7th April 2025

It All Comes To Aught – Part 2

- We warned that volatility would return and become more persistent in the wake of a rational re-pricing of Trumponomics.

- But the market moves on Friday have raised the risk of a more disorderly adjustment.

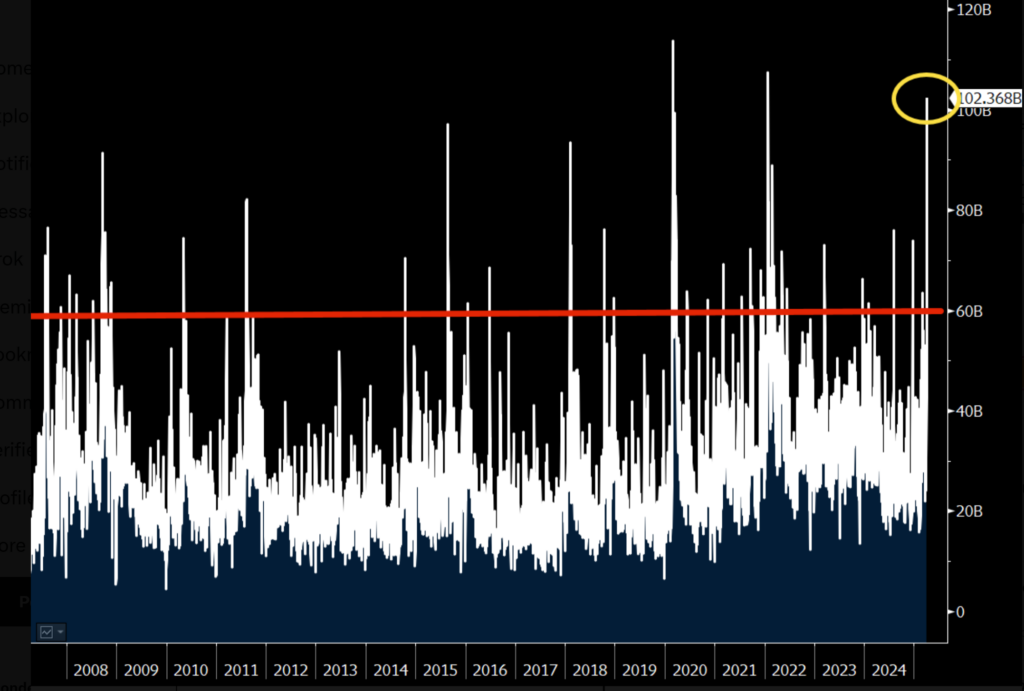

- It was the third biggest volume day ever for the ETF linked to the S&P500, the original big daddy of ETFs, the SPY:

- This was more than double the amount traded in any single stock (Nvidia traded $47bn).

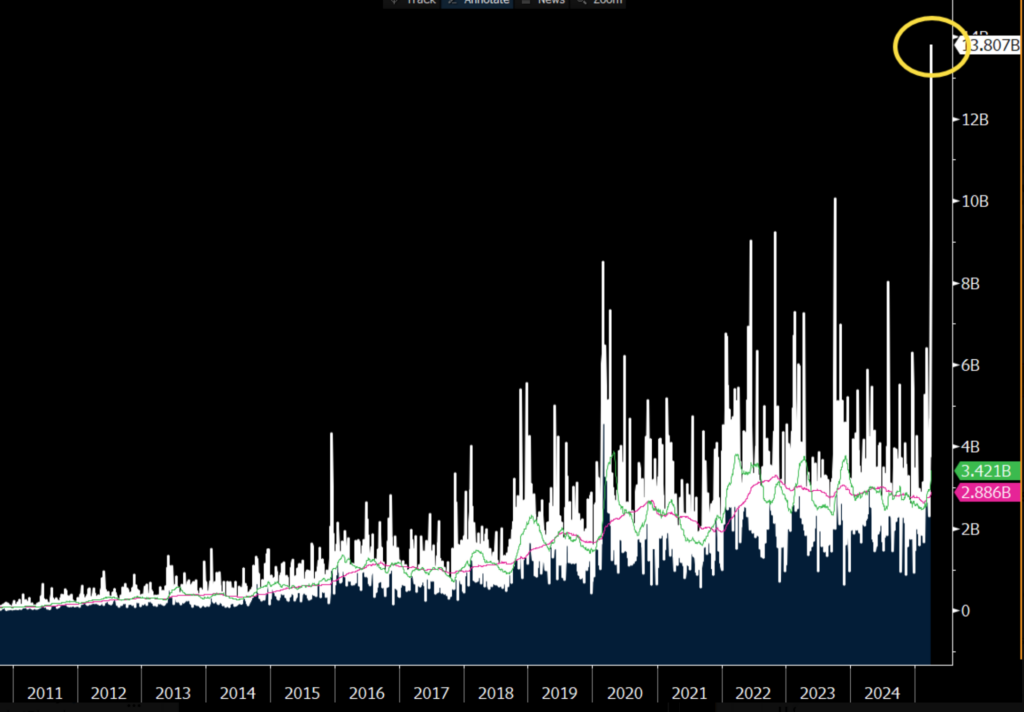

- It was also the biggest ever volume traded in the high-yield bond ETF, the HYG:

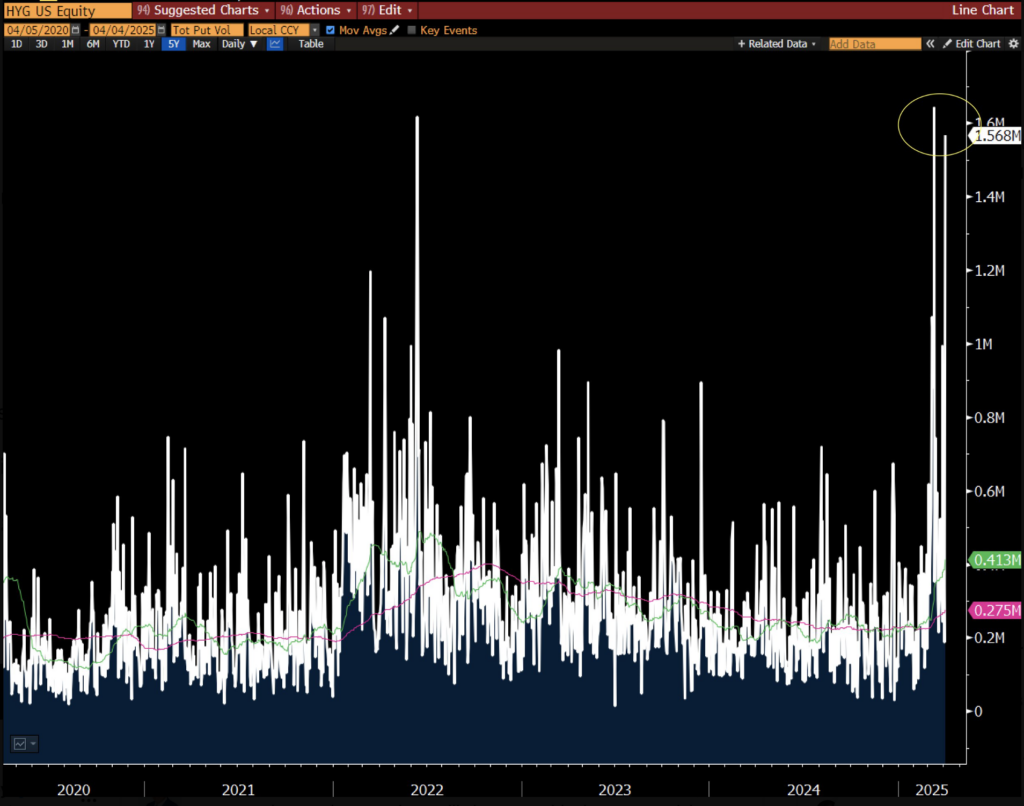

- And almost record volumes traded in Puts on the HYG:

- This is somewhat similar to the price action around the August 5th 2024 wobble, where the VIX spiked to 66 before quickly turning lower, as investors apparently worried about the Yen carry trade unwind.

- It is also even bigger volumes traded than took place as the pandemic took hold in March 2020.

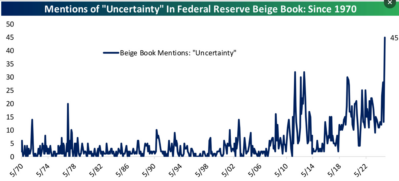

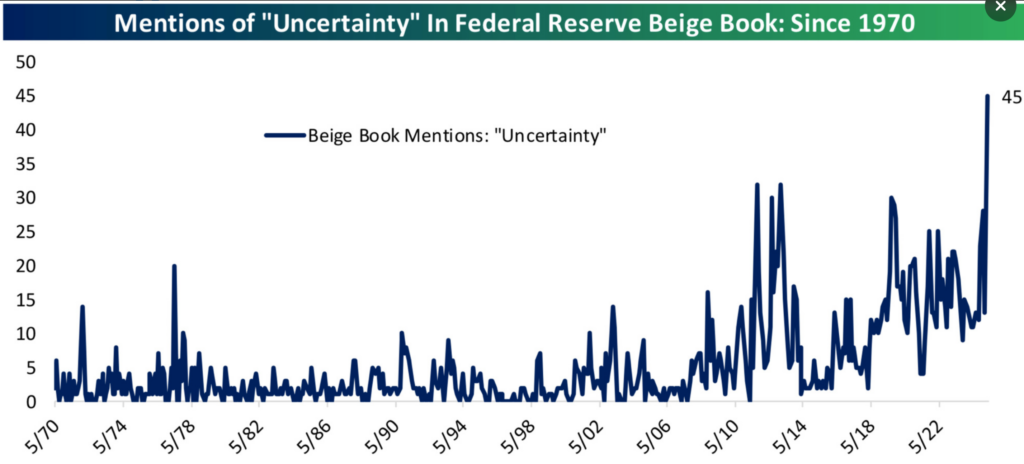

- This is synonymous with the apparently hysterical levels of uncertainty – once again here is the chart of mentions of the word “uncertainty” in the Fed’s Beige Book:

- This looked out of line with actual uncertainty. How could it be more uncertain than the oil price panic of the 1970s, the end of the Cold War, the dot com bust, the collapse of the banking system and the onset of a completely new virus that shut down the world?

- Trump’s tariffs might lead to an unknown amount of retaliation but there really only are four possible outcomes: higher inflation/higher unemployment, lower inflation/lower unemployment, and a mix of the two.

- This is not like administrators walking into the biggest ever investment bank bankruptcy, turning off the screens and the markets being unable to know what the bid should be on a chunk of bonds.

- Rather, the rise in uncertainty should be a sign that we are in a whole new market framework and the system simply cannot compute.

- The market is both overreacting and underreacting to Trump:

- Over-reacting to a shift in macroeconomic fundamentals

- Under-reacting to a change in market dynamics

- The policymakers response to the pandemic created such a Pavlovian reaction function that urged investors to be always invested, FOMO BTFD, the Fed has your back, don’t ask too many questions, that now, when there are real fundamental changes to consider, many simply cannot do it.

- The news is not the facts. There is not just one trade. Each and every company in each and every sector in each and every country will have its own response to the tariffs. It’s time to put in the hard yards and do the research. Just buying SPY and selling VIX won’t work.

- And so the market is caught, like a rabbit in the headlights. Despite the huge volumes traded, nobody bought SPY puts and slapped on VIX tail hedges.

- This means Gamma Exposure has plunged into negative territory, increasing the risk of a market crash.

- It is reminiscent of the Truss Budget.

- The market should have priced in that she would become PM, that she would go big, that Kwarteng would double down even after big market moves because he had a political agenda to achieve.

- Instead, the market waited until the last minute, priced it all in and then lit the touchpaper of hidden convexity.

There is now a significant risk of market dislocation as Trump will not swerve from his agenda, the Fed will be loathe to step in, and investors are unprepared for the volatility of volatility.