The Two Weeks That Will Be

1. Volatility

We started our last monthly missive with the phrase “On Wednesday the Bank of Japan will hike interest rates“, which suggests that a Japanese rate rise was at the very least a known unknown. The record collapse and then recovery in Japanese stock markets in the wake of the interest rate decision was far more of a Black Swan-esque unknown unknown. It’s not the move but the scale and speed that is the red flag to take away from an episode that has already been written off as just another summertime liquidity wobble.

Not least because it wasn’t, in fact, particularly illiquid. Circuit breakers kicked in but they did their job: the moves continued once prices returned. Volumes traded, decent high volumes, without total dislocation. And not just in Japanese stock markets. Here’s the HYG, the ETF that tracks US High Yield corporate bonds, showing a higher volume traded on 5th August than in March 2020 when Covid hit:

An awful lot traded but the price didn’t move very much, suggesting any buyers were met by willing sellers. No real panic about a recession (which would take credit spreads higher). No fear to see here. And yet the fear index itself, the VIX, registered its largest ever intra-day spike. Larger even than various days during the onset of the pandemic and the period after Lehman went under:

All while the S&P500 itself had nothing like the kind of moves that we saw during 2020 or 2008. And it wasn’t just a large move up in the VIX – it was also a big move back down. As @t1alpha put it in the chart below, ‘the past two days were simply “implausible” in the prior regime’:

It can’t just be written off as an esoteric moment in a summertime market when everyone was distracted. The FT reported that ‘visits to Vanguard’s investment platform were twice as high as the previous peak set during the mid-pandemic meme stock mania‘. Investment platforms such as Vanguard, Fidelity and Schwab reported multiple login issues as people flooded online but were unable to trade.

You can see from the timing of the outages that the problems began on the open and persisted through the morning. Even the CBOE struggled to make prices on the open for VIX futures. The VIX is a pure mathematical calculation but cannot be directly traded, meaning that although the VIX index went up to 65, the VIX futures market never printed at that level.

The head of derivatives market intelligence at the CBOE described the price action as “totally divorced from fundamentals”.

By the time people could log in and futures could be traded, the VIX was coming back down again. The volatility sellers were back in force, despite the chaos. For them, this was a golden opportunity to sell the spike. It doesn’t matter if retail punters were worried about the risks of a US recession, calls for emergency Fed cuts, or the implosion of the carry trade via higher Japanese rates. Volatility traders have become so conditioned to sell volatility that even when the position went against them, they doubled down. And it has worked, so far at least.

And why not? The last fifteen years have shown that banks going bust, global pandemics, inflation surges and war are always met with the same response by the authorities: huge interventions to prop up risky assets. It has become profitable to ensure you are at all times fully invested.

Except we are all still human. Passive money, options traders and algorithms aren’t the only players on the field. The speed, scale and sheer inexplicability of the moves become a canary in the coalmine at the back of our minds. For long term asset managers the memory is more mechanistic. The VIX index feeds into their models as a proxy for risk aversion. The spike has now entered their historical data. At the margin this puts their positions on a higher state of preparedness: not DEFCON 1 but not ambling along at peacetime DEFCON 5 either.

The financial system has become more fragile as a result.

2. Earnings

Just in time for an update from one of the most heavily invested and most watched stocks in the world: Nvidia reports on Wednesday. Any slip and there could be a crowded rush for the exits. Even a buy the rumour/sell the fact on better than expected earnings could set off a domino effect. It might just be that 6th June, when CEO Jensen Huang signed the decolletage of a breathless young lady, marked the top in the frothy Magnificent Seven stocks.

3. The Fed

Or, it might not. Although the background level of risk is rising, so too is the desire to increase risk appetite. The August episode has rewarded the double downers. The mood music from the Fed is encouraging everyone else to follow suit. Despite the market having been head faked by promises of a pivot for at least nine months, Jerome Powell used his Jackson Hole speech to tell us that “the time has come for policy to adjust“. This time, he really means it: “My confidence has grown that inflation is on a sustainable path back to 2%”. He’s more worried about unemployment: “We do not seek or welcome further cooling in labor market conditions”.

That’s a slightly strange formulation of words – what Fed Chair would welcome a weaker labour market? It points to the goal of the rest of his speech which is to set out his legacy. His term as Chair ends in just under two years – or effectively sooner if Trump and the Republicans have their way. He might have got it wrong on inflation but darnit he won’t get it wrong on employment. This makes the payrolls data on Friday 6th September central to whether the Fed kicks off its cuts with a 25bp or 50bp at their September meeting. Powell looks to be leaning towards a bigger cut, warning the rest of the Fed that if they don’t get going then they could be accused of seeking or welcoming unemployment by leaving policy too restrictive.

The preliminary estimate of the annual revision to payroll growth seems to have nudged him towards his more pro-active stance. The reduction in estimated payrolls of 818,000 is the largest downward revision since 2009, as this chart from Fed expert Julia Coronado of MacroPolicy Perspectives shows:

We won’t know the official revision until the January 2025 employment report but it is surely not unexpected that a huge pandemic and shifting immigration patterns have left the data prone to significant revisions.

The rest of the Jackson Hole jamboree looked into this in more detail.

- A paper by Gauti Eggertsson suggested a tweaked Philips Curve that shifts when it crosses the Beveridge threshold that miraculously ‘matches the U.S. experience since the Federal Reserve’s tightening cycle began in March 2022‘. It shows that when there is a high degree of vacancies to unemployed people, a tight labour market can resolve itself without unemployment rising.

- A paper by Carolin Pflueger argued that changing perceptions of the Fed meant that once they started hiking aggressively, they got more bang for their buck in terms of credibility, which ‘likely aided the transmission of monetary policy to the real economy and improved the Fed’s inflation-unemployment tradeoff‘.

Which is all jolly nice for the Fed. They didn’t really know what was going on in the labour market but it turned out OK even as they were late to deal with the inflation surge, because once they got going they really got going. Phew!

As Powell pointed out with the hint of a slap on his back: ‘An important takeaway from recent experience is that anchored inflation expectations, reinforced by vigorous central bank actions, can facilitate disinflation without the need for slack.’

Powell even felt relaxed enough to allow himself a little joke about his argument for transitory inflation. The audience giggled and nodded along when he pointed out that ‘The good ship Transitory was a crowded one, with most mainstream analysts and advanced-economy central bankers on board‘. So we all got it wrong! Oh well.

The three other papers at Jackson Hole revealed the somewhat un-revelatory:

- if government debt is considered risky then QE moves losses from bondholders to taxpayers (Hanno Lustig paper)

- mortgage markets are central to monetary policy transmission (Philipp Schnabl paper)

- higher interest rates have a bigger impact on countries which are more indebted (Ida Wolden Bache paper)

Whatever the next shock is, central bankers aren’t ready for it.

4. The UK

Certainly not Andrew Bailey. His speech at Jackson Hole was all over the place. He touched on the Gold Standard, trade-offs in the Bank of England’s mandate, the LDI crisis, financial stability and extrinsic vs intrinsic persistence of inflation. The final delineation appears to be the most important to the current thinking of the BOE: just how much inflation persistence is in the system? Bailey sketches out three scenarios:

- It is “self-correcting” – ‘credibility of monetary policy‘ leads to ‘well-anchored longer-term inflation expectations‘.

- It persists in an ‘intermediate‘ way – ‘Here we would need to maintain restriction for longer and thus open up more of an output gap‘.

- It persists in the ‘least benign‘ way – ‘structural changes in product and labour markets going on which are causing the supply side of the economy to change as a lasting legacy of the major shocks we have experienced’.

You will have spotted that two of those three scenarios require more restrictive monetary policy. Bailey says that ‘as policymakers we can have all three of these cases in our expectations, with different weights attached’. And as far as he is concerned, ‘at the moment I put more weight on the first case – self-correction – but some smaller weight on each of the other two’.

This is a central bank that has just cut interest rates – where he as Governor provided the casting vote in a close 5-4 decision. And yet he is warning that in two out of three scenarios the persistence of inflation in the UK economy would mean interest rates need to be more, not less, restrictive.

Just in case anyone, such as Rachel Reeves or Keir Starmer, might be worried about that, he argues ‘Tentatively, it appears to me that the economic costs of bringing down persistent inflation – costs in terms of lower output and higher unemployment – could be less than in the past‘. Rachel Reeves must be delighted by such conviction. Inflation might be more embedded in the economy than the Governor of the Bank of England thinks, even though he’s just cut rates, but if he does have to keep rates higher for longer then it probably won’t hurt growth. Probably. Maybe. Could be.

It looks rather like a tentative warning to the new Chancellor given her predilection for above-inflation public sector pay rises. The Bank of England had to cut rates sooner into the term of the new government because they know it will be harder to cut them later.

We know Rachel Reeves has started as she means to go on. Almost half of her £22bn black hole, £9.4bn, came from the public sector pay awards:

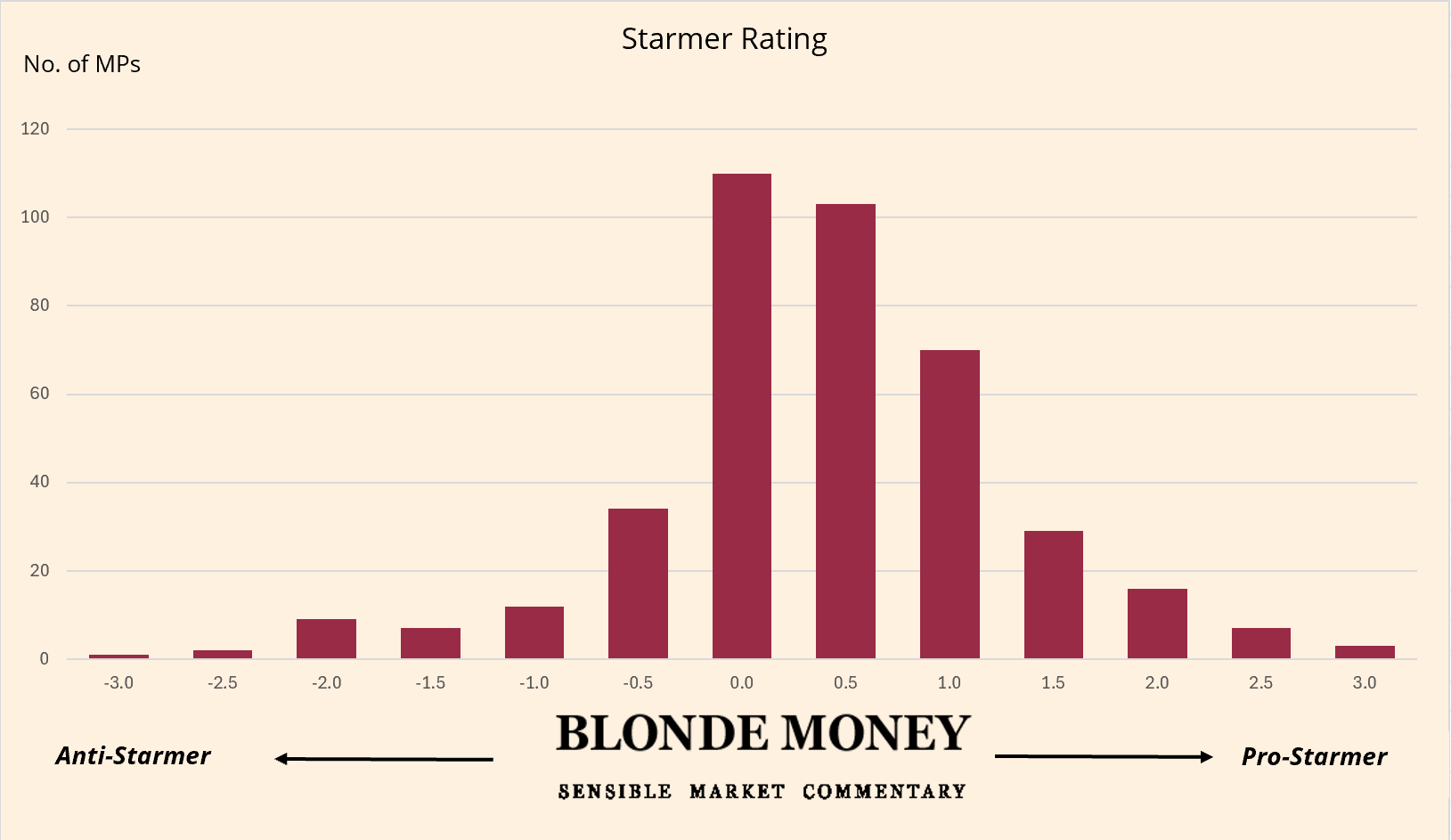

Rushing out this announcement before the summer recess has continued to generate controversy over the axing of the winter fuel payment to those not in receipt of pensions credit. It will become law as a statutory instrument by mid September – parliament returns on Monday 2nd September when you can expect the noise to ratchet up. And not just from the official opposition – members of her own party have already spoken out. Rachael Maskell, a former shadow minister, said ‘I really urge the government to think again about how it’s going to protect the most vulnerable people in our society, our pensioners, this winter‘. The Labour peer, Lord Foulkes, called the decision a “terrible error” and urged “a rethink“. Harriet Harman suggested ‘discussions might be under way’ to ‘make a different cut-off point‘.

Rachel Reeves doesn’t need to make any changes, such is the unassailable scale of the government’s majority. If she does, it confirms that the real opposition lies within her own party. It’s early days. She can wait it out until Budget day. It is going to be so chock full of red meat Labour measures that pensioners will become a footnote to the bonanza of socialism.

5. The US

The Republicans would like American voters to believe that Kamala Harris is a bonanza of socialism. Her economic plan includes tax breaks for families and first-time buyers along with a ban on price-gouging of groceries. Then again JD Vance wants an even bigger child tax credit and Harris has picked up Trump’s policy of banning tax on workers’ tips.

They all want to keep extending the US deficit as far as the eye can see but their ability to do so will be constrained by the US separation of powers. In the current environment it’s not enough to have your party in the White House and with a majority in Congress – they must agree across all party factions. Bernie Sanders sits as an independent who caucuses with the Democrats; the Republicans had a majority in the House of Representatives but cycled through two Speakers in the last session, including many electoral rounds even to elect one in the first place. Voters are fragmented and making policy will be difficult whoever wins on 5th November.

In the face of such fragmentation, the closing of the Democratic ranks around Kamala (and expulsion of Biden) is even more astonishing. A party so riven by ideological in-fighting that it had to compromise four years ago by allowing an octogenarian to run again has suddenly found its killer instinct. Kamala might have dropped out of the 2020 presidential campaign even before the primaries began, she might have had the lowest approval rating of any vice president in history (at least according to NBC’s poll) but she is, crucially, not Biden and not Trump. And with less than three weeks until early voting begins in some states, her party hope this will be enough.

Certainly it has had the effect of motivating the base:

And simply by becoming the candidate, Democrats have become more favourable towards her:

But you can see from the above chart that each side hates the other. With all due respect to Kamala, almost anyone could have been chosen as the candidate and her tribe would have enthusiastically spun the endorsement, just as the other would have painted her as the devil incarnate. Of the elusive “independents”, 46% approved of her with Gallup’s poll of September 2021 and 41% approved of her in their latest poll. This is actually an improvement on just a couple of months ago, demonstrating that she is generating momentum – but it’s from a low base:

Momentum matters. But it shouldn’t be overstated. The presidential race has gone from Trump being 2-0 up in the 89th minute to 2-1 with the ref signalling 5 minutes of injury time and a fresh pair of legs substituted for the striker. There is hope for Democrats where there was none before.

But Harris is no Ole Gunnar Solskjaer. In Michelle Obama’s speech to the DNC she warned ‘Kamala and Tim, they have lived amazing lives. And I am confident that they will lead with compassion, inclusion and grace. But they are still only human. They are not perfect. And like all of us, they will make mistakes’.

She continued: ‘But luckily, y’all, this is not just on them. This is up to us, all of us, to be the solution that we seek’. In other words: get out and vote. Get your friends out to vote. Whatever Kamala says or does. Whatever gaffe might happen. Whatever negativity you hear in the headlines. Whatever happens.

This is an admirable exhortation to the twelfth man but it smacks of the difficulty ahead for the Democrats. American election campaigns begin just as the previous one ends. The Democrats have produced a remarkable defenestration of their leader, and the leader of the free world, in order to put themselves in with a chance. The UK’s Conservative Party should have taken heed of such an alleged constitutional impossibility.

6. Japan

Japan, the land of the one party government, is also embracing political change. Prime Minister Kishida has announced he will step down as party leader when his term ends in September following months of declining public opinion towards him and his cabinet. An election isn’t required for a year but it’s clear his party felt he had become a liability in the wake of a series of scandals.

That leaves Canada as the only G7 nation with the same leader since lockdowns were lifted. It is no surprise that governments have been punished by such a significant event. Even Trudeau was forced to continue as a minority administration after his party set a record for the lowest vote share of a party that would go on to form a government.

Given Japan was the butterfly whose wings flapped into a market earthquake, a change of political direction in Japan is hardly a harbinger for increased political stability.

7. The Middle East

All of this creates increased geopolitical tension. Enemies know it’s a good time to attack when a country is internally distracted from supporting its friends.

Hence we see the US Navy now reportedly has enough assets gathered in the Middle East to “militarily defeat almost any country in the world”:

Iran is not going to remain silent forever. The huge Arbaeen pilgrimage is currently taking place, with Palestinian flags flying amongst the more than 21 million pilgrims in Iraq, 3.5m of whom are Shia Muslims from Iran. Once concluded there would be an opportunity for Iran’s retaliation on Israel.

Political risk is rising whilst the financial system is becoming inherently more unstable.