The Two Weeks That Will Be (19th October 2025)

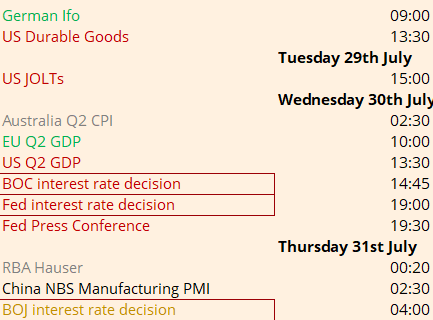

1. The FedThe Fed will cut rates by 25bp on Wednesday 29th October with a number of wannabe-governor dissenters voting for even larger cuts. The doves are in the driving seat, with FOMC members getting themselves into knots trying to describe how tariffs create inflation persistence whilst a weakening jobs market requires less restrictive policy. Fed Kashkari tortuously summarised the …