The Two Weeks That Will Be

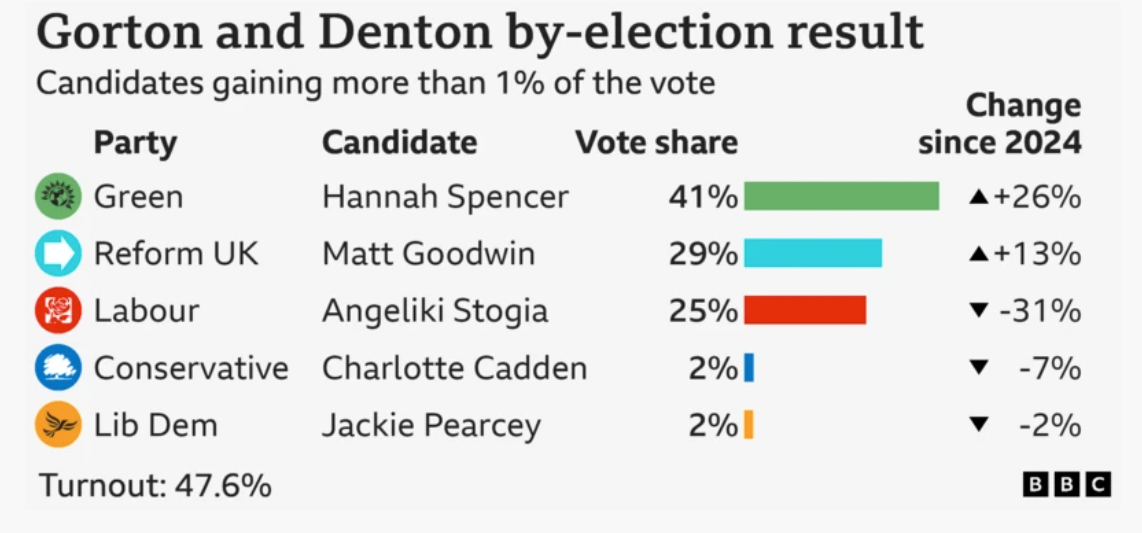

1. The UK Election

++ See our separate note “UK Summer Election – Part 3” for full details ++

2. European Parliament Elections

“The future of the sovereigntist camp in Europe, and of the Right in general, now rests in the hands of two women”, said Hungary’s Viktor Orban about the potential shift in power that is coming in the European Parliament elections which run from Thursday-Sunday. He was talking about Italy’s Meloni and France’s Le Pen, with their respective parties Brothers of Italy and National Rally expected to perform well and add a chunk of seats. But he could also have been talking about Meloni and Von Der Leyen with the latter potentially requiring the support of the former to continue in her role as President of the European Commission.

The rise of Meloni, whose party is predicted to move from the 6 seats it held five years ago to around 25, summarises the shift taking place in European politics. A focus on immigration, sovereignty, belief in socially conservative values and an element of insurgency have all captured the zeitgeist for an electorate that was sick of the old legacy parties. Replicated across all member states this could result in a situation where the old ‘grand coalition’ of parties fails to hold a majority of seats for the first time, replaced by a majority for the ‘populist right’ as this graphic from the ECFR of their election model demonstrates:

This is going to complicate policy making in Europe and result in tougher immigration policies, greater opposition to net zero targets and a more complicated position on foreign policy, not least towards Ukraine.

3. The ECB

The ECB will go first with rate cuts at their meeting on Thursday even with core CPI inching higher than expected. The average print of 2.76% for April-May is above the ECB staff projection of 2.5% suggesting that those forecasts will be revised up. This will be music to the ears of hawks who have been trying to prevent back-to-back interest rate cuts. Klaas Knot is even trying to pitch for rate cuts only to come in the quarterly meetings when new projections are released. The currency might help out the doves now that the ECB is taking the plunge just as the Fed rows back from rate cuts altogether.

4. The Fed

It will be a communications challenge for Powell on Wednesday 12th June. The Fed will make no changes to interest rates but we will get the latest dot plot in the Summary of Economic Projections. Half the year has gone and no pivot has yet materialised, leaving only four meetings at which the precious promised pivot of rate cuts could come. Although the median 2024 dot might show two 25bps cuts that will leave half the committee anticipating one or none.

On the same day, the latest inflation print will be released. Although the core rate of inflation has clearly settled around 3%, still some way from the 2% target, the market will once again focus on the second decimal point as it searches desperately for evidence that inflation is coming down, honestly.

The risk is therefore that it all looks rather hawkish. Powell will be doing his best to put a dovish spin on the press conference, much as he did at the last meeting. When asked “was there a discussion about a rate hike at all?” he waffled “So the policy focus has been on…what to do about…holding the.. current level of restriction. That’s really—that’s part of the policy. That’s where the policy discussion was in the meeting“. When asked outright he simply said “it’s unlikely that the next policy rate move will be a hike.” But we now know from the Minutes of that meeting that a hike was not only discussed, but favoured by some participants:

- “Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate”.

- “A number of participants noted uncertainty regarding the degree of restrictiveness of current financial conditions and the associated risk that such conditions were insufficiently restrictive on aggregate demand and inflation”.

In such a world it’s quite likely that at least one person on the FOMC actually increases at least one of their dots above the current 5.25-5.50% level, particularly if we get strong prints from the bellwether data of ISM Manufacturing on Monday and payrolls on Friday. Powell has a job on his hands trying to emphasise the “longer” element of “high for longer”, rather than the “high”. At some point he will come unstuck and the yield curve will bear steepen – but that’s a story for after the summer holidays given risk appetite remains blindly unbowed.

5. The BOJ

Expectations of higher US interest rates had already contributed to the rally in USD/JPY to 34 year highs. The BOJ intervened but the pair is back up towards the 160 level, prompting BOJ’s Adachi to remark that “If yen falls accelerate or persist, consumer inflation may rebound sooner than expected. If this happens at a time when there is a higher chance of inflation durably and stably exceeding 2%, we may need to push forward the timing of an interest rate hike“. Takeo Hoshi, economics professor at the University of Tokyo (and chair at a recent review meeting at the BOJ), also warned about the impact of the exchange rate and suggested the BOJ must get into the position of raising rates steadily.

The BOJ is clearly itching to take this advice and raise rates further. Governor Ueda gave a concise and candid summary of ‘the perennial question of Japan’s struggle to escape a long period of zero-to-low inflation‘ at the recent BOJ-IMES conference where he concluded that Japan had entered a new equilibrium. He blamed the deflationary decades on three things: (i) the lack of a specific inflation target until 2013, (ii) the delay in implementing the required scale of asset purchases in the early 2000s and (iii) how low inflation expectations became entrenched. Wages “astonishingly” just didn’t budge between 1999 and 2013:

But Ueda is optimistic for the future. Japan is in a new era. The pandemic and rise in inflation globally provided a useful shock to the system because it allowed businesses to raise prices:

The inflation genie is out of the bottle. Ueda is delighted. He won’t want to snuff it out but he will want to get interest rates up while he can. If the BOJ don’t raise rates at their meeting on Friday 14th June they will still signal that that is their direction of travel.