regime and reducing the length of pay deferrals. A nice result for bankers from the same Rachel Reeves who said in her Mais Lecture that ‘the analysis on which [New Labour] built was too narrow… An underregulated financial sector could generate immense wealth but posed profound structural risks too’. Government comes at you hard. One minute bankers are public enemy number one, seducing even Blair and Brown, the next the Chief Executive of UK Finance gushingly describes your speech as ‘the most pro sector, pro growth speech I have heard in years’.

To be fair, Reeves needs some supporters. The FT warned ‘corporate business cools on Labour’ whilst The Times wrote ‘Labour’s tax rises have burnt through the goodwill of business chiefs’. The latter reported on a draft letter by the British Retail Consortium where any signatories were warned ‘the Treasury was making clear there would be consequences if they continued to criticise the chancellor publicly’. This sort of politicking wouldn’t usually warrant the attention of markets – except that Reeves needs credibility from them for her plans or the wait for growth will be eaten up by rising bond yields. Trump just accelerated the timeline: his reflationary plans will see interest rates rising across the world whilst his business-led administration doesn’t need homilies from trade bodies for endorsement. If the market accepts the credibility of his mandate, it will cast doubt on the growth-delivering capabilities of the tax-raising, public-sector focused, slow-moving UK government.

We will get an update on the challenge faced by the Chancellor with the latest PSNBR data on Thursday.

3. The BOE

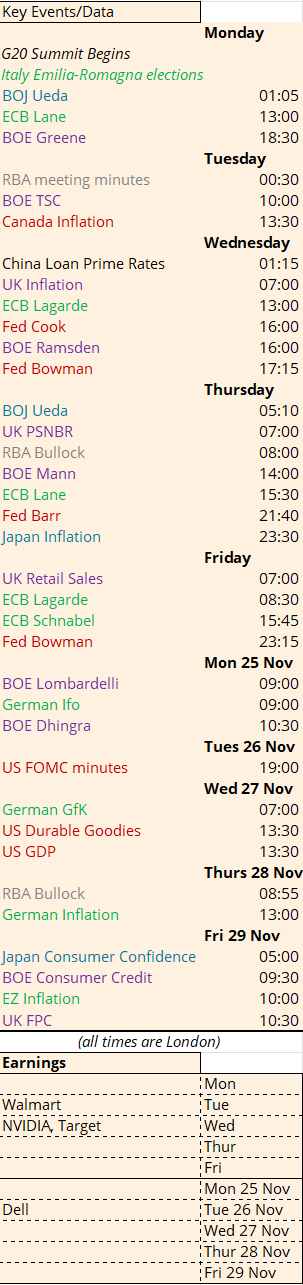

The BOE will be more focused on inflation on Wednesday. Having just cut interest rates again they warned in the latest Monetary Policy Report that ‘a more substantial fall in services inflation [is] not likely until next year‘. They are sounding more and more like they wish they didn’t have to be making any decisions right now. Governor Bailey’s Mansion House speech managed to throw shade on Trump and Brexit whilst apologising for poor data collection and randomly throwing in a couple of paragraphs on AI. We can hope for more illuminating comments from a raft of BOE speakers in the next two weeks: Greene on Monday, Ramsden on Wednesday, Mann on Thursday and (along with our good selves) Lombardelli and Dhingra at the annual BOE Watchers Conference on Monday 25 November. The new Treasury Select Committee will also grill Bailey, Mann, Lombardelli and Taylor at their usual post Monetary Policy Report testimony on Tuesday. The TSC is now staffed with a slew of left-leaning economists alongside former Conservative Treasury ministers and is unlikely to be a comfortable ride for the MPC.

4. The Fed

Powell “pivoted” last December, didn’t deliver it until a jumbo cut in September, cut again and then said they don’t need to be ‘in a hurry to lower rates’. He also said the Fed would ‘reserve judgement’ on Trump tariffs as it ‘isn’t obvious until we see actual policies’. Which feels a little surprising given the market has already decided it’s all going to be rather inflationary, with the largest increase in the 10 year yield after a rate cut since 1995:

A more appropriate data set would go back to 1918 to try to encapsulate a global pandemic and a war. Still, this has been quite the move higher in yields, raising concern the Fed is making a policy mistake. They were accused of that when they failed to raise rates in the face of higher inflation; then they were accused of doing too little when the labour market softened. This is a reminder that we are not in a normal cycle, or indeed a cycle at all. There have been a series of huge shocks since 2020 and monetary policy is trying to cope as best it can – not least when it is in the political firing line. Inflation is pernicious politically, as almost all incumbent governments facing election in the last couple of years found out. Central banks might be independent but they are also political animals. Powell has a legacy to protect. If he lets the Fed fall behind the Trump tariff curve, he had better hope the bond vigilantes teach Trump a lesson before DJT dishes a lesson out to him.

FOMC Minutes of the post Trump election meeting will be released Tuesday 26 November; Fed’s Bowman speaks Wednesday from the new centre of power – West Palm Beach, Florida.

5. Europe

Regional elections in Emilia-Romagna this weekend have been darkened by clashes between the far left and far right. Incendiary rhetoric from a violent period in Italy’s history has ratcheted up. The centre-left Mayor of Bologna accused the government of sending ‘300 Blackshirts’ whilst the right-wing deputy PM Salvini called the anti-fascist protestors ‘communist insects’. So far turnout looks to have taken the hit although the election runs over two days.

For all the talk of polarisation in America, its two party system has prevented the rise of a singular party on either extreme right or left – even if each party would characterise the other as extremist. Under the more proportional voting systems of Europe, there is supposed to be a pressure valve that allows the ‘smaller’ parties to soak up protest votes, leaving the ‘bigger’ central parties to govern. With voters increasingly disenchanted with traditional parties who failed to adapt to the rise of anti-establishment sentiment, electorates have fractured to such a degree that coalition building is almost impossible. See France, where the media cheered the apparent failure of Marine Le Pen’s National Rally in the summer’s elections before reality intervened: the selection of an unelected external prime minister who is beholden to Le Pen’s effective veto.

Germany tried – and has now failed – to hold together a three party coalition at the federal level. A completely new party on the far left has emerged with 6-9% of the polls after less than a year in existence. The far-right AfD polls above Chancellor Scholz’s SPD. And Scholz’s first significant act of heading towards an election was to pick up the phone to Vladimir Putin. Scholz is trying to shore up his party’s core vote who have become tired of funding the Ukraine war. This is not the confident act of a campaign with positive momentum. Scholz isn’t even guaranteed to be the Chancellor candidate for the SPD. He used to be mayor of Hamburg but two regional politicians have gone public with calling for him to be replaced, preferring instead Defence Minister Boris Pistorius. A poll of SPD supporters showed 58% of them agreed with only 30% backing Scholz.

All of which confirms that Germany is effectively ungoverned until at least March next year – and likely well beyond that. With such a fractured electorate bearing the scars of the failure from a three-party coalition, nobody will be given a clear mandate.

6. Earnings

US equity funds recorded their second highest inflows since data going back to 2008. Investment grade bond spreads are at their tightest since 1998 whilst junk spreads are the lowest since the credit bubble of 2007.

The VIX index has both priced out election uncertainty and started to price in nerves over the S&P500 being priced for soft landing perfection. Step forward Nvidia earnings on Wednesday. This has the potential to cast a very long shadow as we head into the holiday season with Thanksgiving only a fortnight away. Volatility of Volatility will remain elevated.