The Two Weeks That Will Be (19th October 2025)

1. The Fed

The Fed will cut rates by 25bp on Wednesday 29th October with a number of wannabe-governor dissenters voting for even larger cuts. The doves are in the driving seat, with FOMC members getting themselves into knots trying to describe how tariffs create inflation persistence whilst a weakening jobs market requires less restrictive policy. Fed Kashkari tortuously summarised the position with his recent comment that “there’s more risk of a labour market negative surprise than a big uptick in inflation. On the other hand, if I were to guess which mistake we’re more likely making, I think we’re more likely betting that the economy is really slowing more than it really is”. Always reassuring to know that the Fed wants to take out insurance even as it’s not sure what the insurance is for.

The lack of statistics due to the shutdown doesn’t help. There is however one oasis shimmering in the data desert and it’s a big one. We will get the latest inflation print on Friday. Traders will cling to this to set the tone even though one data point should never be the only guide for policy.

The FOMC meeting will also feature a discussion over reducing, if not ending, balance sheet run-off. Fiscal mechanics and QT during the government shutdown have contributed to a spike in usage of the Fed’s standing repo facility, which recently saw the largest amount borrowed over a two-day period since the pandemic. Putting this together with the wobbles in US regional banking stocks over fraud disclosures and the bankruptcy of auto part maker First Brands (where $2.3bn “simply vanished“) and it looks as though systemic risk is rising. The VIX has even managed to break out of its becalmed somnolence, hitting the highest levels since the aftermath of Liberation Day volatility. The CNN Greed/Fear index printed into “Extreme Fear” territory.

2. Earnings

And yet the S&P500 is still within a couple of percent of record highs. Either the stock market knows something the VIX doesn’t, or a correction is coming. After all, a VIX of 21 translates into a monthly move in the SPX of just over 4%. That shouldn’t be all that unusual, particularly in a world of economic warfare between the two big geopolitical players, record high sovereign debt levels and fracturing electorates creating unstable governments.

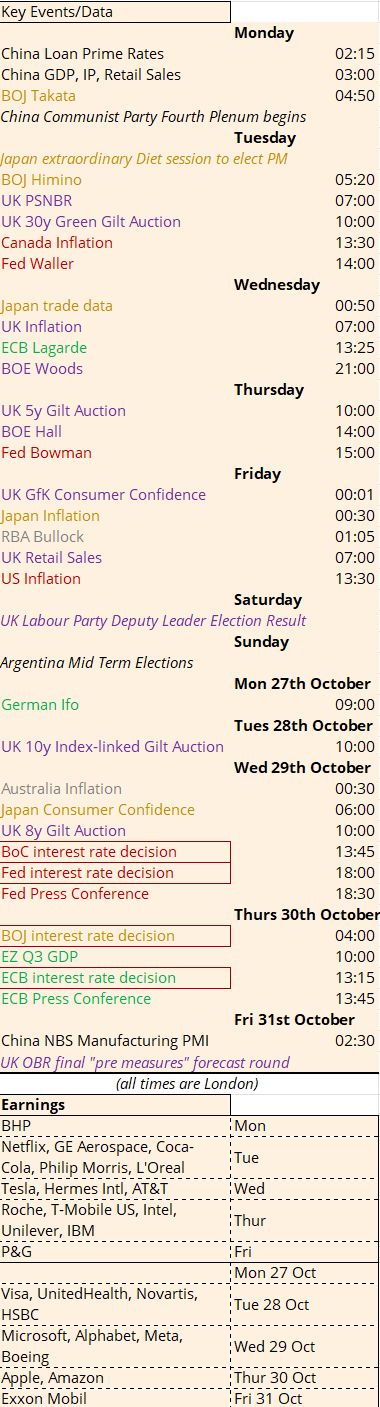

It is not that we are headed necessarily for a crash; but that volatility itself is woefully under-priced. The next two weeks could see the S&P500 correct by 10% and also reach new record highs. The BTFD/FOMO crowd will be both shook and lit. Earnings releases will take on even greater weight in the absence of economic data due to the shutdown. Watch out for:

- Netflix on Tuesday

- Tesla on Wednesday

- Intel and Unilever on Thursday

- Microsoft, Alphabet and Meta on Wednesday 29th October

- Apple and Amazon on Thursday 30th October

3. France

And in such an environment, political risk comes racing back into market pricing. France’s new prime minister might have survived a no confidence motion – by 18 votes – but the budget will not. Although a draft has been submitted, it has not been endorsed by the Socialists, with their leader Olivier Faure combatively responding that “What the prime minister is proposing in terms of tax policy is totally insufficient. The budget presented is not ours, and we will fight in Parliament to include social and tax justice”. He went on to propose a wealth tax as the solution. With Macron’s flagship pension reform suspended in order to gain Socialist support for Lecornu to continue as PM, the President must wonder what other ignominious sacrifices will be required to remain on Jupiter’s throne.

Except that it is all part of the theatre of French politics. Macron doesn’t expect the Budget process to succeed. But rather than ram it through using Article 49.3 (and face the inevitable no confidence vote for doing so), Lecornu will let MPs thrash out the budget between themselves. This enables each side to demand what their voters want, shoring up their core vote, and blaming the other side’s intransigence for the fallout. Macron hopes to escape the bourgeois fist fight, staying above the fray from the lofty vantage point of the Élysée Palace. If by some miracle it were to pass, he survives as the patient arbiter; if, as is more likely, it leads to an election that is won by Le Pen’s National Rally then he can spend his final year exiting the presidency by blaming the right wing radicals for France’s woes. And then come back five years later. It’s a suicidal strategy but les jeux sont faits. The Budget will start to be debated in the National Assembly on Friday 24th October and must be passed by 23rd December.

4. The ECB

The credit rating agencies aren’t waiting to see how that goes. S&P popped up with an unscheduled ratings downgrade. They noted that the ECB has had its part to play in dampening the negative feedback loop from French political risk to its debt/deficit dynamics: “Since the European debt crisis, the various backstop mechanisms from by the European Central Bank have limited the spread of volatility in sovereign bonds, which in our view explains the somewhat contained volatility of French spreads compared with German bunds, despite an unprecedented political impasse”. Perhaps they never heard Lagarde’s March 2020 speech in which she said with great foresight that “with more debt issuance coming down the road…. we will be there, as I said earlier on, using full flexibility, but we are not here to close spreads. This is not the function or the mission of the ECB. There are other tools for that, and there are other actors to actually deal with those issues”.

When the ECB meet on Thursday 30th October they will be loathe to get pulled back into this argument. They will keep their heads down and leave interest rates unchanged.

5. The UK

How Rachel Reeves must hope she could keep her head down until the Budget. She keeps saying that she will make the “numbers add up” but she doesn’t even know what number she needs to find yet. That changes on Friday 31st October when the OBR deliver their final “pre-measures” forecast to the Treasury. Such stock is put on the OBR’s model that debate rages over whether they have already taken their snapshot of market parameters, thus ensuring the biggest weekly drop in 10y Gilt yields since April would not have been counted, making Reeves’ task even harder.

This is madness. Politicians need to get away from the idea that a government’s plan is only judged at fiscal events. Reeves’ desperation to move to only one event per year and maximise headroom by kitchen-sinking tax and spend decisions belies an administration that has failed to grasp what government is for. Not being Liz Truss is a necessary but not sufficient condition for success. Reeves’ “plan” to increase gambling taxes, no change to levies on banks, cutting VAT on household energy bills, “can’t leave welfare untouched” and then raising income tax anyway might momentarily assuage market concerns. But then Gilt investors will immediately turn to what comes next. The ensuing recession and concomitant increase in borrowing for a government that has no mandate for any such measures will be fatal for Reeves and ultimately Starmer.

Their enemies await two opportunities to build their arsenal of ammunition.

- On Saturday we will get the Deputy Leader election result, which will see the “anti-Starmer” candidate Lucy Powell win. The last time Labour had a deputy leadership election in government in 2007, Harriet Harman won. Gordon Brown promptly refused to make her deputy prime minister. It is never helpful to an embattled prime minister for an alternative lightning rod with their own electoral legitimacy to emerge.

- On Thursday, the Caerphilly by-election for the devolved Welsh Senedd will see victory for either Plaid Cymru, or, more likely, Reform. Although turnout is likely to be low, it will be totemic for the diminution of Labour support. Since the end of WWI it has only ever returned Labour victors. Keir Hardie took his first seat as Labour leader in Merthyr Tydfil, half an hour up the road. Losing this seat will also complicate the electoral maths in the Senedd as it would put Labour on 28 seats in the 60 seat assembly, leaving them having to turn to Plaid or independent members for support.

The data is unlikely to provide any respite. There is likely to be another nasty reading from the latest UK inflation number on Wednesday as the headline figure is expected to rise to 4%. The borrowing numbers on Tuesday will also provide a reminder that even with an OBR model, actual out-turns do not match forecasts.

6. The BOJ

Politics is never just about adding up economic numbers. It’s about the blood and guts of voter expectations. Even quasi one-party Japan is not immune to the voter fragmentation that has dogged developed economies since the pandemic. After Komeito pulled out of the 26 year long partnership with the LDP, the leader of the second largest party, the Constitutional Democratic Party of Japan, spoke for many opposition MPs when he said “This is a rare opportunity. We can change the government now if [the opposition parties] can co-operate by overcoming our differences and finding common ground”.

Co-operation in a system that has never required coalition building hasn’t panned out for those who would depose the LDP. At least not yet. The LDP have found a new partner for now in the shape of the Japan Innovation Party (known as Ishin). Together, they will only be one seat short of a majority in the Lower House. However it’s not yet clear if it will be a formal coalition, with Ishin having promised to back Takaichi for prime minister in the vote on Tuesday but not committing to sending ministers to the cabinet. This does not behove a stable government ahead.

The Bank of Japan will therefore stand pat on Thursday 30th October until the political outlook has stabilised.

7. Argentina

An honourable mention for Argentina’s mid-term elections on Sunday which will serve as a reminder that Trump and Bessent are constructing an economic and defence umbrella whereby America’s power and resources can also be all yours, if you’re prepared the pay the entry fee. ‘Twas ever thus, but Trump says the quiet part out loud. In a meeting with Argentine President Milei, Trump couldn’t have been clearer: “If he loses, we are not going to be generous with Argentina“.