18th September 2025

UK: Anatomy of a Rolling Fiscal Crisis – Part 2

- Discontent is spreading within Labour MPs, with the Deputy Leadership election crystallising into a referendum on Keir Starmer.

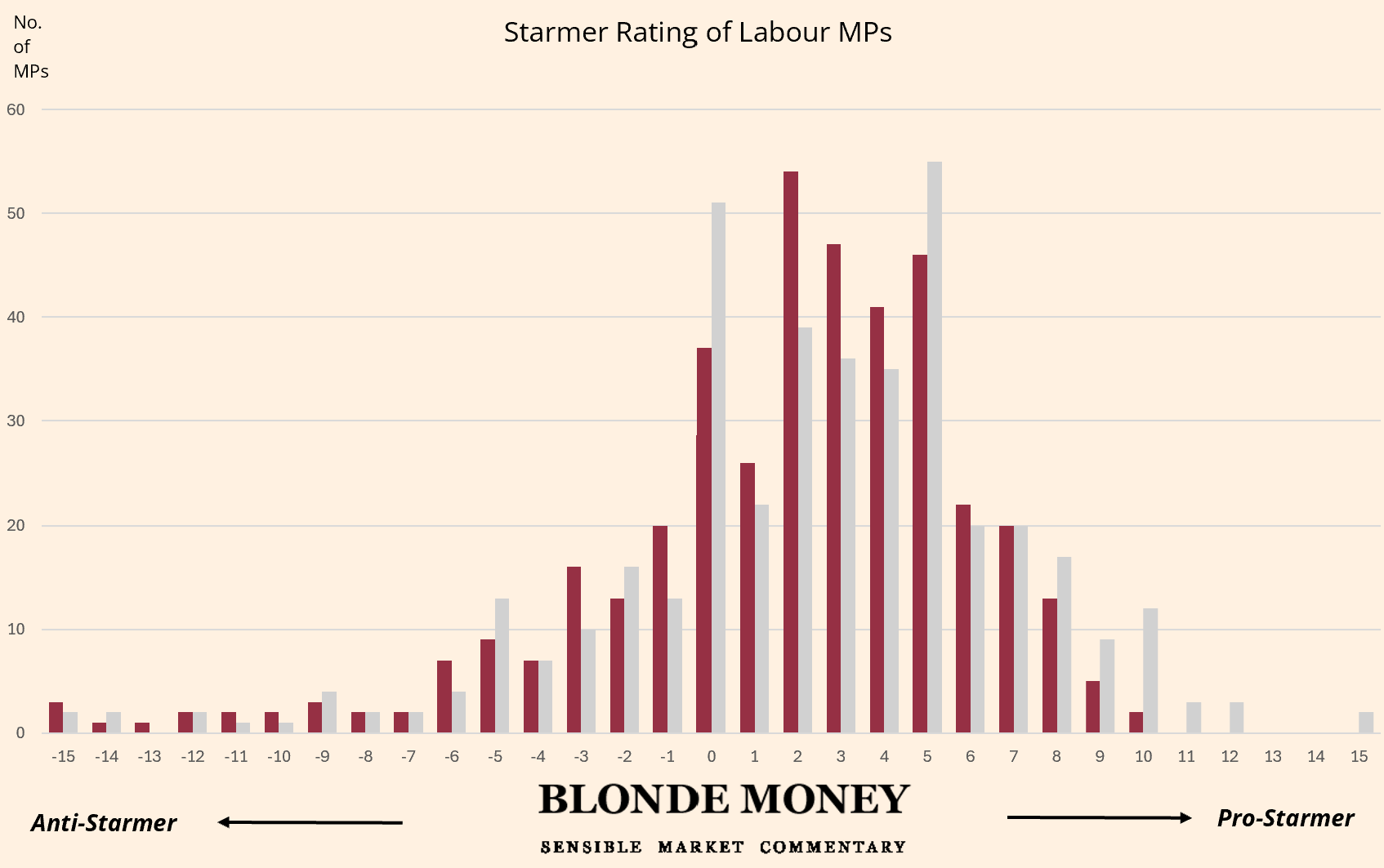

- We have updated our Starmer Ratings to take into account revealed preferences over nominations for the deputy leadership. The distribution has shifted leftwards in an anti-Starmer direction as the chart below shows, where the grey bars are those prior to the Welfare Rebellion vote and the red bars where MPs stand now:

- We are about to enter a crucial time period:

- The Budget forecast period has already been roiled by the flying of various kites as speculation mounts.

- This will intensify once Reeves – and increasingly Starmer, having poached her second in command, Darren Jones – learn the exact size of the fiscal gap that they have to fill.

- With the deputy leadership campaign overshadowing that process, we can expect even deeper lobbying against the leak of any policy that the anti-Starmer groups disagree with.

- This is a recipe for chaos with the market unable to comprehend what will become policy given Labour apparently commands a huge working majority which masks the huge ideological divisions that lurk beneath.

- The scale of the task will require Reeves to break a manifesto pledge not to raise the three main taxes.

- The Treasury is already rolling the pitch. A recent article in the FT quotes “officials” who warn the anticipated downgrade by the OBR to productivity growth could amount to “tens of billions of pounds”.

- The article suggests the Tories will be blamed for this, as the revision to productivity would be an “historical” verdict. As such, the article suggests that Jeremy Hunt’s cuts to employee national insurance might be reversed.

- And with taxes rising on working people, they will have to rise on “the rich” even more to ensure unhappy left-leaning Labour rebels are kept on board.

- Expect to hear more on the Mansion Tax and removal of higher-rate pension reliefs and/or the tax-free pension lump sum.

- The Treasury is already rolling the pitch. A recent article in the FT quotes “officials” who warn the anticipated downgrade by the OBR to productivity growth could amount to “tens of billions of pounds”.

- A volatile market will render the OBR’s model output redundant.

- Assuming a similar time frame to last year’s budget, the market parameters used for the OBR’s model will run from approximately 26 September to 9 October.

- Should Gilt yields move higher between then and the final forecast on 21 November, there could be an unholy last minute battle to ram in extra policies to ensure the market is convinced the numbers add up.

- Assuming a similar time frame to last year’s budget, the market parameters used for the OBR’s model will run from approximately 26 September to 9 October.

- The febrile atmosphere plays into the hands of those who would destabilise Starmer.

- A change to the Labour Party rule book no longer means that a confidence vote in the leader can only be brought at the party conference.

- Chapter 4, Clause II of the 2025 rule book has removed this requirement, meaning that a confidence vote can be brought at any time if 20% of Labour MPs nominate an alternative.

- The leader of the Labour Party must be an MP, complicating plans for Andy Burnham to swoop in, given he is Mayor of Greater Manchester.

- Starmer knows his enemies are coming for him.

- The reshuffle has engendered more ill discipline rather than less, with backbenchers sensing their futures might not be best served by the man currently in charge.

- The best laid political plans are always prey to events.

- A fiscal crisis would usually concentrate power at the centre but Starmer’s opponents evidently feel any kind of volatility would expose his weaknesses.

- There is a risk that events spiral beyond anyone’s control.