The Two Weeks That Will Be (8th February 2026)

1. The UK

“He did well, the sense is he is no longer in danger“. So said a Conservative MP of Boris Johnson on 25 May 2022 after the full details of the Partygate reports were released. Six weeks later the prime minister had resigned.

At that point, the Conservative Party were polling at 32%, ten pct pts behind Labour and twelve pct pts behind their share of the vote at the 2019 general election. Two thirds of the public thought he was doing badly as prime minister. Keir Starmer is in a similar, if not worse, position. Labour are polling at 19%, a fifteen pct pt decline since their landslide election victory, ten pct pts behind Reform and 71% of the public think he’s doing badly.

And that was before the spotlight fell full square onto his personal judgement. Keir Starmer cannot escape that it was his decision to appoint Peter Mandelson as US Ambassador and to block Andy Burnham for the Gorton & Denton by-election. The extent of outrage over the former has left Labour MPs wondering if they’re on the right side of events. Month after month of painful policy decisions is nowhere near as uncomfortable as the dawning realisation that you are marching wearily up a hill for a leader who compromised on just how much of a relationship with a convicted sex trafficker was ok for a holder of high office.

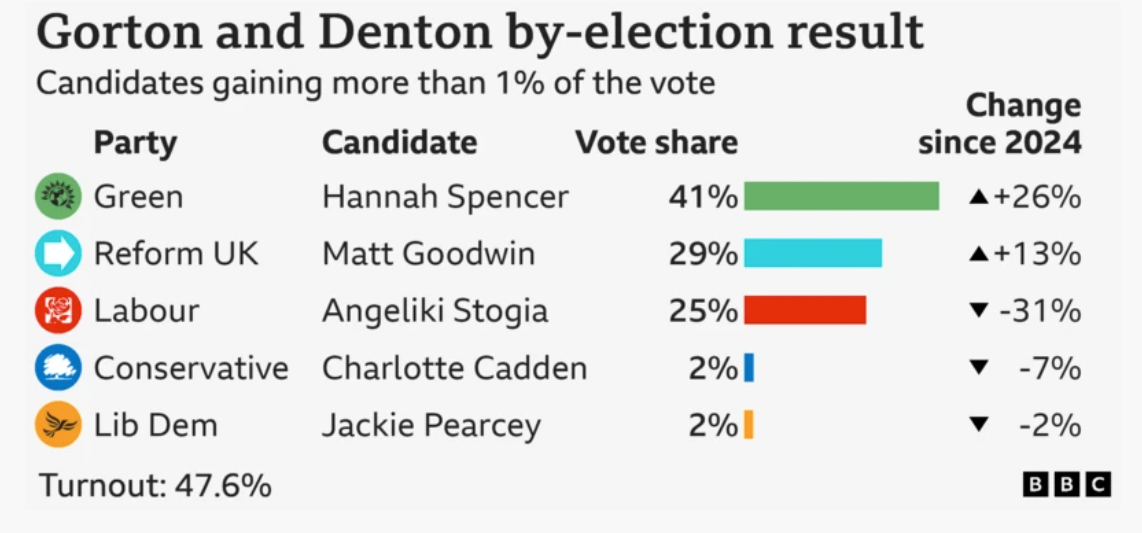

We won’t know the outcome of the latter decision on Burnham until the morning of 27 February but anger over Starmer’s decisions buttress the campaign slogan of Reform UK: vote for us, get rid of Keir. That is unlikely to do enough to get Reform over the line as the demographics of the constituency favour the Greens (listen to our latest podcast with political science expert Rob Ford for more details) but it is another nail in the coffin for Keir that either party is in contention in such a Labour stronghold.

Whatever the result, Starmer’s political judgement remains in the dock, given he decided to plump for rushing into an early by-election. Given he had relied on Morgan McSweeney for his political antennae, the latter’s resignation is unlikely to improve matters.

Sir Chris Wormald, the Cabinet Secretary, is likely the next to fall. The vetting process was blamed in McSweeney’s resignation statement, in Gordon Brown’s excoriating exhortation calling for “historic change” of accountability for public appointments, and Starmer said it must be “looked at”. A senior scalp from the civil service will be required.

None of this will stop the uneasy settlement between the factions of the Labour Party from breaking out into the open. Anyone to the left of McSweeney will rejoice in his defenestration, even though his decontamination of Corbynist sentiment in the party enabled it to ascend to government. But the right of the party are also flexing their muscles. Lord Glasman, the spiritual leader of “Blue Labour”, did not hold back when he told Sky News that Lord Mandelson and New Labour “just led to sin and vice, squalor and deceit, and perversion and disgusting actions”.

The Labour Party might not be regicidal but they are certainly fratricidal. The country might prefer the former once it sees the blood spilt by the latter. There are mechanisms to minimise the viscera. If Starmer were to become what the Labour Party rulebook describes as “permanently unavailable” then the Cabinet choose one of their own to take over as party leader, in consultation with the NEC, “until a ballot… can be carried out”.

Parliamentary recess begins after the house rises on Thursday, returning on 23 February, just three days before the Gorton & Denton by-election. We are entering a period of where events, dear boy, events are set to spiral into further instability.

2. Japan

Japanese PM Sanae Takaichi’s gamble on a snap election has paid off. With sanakatsu (“Sanae mania“) sweeping through the nation, her party and its coalition partner Ishin have won a super majority of more than two thirds of lower house seats. The hastily-combined opposition party Centrist Reform Alliance saw its seats halved. This means that even without a majority in the upper house, Takaichi’s government can override any legislation they choose to reject, easing the policymaking path. The reheated reflationary Abenomics 2.0 is good to go, meaning the temporary cut to the consumption tax that spooked the JGB market and hit the JPY earlier this year is about to become reality. Japan is about to run the economy hot, accepting a weaker currency and higher interest rates. Bank of Japan’s Tamura, a known hawk, is the first BOJ member slated to make a comment with a speech due on Friday.

The election result also validates Takaichi’s hawkish approach to defence and undermines Chinese attempts to isolate her. This victory gives her a huge personal mandate, given she managed to convert her strong approval rating into such an overwhelming victory for her party. US Treasury Secretary Scott Bessent welcomed the result, saying Takaichi “is a great ally… And when Japan is strong, the U.S. is strong in Asia”. In response, Takaichi posted on X that “The potential of our Alliance is LIMITLESS”.

3. Geopolitics

Meanwhile the arbiter of international law, the USS Gerald R. Ford, is reported to be on its way to the Middle East as Trump corrals American assets onto Iran’s coastline while US/Iran nuclear talks continue in Oman. The Iranians might have denied they ever planned a live-fire exercise this weekend in the Strait of Hormuz but there will be events to mark the anniversary of the Iranian Revolution on Wednesday. The Munich Security Conference starts on Friday, and its website exhorts its guests “Engage and interact with each other: Don’t lecture or ignore one another”.

It’s not clear if such rules apply to the inaugural meeting of Trump’s Board of Peace in Washington DC on Thursday 19 February. Netanyahu is due at the White House before then. And Ukraine and Russia have apparently been invited to Miami ‘in a week’, with the US having told Zelensky that they want a deal done by June. Given negotiations are usually at their closest when they seem the most far apart, we can expect rhetoric and tension on all sides to ramp up over the next two weeks.

4. The US

All US data is almost entirely unintepretable for monetary policy until Kevin Warsh takes up the reins at the Fed. Stephen Miran is stepping into the vacuum, giving two speeches on Monday and one on Friday. There will be an update on the labour market with the anomalous release of Non Farm Payrolls on a delayed Wednesday, leaving a rare 48 hour period where it will be followed up by inflation data on Friday. But the FOMC Minutes on Wednesday 18 February will lay bare the range of views on what these data actually mean to monetary policymakers.

5. Earnings

Desperate as the market is to price all assets off the fed funds rate, it is no longer the marginal indicator for the destination of the economy. Tariffs, trade relationships, supply of semiconductors, currency wars, health of consumer wallets, and the adoption of new technology are all more important. Interest rates are but one factor input in a distribution of price outcomes that is lepto-platykurtic: the downside has a long painful tail but moderate upside is more likely.

This is the result of the “Don’t Get Caught Short” message generated by last year’s Liberation Day volatility. You can never be long enough – until the moment when the weight of new information means you’re long at too high of a price. This creates the kind of unstable volatility of volatility that we have seen in JGBs, Gold and Silver, Bitcoin and the MAG7. The VIX index has so far this year been printing higher lows, indicating the shift to a more volatile regime.

In such a world, earnings have the potential to destabilise the broader market. We will be keeping an eye on consumer staples Coca-Cola on Tuesday, McDonald’s on Wednesday and Walmart on Thursday 19 February. For a sign of the success or otherwise of leveraged entities, watch Softbank on Thursday.