The Two Weeks That Will Be (26th January 2026)

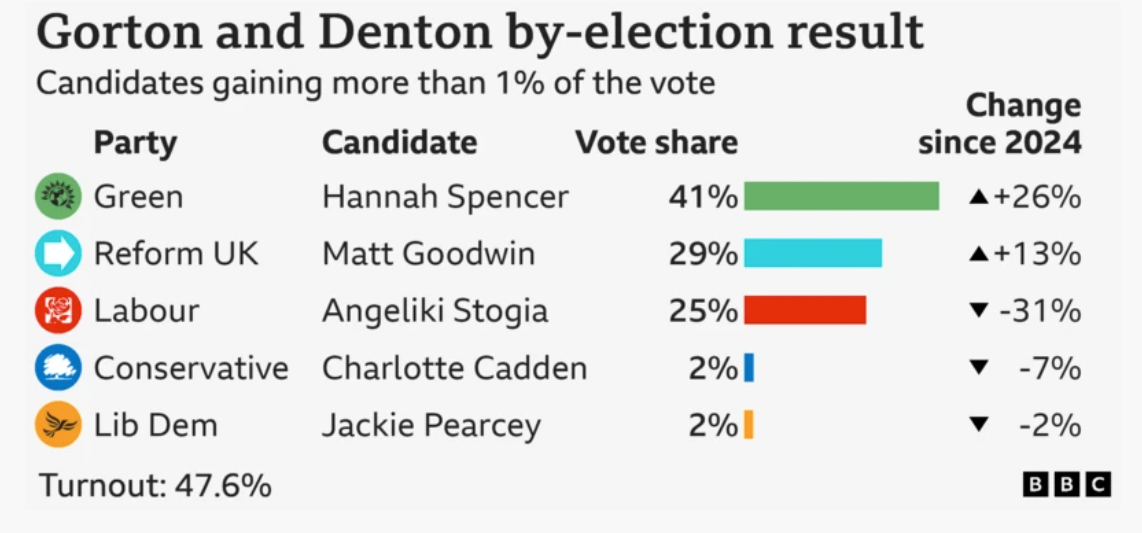

The starting gun to replace Starmer has been fired after Andy Burnham submitted his application for a waiver to run in the Gorton and Denton by-election. The subsequent block by a 10 person NEC senior subcommittee will exact a cost on Starmer’s leadership. Everyone knows the entire debacle only ensued due to Starmer’s vulnerability. Ducking yet another blow by failing to enter the ring doesn’t end the fight. It only demonstrates weakness, as the mounting enemies to Starmer will be further encouraged to exploit.

Political leaders can only exert power over the party network if they aggregate power in the first place. Weak leaders with hugely negative personal ratings and who have presided over – and are blamed for – one of the most precipitous declines in a new government’s polling since records began hold very few cards.

It is not the worst drop however, as pollster Peter Kellner recently reflected, with four other governments having fallen further and still gone on to win at the next election:

Kellner warns however that the big turnarounds come from “change” – either due to an event like the Falklands, or (perilously for Starmer) a change of leader. And with several parties now on the pitch, rather than just two, the agent of change will have to fight on multiple fronts. Kellner argues risk-taking and belligerence are required to deliver the “Wow” factor that is the Hail Mary pass. Spending months bogged down in internal Labour party politics is unlikely to deliver that.

Particularly when Burnham is already working on the Wow. His letter asking for permission to stand for selection is as close of a leadership pitch as he can get. A mention of “cotton workers of 1862”, a dash of “I left Westminster… it wasn’t working for people”, lip service on “the progress already made… is truly impressive” and finally “I am confident we can win”. Blocking his formal path will not stop Bambi trying to wow with his Manchesterism. He will chunter his message even more loudly, encouraging other contenders to set out their stall and eclipsing anything said by the actual prime minister who appears never to have quite understood the power of the bully pulpit. The barrister who excelled in technical legal opinions rather than grandiose jury-winning performances has always preferred writing articles than charming interviews or stirring speeches.

Hiding behind the Labour Party’s internal rulebook might win this procedural battle but it invites challenge. The party machine can be subdued, stacked and sutured but never tamed into complete submission. Dissent will be registered and party management will be even harder. The machinations that are about to spill into the open are the precursor to an eventual split in the Labour Party that will usher in an early general election.

Right now it gifts momentum to Labour’s adversaries. One argument deployed against Burnham standing is that the Manchester mayoralty might be won by Reform. It is always weak for a governing party to define itself by its opponents as it hands them the initiative. With talk that Zia Yusuf might run for Reform and the Greens moving into pole position with the bookies, the entire by-election risks descending into a precursor to the next general election: Reform v Greens with the Labour Party rendered irrelevant. And with reports the by-election might take place before the local/Scottish/Welsh elections, it will generate momentum for those parties precisely when Labour can least afford it. One thing we can be sure of: this by-election will not go quietly into the good night.

Starmer’s attempt to block a rival and draw a line under “psychodrama” have instead increased the risk to his position. Kemi Badenoch can benefit from ousting Robert Jenrick because he was defecting to another party. The leader of the opposition at a minimum must keep their party together. But Keir Starmer isn’t just leader of the Labour Party, he is the prime minister. Not only should he be confident enough to welcome anyone talented to his bench of MPs, he shouldn’t waste energy and political capital in fending off rivals, of which there will always be a queue. Politics is never won from the rulebooks.

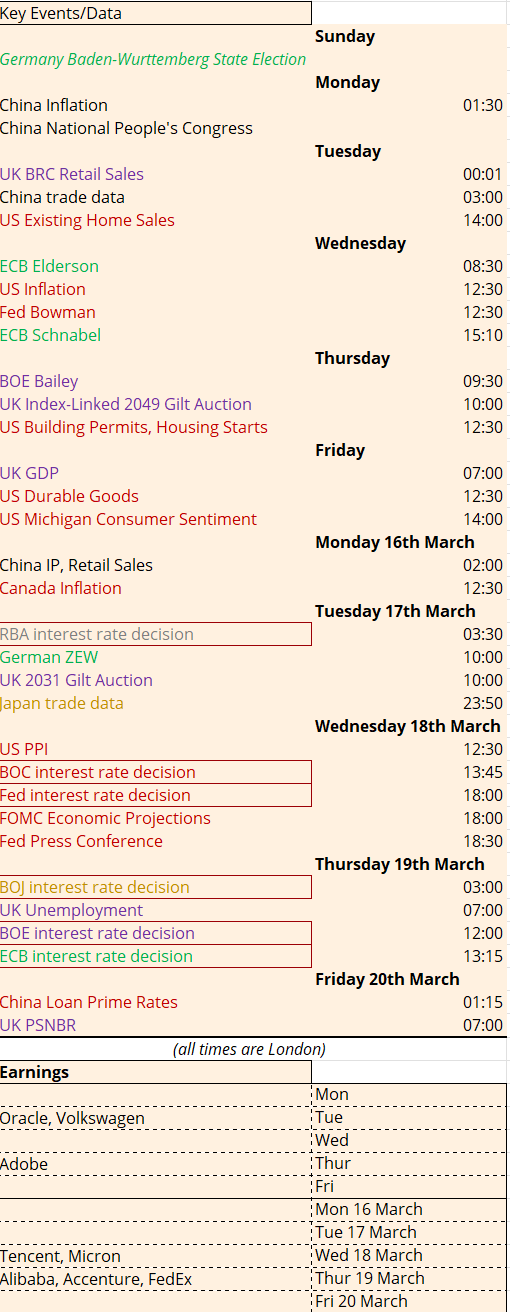

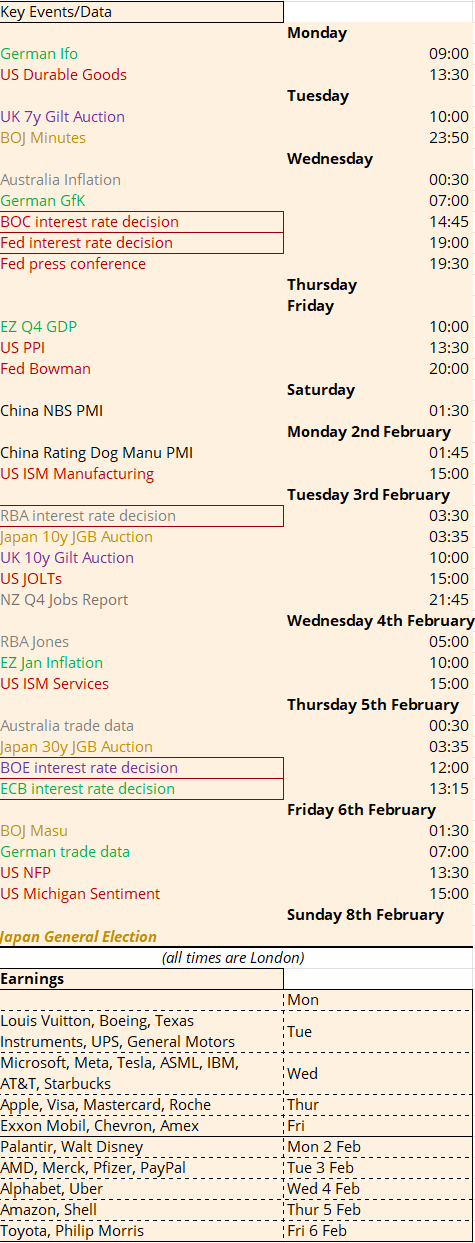

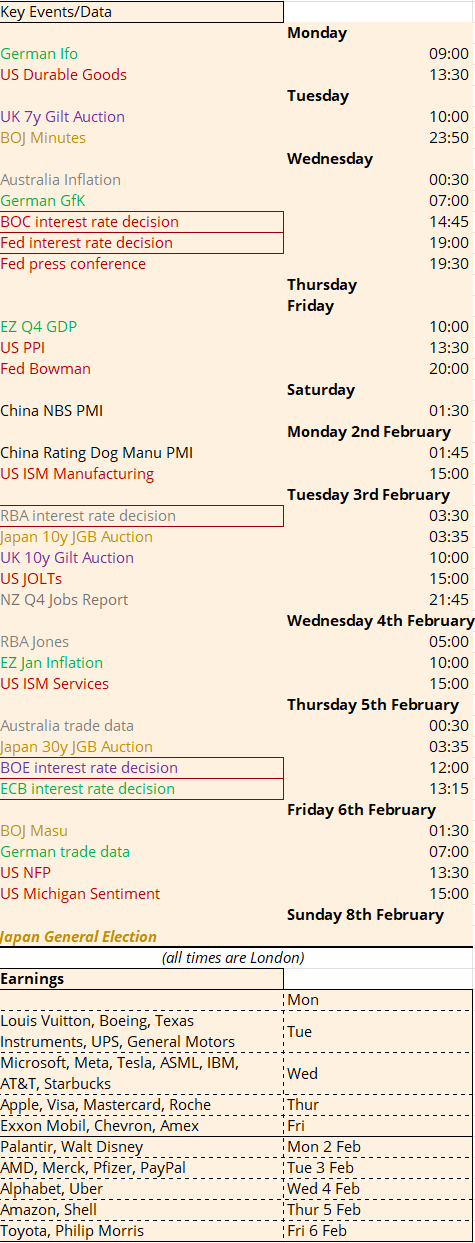

The Bank of England will leave rates unchanged on Thursday 5th February. Having barely managed to deliver the last cut, they will hold tight whilst political machinations, both domestically and globally, play out. Gilt auctions on the two Tuesdays should pass without incident given bond investors still perceive other countries as more of a risk than the UK.

- Japan

One of those riskier countries is Japan. There is a 10y JGB auction on Tuesday 3rd February and a 30y on Thursday 5th February. Foreign investors bought 53% of Japanese Government Bonds last year, accounting for the majority for the first time according to the Japan Securities Dealers Association. Those investors must now contend with greater volatility, whether it is rumoured US/Japanese intervention in USD/JPY or spiking yields due to expectations of looser fiscal and tighter monetary policy.

Takaichi recognises the threat, telling the Nikkei the temporary consumption tax cut on food “would not rely on deficit-financing bonds…We must convey this correctly as a message to the market. This is sometimes misunderstood by those outside Japan… What is important for the government is to accurately communicate [to investors] that it is mindful of fiscal sustainability”.

The election on Sunday 8th February was called by Takaichi in order to strengthen her mandate. But whilst she has a high personal approval rating, her party are still struggling having lost their majority in both houses for the first time in Japanese post-war history. Worse, their coalition partner Komeito is now campaigning explicitly against them, having formed a new party with the largest opposition party (the CDP). It was this new party, the Centrist Reform Alliance, who mooted the cut in consumption tax on food that then caused yields to rise after Takaichi said she was also considering it. The LDP evidently fear what the new alliance might achieve – the campaign period for this snap election will be the shortest ever, reducing their ability to make an impact in just 16 days. Turnout is also expected to be depressed given the weather conditions at this time of year. And Japan has undergone the same voter fragmentation as other G7 democracies, with the anti-immigrant Sanseito and anti-inflation Democratic Party for the People both gaining ground.

Takaichi will therefore struggle to get the fresh mandate she requires. She has already lost 8 pct pts in the last month according to the latest poll. It is still clear that whatever constellation of government emerges, it will be one that is keen to combat the rising cost of living given that is the top issue on voters’ minds. For financial markets this is a paradigm shift from the lost decades of the recent past. Where the BOJ were once the only game in town in the battle to slay the deflationary dragon, the marginal price of Japanese bonds and currencies will now be set by global investors searching for a home in a global bond-glut ugly contest. Whilst Japanese investors may prefer to bring money home, foreign capital will ultimately baulk at a re-heated Abenomics 2.0. The BOJ is no longer the price maker; the government will become the price taker.

- The EU

The ECB will leave rates unchanged on Thursday 5th February. Christine Lagarde will have to get back to the day job after a dramatic Davos trip where she talked of her female emotions over American kinship with Europe and stormed out of dinners. Her time at the helm of supranational institutions is nearing an end. Her term expires in October 2027 and the game of chess over her successor has already begun. The surprise elevation of Boris Vujčić, Croatian Central Bank Governor, to ECB Vice President means the big EU nations are still fighting it out for the top job. The European Parliament had preferred the contenders from Portugal and Latvia; the Croatian ultimately beat them all.

There are now three big vacancies left to fill – aside from Lagarde, by the end of 2027 we will also see Isabel Schnabel and Philip Lane depart. There has never been a German President of the ECB; could Schnabel be elevated? Joachim Nagel might have something to say about that. Given the mounting risks for European debt, particularly the unleashing of Germany’s constitutional debt brake, the future path for the ECB will be at least as politically important as it is economic.

France might be the dog yet to bark but it continues to limp on despite its lack of a functional government. Reconstituted prime minister Lecornu managed to ram through the income section of the budget with recourse to Article 49.3 despite having promised not to use it. He subsequently survived the two no confidence votes brought against him (one from the left and one from the right) although the first only fell short by 19 votes. Lecornu is likely to have to go through the same process again to pass the spending section of the Budget. As Marine Le Pen put it, “Don’t think that no one is watching you. The French people see you, and they will make you pay for it at the ballot box. Not only for the (budgetary) bloodletting you are inflicting on them, but also for the humiliating process you are using”.

The European Parliament decided to join in with the dysfunction by voting to refer the long-awaited Mercosur trade deal between the EU and South American nations to the ECJ. Another narrow decision with 334 voting for and 324 against, means approval by the European Parliament will be delayed, possibly for two years. This leaves the European Commission in the potentially inflammatory position of provisionally applying a deal that another European institution has yet to ratify. And all because MEPs felt the tactics towards approval “prevent [member states] national parliaments from having their say on the agreement”. It all adds up to yet another challenge to the authority of Ursula Von Der Leyen. She managed to win the latest no confidence vote against her but it is the fourth in seven months. Given her diminishing authority, she might prefer an exit towards the German Presidency when Steinmeier’s term ends in March 2027.

- The US

Where Europe contends with weakened leaders, angry electorates and floundering attempts at strategic autonomy without the defence budget to pay for it, President Trump marches on. As his hubris rises, so too will the challenge against him.

The Fed meeting on Wednesday will be the perfect opportunity to announce his choice of Fed Chair, signalling that whatever this particular group of people are doing (or in Trump’s view, not doing, when it comes to rate cuts) they’re the rear view mirror. Whilst the Supreme Court has so far sounded sceptical on the President’s power to fire a Fed Governor in the Lisa Cook case, the process is providing the Trump administration with useful pointers over how to attempt to do so successfully in the future.

In any event, the Fed is no longer the marginal player in town given the significance of geopolitics and fiscal policy. Trump toughening up immigration is already having an impact on the labour market which we will see in the Payrolls number on Friday 6th February. The first trilateral talks between the US, Russia and Ukraine could yet unleash a peace dividend, particularly if a frozen conflict and a Waitangi style agreement over the buffer zone emerges. Iran remains in turmoil with the internet still in blackout and conflicting reports over casualties. And we are yet to get the final details of the Greenland deal. A few basis points on inflation or a recalcitrant Fed will not move the dial on the global economy.

- Earnings

It’s MAG7 time, along with defence heavyweight Palantir and a consumer update from Starbucks and Visa. These are the earnings to keep an eye on:

- Wednesday: Microsoft, Meta, Tesla, Starbucks

- Thursday: Apple, Visa

- Monday 2 February: Palantir

- Wednesday 4 February: Alphabet, Uber

- Thursday 5 February: Amazon