The Two Weeks That Will Be (25th May 2025)

1. Trade

Tariff negotiations continue, as they will, ad nauseam, ad infinitum. Trump pops up to push things along, constantly hustling for the deal. Almost the exact opposite of how the EU operates, where a consensus emerges summit by summit, line by line, tortuous text twisted into tortuous text.

As soon as the FT had briefed that ‘The EU has been pushing for a jointly agreed framework text for the talks but the two sides remain too far apart‘, the die was cast. Donald Trump is not a man who would ever be interested in anything called a framework text. He just wants you to answer one simple question: What are you going to do for me? Hence his Truth Social post announcing the 50% tariff on the EU began with his complaint that the EU “has been very difficult to deal with“.

This is the heart of the issue between the US and the EU and it will not be resolved by 1st June, or, possibly, ever. The cultural approach to politics between the two is just too different – and that’s without the complicating factor that it’s not just the relationship between the two that matters. There are 27 countries in the EU and 20 in the Eurozone. Germany and France might lay claim to being the only ones that matter but Georgia Meloni and Pedro Sanchez would have something to say about that. Not to mention veto king, Viktor Orban. Then there are the three institutions which comprise EU decision making and how they each make policy, including the complex mechanics of qualified majority voting… this is about as far as Trump can get from what he would consider one executive power talking to another. As Scott Bessent put it with phlegmatic understatement, “I think this is in response just to the EU’s pace. I would hope that this would light a fire under the EU”. Furiously scribbling out annexes for a framework text isn’t going to cut it. So expect the tariffs to remain higher on the EU for some time to come.

2. The ECB

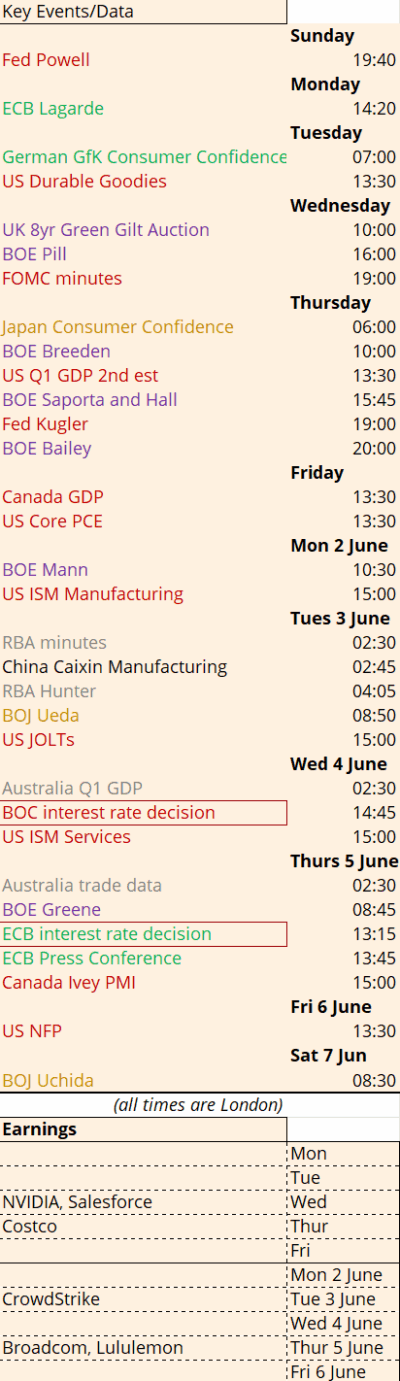

By comparison the executive powers of the ECB look positively untrammelled. Christine Lagarde only has to herd 21 voting attendees and it is not a democracy. Rather a many-headed hydra where doves and hawks shapeshift as political constraints bind as much as the economic. Belgium’s central bank governor has flipped from caution three months ago that the ECB shouldn’t “sleepwalk to 2%” to warning last week about shocks to growth that “might warrant to be mildly supportive” with rates “slightly below 2%”. On Thursday 5th June the ECB will cut again, not least given the near 5% rally in the Euro against the dollar since Liberation Day.

3. The US

Meanwhile the Fed are content to sit back and let the politicians do the work. The FOMC Minutes on Wednesday are therefore unlikely to shed any light. Even the data is of little help given taking the imprecise DOGE chainsaw to the supertanker of US government is likely to muddy the payrolls numbers on Friday 6th June. The ISM Manufacturing on Monday 2nd June is marginally clearer but it is still a survey, driven by sentiment, rather than hard data. It hit its highest point in almost forty years in March 2021, not because that was the best moment for the US economy over that whole time, but rather due to sheer relief at the end of the initial Covid lockdowns and deployment of the vaccine.

Whilst Powell and co keep their heads down and let the data dust settle, they are working on a periodic review of the Federal Reserve’s “Consensus Statement”. Powell acknowledged in his speech at the Laubach Research Conference that “there is always room for improvement” in the Fed’s communications and that the new framework should work “a wide range of economic environments”. He will be happy all the focus is on the White House for now, rather than the FOMC, as he warned “inflation could be more volatile going forward than in the inter-crisis period of the 2010s. We may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks”.

4. Other Central Banks

Volatility of the data is key for all market participants to accept in the new world order. The Bank of Canada did an admirable job in April of trying to forecast the path for inflation and growth in two scenarios, the first with limited tariffs, the second a protracted stagflationary trade war:

Scenarios have become the order of the day, with the Bernanke Review prescribing them for the Bank of England and Bernanke now saying the Fed should do the same.

Australia can join in when Sarah Hunter, Assistant Governor of the RBA, speaks Tuesday 3rd June on “Joining the Dots: Exploring Australia’s Links with the World Economy”.

5. Bonds

But all of this smacks of navel gazing when long term Japanese Government Bond yields hit record highs. The 40-year jumped by one whole percentage point since the beginning of April. As Barclays’ Ajay Rajahyaksha put it in an FT article, “That sort of thing just isn’t supposed to happen in the developed markets; bonds are supposed to be the safe asset class”. He also points out the 35-year bond has a yield almost 1 percent higher than the on-the-run 40-year. Yield curves can get kinky but that’s an eye-watering differential that, once again, isn’t supposed to happen, given yield curves are normally upwards sloping. We will be hearing from two key BOJ speakers: Governor Ueda on Tuesday 3rd June, Uchida on Saturday 7th June.

The price action in JGBs, particularly following poor bond auctions, is a red warning light flashing loud and clear. It started with the LDI debacle, carried on with the run on Silicon Valley Bank and collapse of Credit Suisse, paused briefly during the MAG7 low volatility equity rally of 2024, before hoving hard into view with the election of governments desperate to bust their fiscal constraints. We are in a higher inflation, higher interest rate and higher debt world. The chimera of AI driven growth is not sustainable everywhere, particularly with a tariff hungry US president intent on gobbling up the world’s limited supply of resources Pac-man style.

7. Earnings

And so the biggest event of the next two weeks comes from Nvidia’s earnings on Wednesday. It was already the bellwether for the S&P500. Now it is the front line of the US/China economic war. Jensen Huang finds himself as the unlikely Foch at the Marne. He has to attend dinners at Mar-a-Lago to prevent extra restrictions on the crucial H20 Nvidia chip whilst warning Chinese technology “will diffuse all around the world” if American firms can’t compete in China. He praises Trump as ‘visionary’, echoing the ideas championed by Bessent in his October Economist op-ed: “Manufacturing in the United States, securing our supply chain, having real resilience, redundancy and diversity in our manufacturing supply chain – all of that is excellent”.

Nvidia is also on the front line of one of the economic war’s weapons of mass destruction: gamma. As one of the biggest stocks in the S&P500, moves in Nvidia permeate throughout the entire index. And gamma, whilst positive, has fallen by about half due to the regular option expiries that have just taken place. This means that the index has more room to move around. [For a clear explanation of how this affects trading, watch this video by SpotGamma]

8. The UK

On top of this pile of tinder sits the UK bond market. Already vulnerable thanks to the LDI debacle and Liz Truss’ attempts to ram through revolutionary change without a mandate, the Labour government has now boxed the bond market into a fiscal corner. Gilt investors told us in March that they were sure the government would cut spending and raise taxes to meet their fiscal rules. But they appear to have forgotten the government’s large majority does not translate into a blank cheque political mandate. Shedding as many points in the polls as the Boris Johnson government; losing approval from their own voters; losing a by-election and two thirds of their councillors are tough for many of those new Labour MPs to bear.

And so, then came the u-turn. Except it wasn’t really a u-turn. Just a promise to ensure the toxic winter fuel payment removal would be reduced, somehow. Leaks that this would be done by raising the threshold of income were then replaced by leaks that it would be done by restoring its universal application but taken back through high earner’s income tax returns. This public discussion of policy tweaks is a sign the government is frit – confirmed by the delaying of the child poverty strategy until the autumn Budget. They can’t make any decisions because Reeves outsourced them all to the OBR’s spreadsheet.

This would be untenable to any Prime Minister, let alone one with a massive majority facing such a massive rebellion. And so, if Rachel doesn’t go, then the fiscal rules must. “Sources” told the Mail on Sunday “The fiscal rules will go. I was in the room when it was discussed”.

The fiscal rules need reform but it cannot be done now that the government staked its credibility on commitment to them, rather than commitment to a credible fiscal plan. We discussed this as part of the NIESR webinar on “Fixing the UK fiscal framework” (watch 12’16 – 22’30) and it came up again at the Bank of England Annual Watchers Conference. An attendee from a think tank asked the panel, on the one hand the rules are too inflexible to incorporate a shock but on the other, reform would signal too much flexibility and panic the markets, so what can be done? The respondents, from former BOE MPC members to hedge fund investors and bank strategists, could only shake their heads and say, they wouldn’t start from here. Changing the fiscal rules in order to tax more, spend more, and borrow more would only be countenanced by the market in an emergency. But the government can’t carry on with their current path without tearing the party apart completely. At some point the Gilt market will spot this and take it out of their hands.