The Two Weeks That Will Be (1st December 2025)

Whilst the political and economic authorities of the UK wrangle with the ongoing fallout from the tortuous Budget process, there are a number of key events in the next two weeks that could add fuel to the fire.

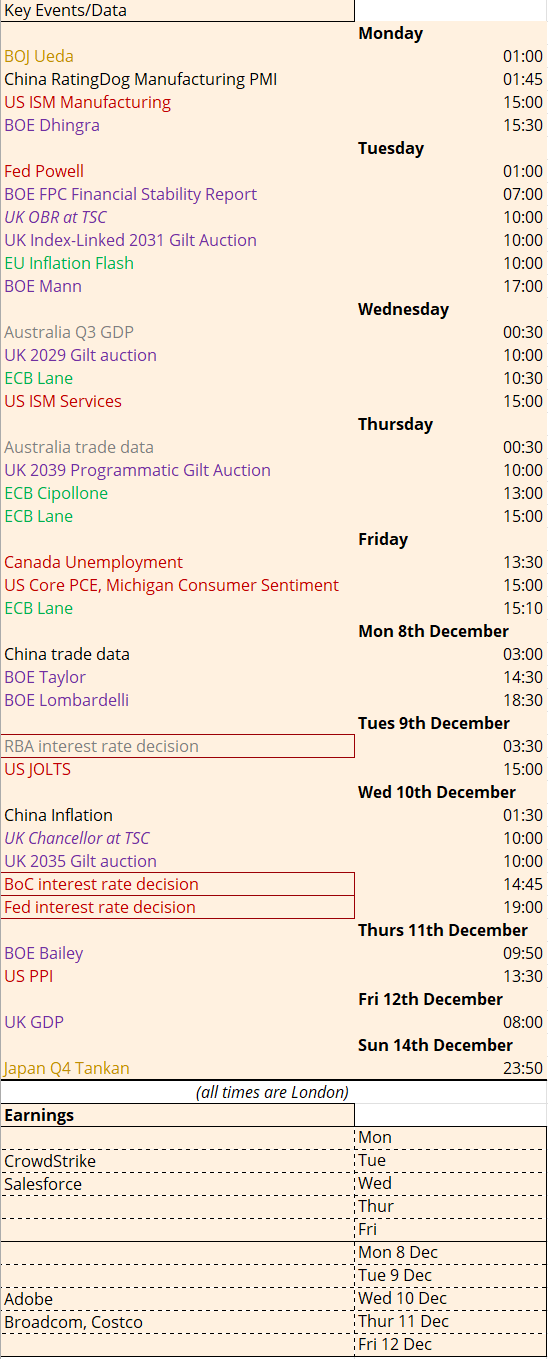

The most important dates will be two appearances in front of the Treasury Select Committee by the main protagonists in the Budget debate: up first it is David Miles and Tom Josephs from the OBR Budget Responsibility Committee on Tuesday, followed by Chancellor Reeves herself on Wednesday 10th December. The Chair of the OBR, Richard Hughes, has already resigned “to quickly move on from this regrettable incident” of leaking the documents early; the Chair of the TSC, the Labour MP Meg Hillier, responded by thanking him “for approaching his work with dedication throughout his time as Chair of the Office for Budget Responsibility – often in trying circumstances“.

Hillier went on to say “I commend his decision to take full responsibility for the incident“. As did John McDonnell (“It’s reassuring that there are people maintaining standards of accountability“). The implication, made explicit by Kemi Badenoch, is that the Chancellor should now do the same and resign following the release of misleading information. But the Treasury remains on the offensive. The Independent is reporting that the OBR chief was “forced out” after publishing those revelatory details of the improving fiscal headroom last Friday, with an ‘insider’ briefing “Had all other things been equal Richard could have survived with an apology and a resolution to change some systems. What would’ve been survivable in peacetime was no longer survivable“. It’s official then – the Budget Battle is turning into a full blown war.

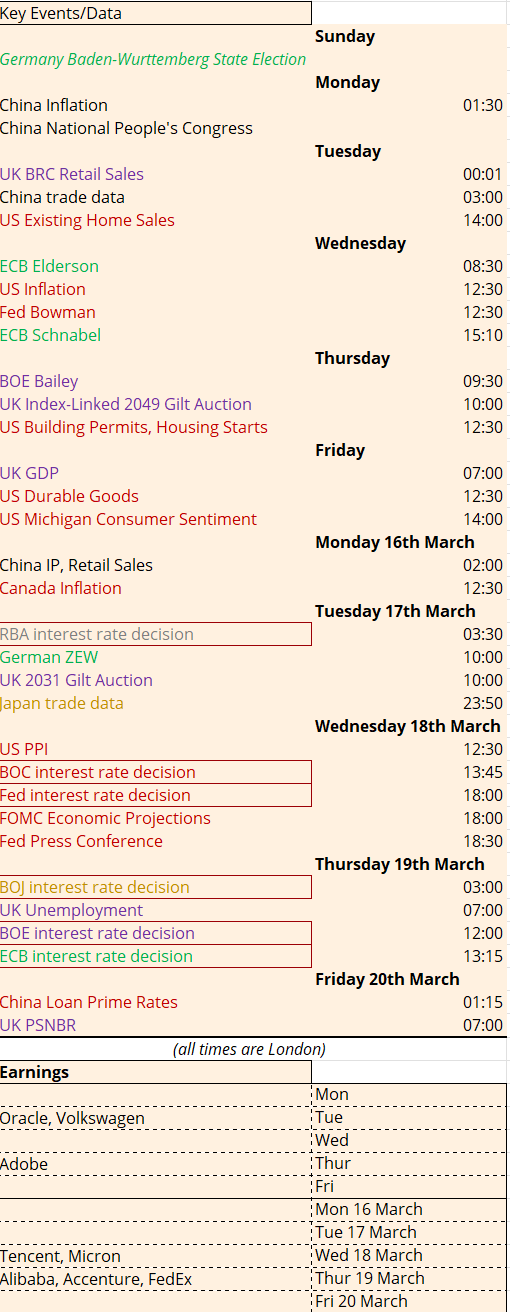

The BOE Financial Policy Committee will have a chance to outline where it sees risks ahead with its latest Financial Stability Report released on Tuesday. Bank of England speakers include Catherine Mann, also on Tuesday, and Taylor and Lombardelli on Monday 8th December. Andrew Bailey rounds things off with a fireside chat with the FT’s Chris Giles on Thursday 11th December. Their topic is also “financial stability”, which might prompt a look at the Gilt auctions taking place on Tuesday, Wednesday and Thursday this week as well as Wednesday 10th December. Although the DMO issuance update released to coincide with the Budget provided some support to Gilt markets with total issuance lower than expected and the cancellation of three long-dated Gilt auctions, this fiscal year will still be the second highest on record:

The DMO also provided an illustration based on OBR forecasts which showed issuance could be even higher next year:

Given the OBR made no mention whatsoever of the word “recession” in that five year outlook, it is possible that issuance levels could end up even higher. A dovish BOE can offset some of the drag but may already be behind the curve. The latest UK GDP release on Friday 12th December will provide an update.

2. Japan

With the BOJ gearing up for rate hikes just as new PM Takaichi tries to reheat the reflationary Abenomics 2.0, JGB yields are rising to multi-decade highs. The bellwether Tankan survey for Q4 will be released on Sunday 14th December. Currency intervention looms large in the background, providing a potential pothole for those assuming ongoing declines in the VIX index mean any and all risk has been conquered globally.

3. The US

But the big event of the next fortnight is The Fed decision on Wednesday 10th December. President Trump, with his customary sense of timing and ability to maximise the spotlight, is apparently ready to name his new Fed Chair. This will overshadow the decision, warning recalcitrant FOMC members that there’s a new sheriff in town. Given the balance of risks and that the majority of FOMC members have been erring on the side of dovish, we think the Fed will cut rates 25bp. The data before then is thin on the ground and in any case irrelevant given the government shutdown has had a short term impact on the economy and prevented the reliable aggregation and dissemination of data.

All of which means the US economy will be getting a monetary boost just as it gets a fiscal boost, leaving only the usual year end liquidity shenanigans and book-tidying to throw a spanner in the FOMO ointment. It is going to be something of a wild ride into the close of the year.