The Two Weeks That Will Be

1. The UK

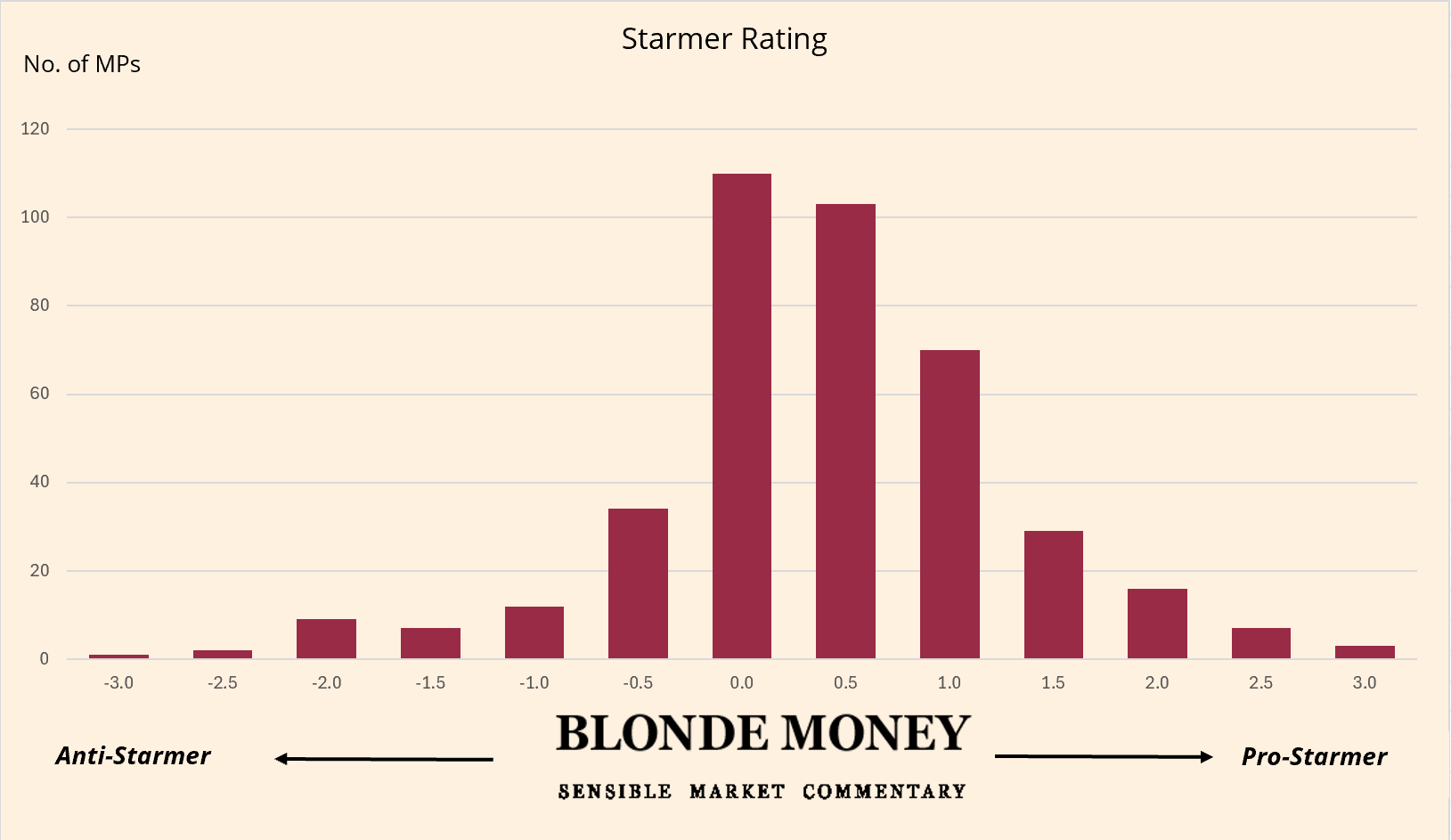

The Prime Minister has demonstrated his ruthlessness by ditching his Chief of Staff, Sue Gray, before even 100 days in office had been completed. It also demonstrates a surprising amount of pressure for a man who has just delivered an historic victory to his party. This does not bode well for the long term.

Short term, he’s flexing his man management muscles. He has promoted the architect of his electoral campaign, Morgan McSweeney to replace Sue and then promoted two women from his team to be deputy chiefs of staff. He has also brought in a very experienced journalist, James Lyons, currently at TikTok, to head up a new strategic communications team. All in all, this is a victory for the politically-astute, steeped-in-Labour-blood specialists over Whitehall bureaucrats. We can expect there to be a much clearer political message going forward.

Rachel Reeves has been trying to shout about her message for some time now. Ahead of her party conference speech, she wrote an op-ed in the Times Business Section emphasising ‘my message to business is this: if growth is the challenge, then investment is the solution — and I want to work with you to deliver that. We ran as a pro-business party and we are governing as a pro-business party‘. She told the FT on 4th October that ‘Invest, invest, invest is the theme of this Budget‘ whilst also warning ‘It’s about making prudent, sensible investments in the long term and we need guardrails around that’.

All very lovely words but nobody will believe them until she actually stands up and delivers the Budget on 30th October. There is already speculation (more accurately described as lobbying) that restrictions on non-doms and the hike in the rates for private equity carried interest must not be implemented in full because they won’t raise revenues due to behavioural changes. In other words, rich people, and their tax revenues, will simply leave. To avoid this, the IFS and the Resolution Foundation have proposed an exit tax. This feels like an endless game of whack-a-mole, where assumption after assumption means that changing x means also changing y and z. Step forward The Observer which has taken analysis from Policy in Practice to argue that the surge in claimants for pensions credit means that cutting the winter fuel allowance might not raise as much money as Reeves had suggested, not least because being in receipt of pensions credit opens up an avenue to receive other state benefits. The Chancellor’s complex spreadsheet, constrained by the OBR and her fiscal rules, might just fall under the weight of its own assumptions.

This is where the political messaging is key and why Starmer had to make changes now or never. To get growth, the government will need investment. But investors won’t be keen on a basket case economy riven by instability. There needs to be a clear message and a sensible plan. The government is hosting a Business Investment Summit on Monday 14th October precisely to demonstrate that the fresh borrowing due in the budget a couple of weeks later can be financed. Larry Fink of BlackRock and David Solomon of Goldman Sachs are amongst the bigwigs reported to be in attendance.

In the two days after the summit on Tuesday 15th October and Wednesday 16th October the latest UK jobs and inflation numbers will be released respectively. The government will already consider these are in the rear view mirror. They will be of more interest to the sideshow taking place in Conservative Party, where beleaguered former MPs mutter about how the improvements in the economy amply demonstrate why Rishi Sunak should have waited longer before calling the election. Nobody else cares. On Wednesday and Thursday, the remaining rump of Conservative MPs will vote on the final two candidates for leader. James Cleverly has generated that all-important last minute momentum thanks to his charming and candid party conference speech. However it will still be Sunak or Hunt responding to the Budget unless the party accelerates the timetable for unveiling the new leader, due, after members have voted, to be announced on 2nd November.

It won’t really matter. As the last few weeks have shown, the Labour Party remains both government and opposition.

2. War

It is likely to be a hectic period for developments in the Middle East. One year on from the egregious Hamas attacks on Israel, hostages remain unreturned, Netanyahu remains in power and active conflict is quite literally exploding across Israel’s borders. Apparently nobody wants a spike in the oil price, at least if we take Bank of England Governor Bailey’s comments in his interview with the Guardian at face value: ‘my sense from all the conversations I have with counterparts in the region, is that there is, for the moment, a strong commitment to keep the market stable’.

But Iran can’t fire 200 missiles over to Israel and not expect some sort of retaliation. With the Hizbollah pager plot apparently nine years in the making, there may well be a more symbolic response than the pure muscular bombing of oil or nuclear facilities. But then Iran will have to respond. And so on. Can Israel rely on the support of the US? Can Iran rely on the US not to support Israel? At some point Biden will have to make a choice. He can’t just say ‘I think — I think that would be a little — anyway’.

In such an environment the risks of a higher oil price are increasing.

3. The US

Meanwhile a US election is just over four weeks away. Trump was happy enough to advise Israel, ‘Hit the nuclear first, and worry about the rest later‘. Harris hasn’t said much so far although one of the most memorable parts of her Convention speech was when she pivoted into the hawkish line about how ‘As Commander-in-Chief, I will ensure America always has the strongest, most lethal fighting force in the world‘.

With polling tight in the swing states this is not a topic on which she can remain silent for long. She has to tread a more difficult path than Trump. The Democratic primary in Michigan in February saw over 100,000 voters back “uncommitted” rather than tick the box for Biden in protest at his stance over the war in Gaza. She didn’t choose Josh Shapiro, the Jewish governor of Pennsylvania, as her running mate, despite his local popularity in the most significant of swing states.

In 2016, Trump took Pennsylvania with 44,292 votes; in 2020, Biden won by 80,555. According to the data company Consumer Affairs, the inflation rate last year for grocery prices was the highest of any US state. The economy remains a key focus for voters:

Although a war in a far away land doesn’t appear to feature heavily in voters’ minds, it certainly would if it reignited a new round of inflation. The latest US number is released on Thursday. Retail Sales follow on Thursday 17th October.

But the most heavily watched release will be the FOMC Minutes on Wednesday. Has the Fed made a terrible mistake? Just after they pivoted to rate cuts with a punchy 50bp reduction, specifically to focus on the employment rather than the inflation side of their mandate, the Non Farm Payrolls report surprised to the upside on all metrics. Powell was asked in the September meeting press conference that if redundancies ‘were to happen, wouldn’t the Committee already be too late in terms of avoiding a recession?’. He replied ‘we’re not waiting for that, because, you know, there is—there is thinking that the time to support the labor market is when—is when it’s strong and not when we begin to see the layoffs. There’s some lore on that’. The Minutes will reveal just how far fairytale folklore about getting ahead of the curve has penetrated the FOMC.

4. The ECB

The ECB will cut interest rates at their meeting on Thursday 17th October following headline inflation having fallen below target for the first time in three years. Yes, services inflation remains stuck, German wage negotiations remain toppy and Lagarde promised to go meeting-by-meeting but patience in this instance is not a virtue. Seven sources were happy to tell Reuters that the doves are pushing for action now. The Fed has given them cover with their punchy 50bp cut and surely Lagarde wouldn’t want to fall behind Andrew Bailey’s bid to get a ‘bit more aggressive’. On Monday, ECB Chief Economist Philip Lane gives the keynote speech at the annual ECB Conference on Monetary Policy. We think he will support the recent line taken by Isabel Schnabel that ‘We cannot ignore the headwinds to growth. A sustainable fall of inflation to 2% is becoming more likely, despite still elevated services inflation and strong wage growth’.

5. France and Germany

Schnabel’s speech also explained that monetary policy can only do so much. She looked at how growth varies wildly between Eurozone countries with Germany the laggard thanks to its diminishing competitiveness:

An even more remarkable chart of Germany’s trauma shows just how much it is struggling compared to other Eurozone nations:

Yes in the left hand chart that’s Greece as the big winner and Germany one of the big losers! A remarkable turnaround from the sovereign debt crisis debacle where Germany had to come to Greece’s rescue.

A weak and wobbly Germany is hardly cause for joy in Athens. The core Eurozone countries are coming under strain. France’s 10 year borrowing costs have surpassed Spain’s for the first time in almost two decades. France’s new PM Barnier is tabling a budget that combines tax rises and spending cuts to trim EUR 60bn from the debt pile. The left group, the New Popular Front, who claim to be the biggest bloc in Parliament, have responded by filing a no confidence motion. They won’t succeed as long as Le Pen’s National Rally continues to leave Barnier to go about his business. And she will, as long as he complies with her demands. Confirmation, if it were needed, that far from losing the elections, Le Pen has emerged even more powerful. Her sword of Damocles hangs over the government.

Germany is in no less political strife. The three regional elections saw poor results for all parties in the federal coalition. The co-leaders of the Green Party felt compelled to resign in the aftermath. Even worse came to the FDP who not only failed to reach the electoral threshold for representation (5% of the votes), but even failed to reach 1% of votes cast. In Brandenburg they were a rounding error, ‘too insignificant to be reflected’ in the provisional results. This is existential stuff. The leader of the FDP, Christian Lindner, is now confronted by the harsh reality that the federal election is due in a year’s time and for the last year his party been polling under the 5% level in the national opinion polls. Either the coalition must dramatically turn around its fortunes or he will do better to pull out of it completely.

The likelihood of the latter – and thus early elections – is increasing. Lindner has ominously described the months ahead as the ‘autumn of decision-making’. Lindner followed this up more recently with ‘Stability for Germany is of paramount importance. But at some point, a government itself can be part of the problem. A government must always ask itself whether it meets the requirements of the times‘. Next year’s budget must be passed by the end of November. The vice-chairman of the FDP warned ‘at this rate, I don’t think this coalition will make it until Christmas‘.

6. Earnings

Away from political machinations, earnings season returns. Kicking off with JP Morgan and BlackRock amongst others on Friday, we will also hear the latest from behemoths Netflix on Thursday 17th October and Procter and Gamble on Friday 18th October.

The volatility wobble in August continues to cast a shadow with the VIX index bid despite the S&P500 remaining up at record highs. Nervousness is and will remain – understandably in our opinion – high.